Sheridan Cosmetics Inc. had a number of transactions during the year relating to the purchase of various inventory items as noted below. For each of the below independent transactions determine what amount should be included in inventory. (a) Your answer is correct. Lipstick products counted in the physical inventory amount to $21,500 which include $1,100 of duty charges for importing the goods and $2,600 of recoverable taxes (i.e. HST). (If an answer is zero, please enter O. Do not leave any fields blank.) (b) Inventory $ eTextbook and Media Inventory 18900 Makeup kits held on consignment by a retailer with a cost of $14,700 (inclusive of $1,200 of commissions to the retailer). (If an answer is zero, please enter O. Do not leave any fields blank.) $ Attempts: 1 of 3 used

Sheridan Cosmetics Inc. had a number of transactions during the year relating to the purchase of various inventory items as noted below. For each of the below independent transactions determine what amount should be included in inventory. (a) Your answer is correct. Lipstick products counted in the physical inventory amount to $21,500 which include $1,100 of duty charges for importing the goods and $2,600 of recoverable taxes (i.e. HST). (If an answer is zero, please enter O. Do not leave any fields blank.) (b) Inventory $ eTextbook and Media Inventory 18900 Makeup kits held on consignment by a retailer with a cost of $14,700 (inclusive of $1,200 of commissions to the retailer). (If an answer is zero, please enter O. Do not leave any fields blank.) $ Attempts: 1 of 3 used

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

7, please read the qestion and answer section B

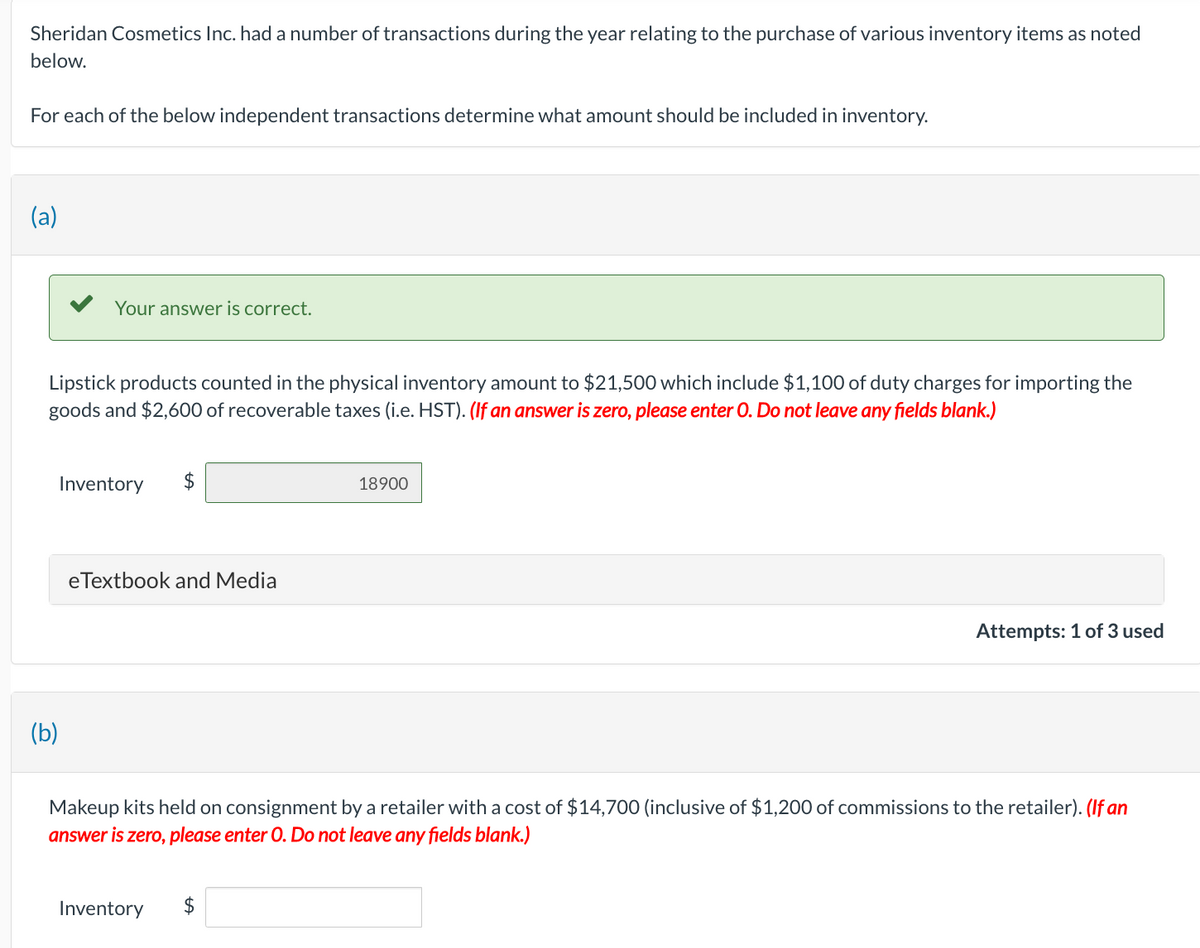

Transcribed Image Text:Sheridan Cosmetics Inc. had a number of transactions during the year relating to the purchase of various inventory items as noted

below.

For each of the below independent transactions determine what amount should be included in inventory.

(a)

Your answer is correct.

Lipstick products counted in the physical inventory amount to $21,500 which include $1,100 of duty charges for importing the

goods and $2,600 of recoverable taxes (i.e. HST). (If an answer is zero, please enter O. Do not leave any fields blank.)

Inventory

(b)

$

eTextbook and Media

Inventory

18900

Makeup kits held on consignment by a retailer with a cost of $14,700 (inclusive of $1,200 of commissions to the retailer). (If an

answer is zero, please enter O. Do not leave any fields blank.)

$

Attempts: 1 of 3 used

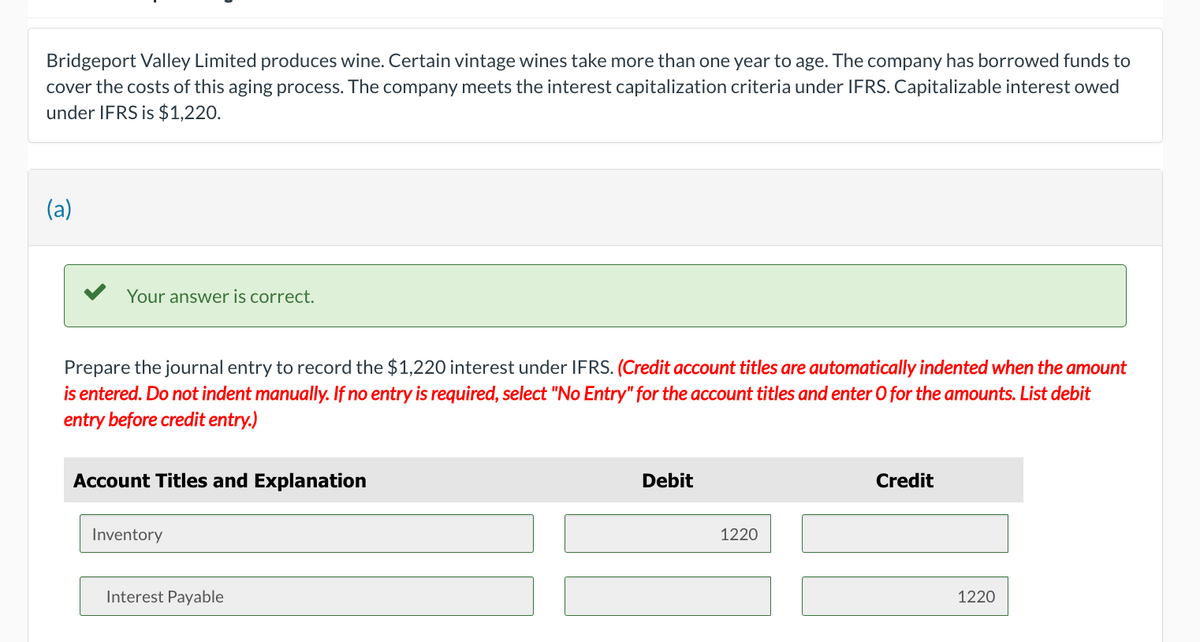

Transcribed Image Text:Bridgeport Valley Limited produces wine. Certain vintage wines take more than one year to age. The company has borrowed funds to

cover the costs of this aging process. The company meets the interest capitalization criteria under IFRS. Capitalizable interest owed

under IFRS is $1,220.

(a)

Your answer is correct.

Prepare the journal entry to record the $1,220 interest under IFRS. (Credit account titles are automatically indented when the amount

is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit

entry before credit entry.)

Account Titles and Explanation

Inventory

Interest Payable

Debit

1220

Credit

1220

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College