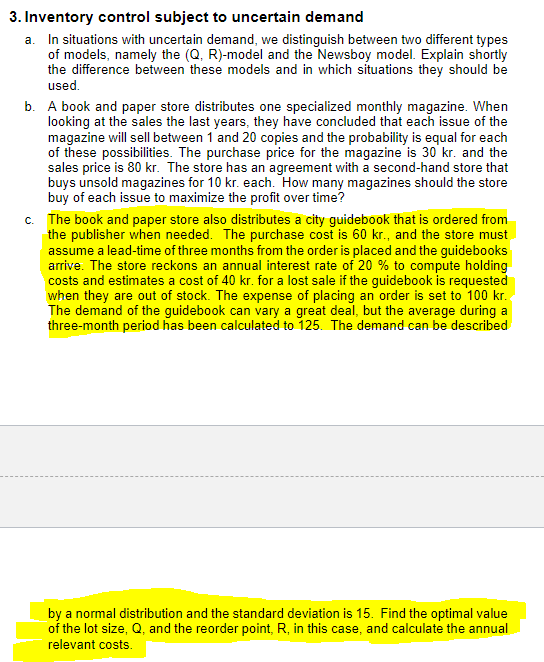

c. The book and paper store also distributes a city guidebook that is ordered from the publisher when needed. The purchase cost is 60 kr., and the store must assume a lead-time of three months from the order is placed and the guidebooks arrive. The store reckons an annual interest rate of 20 % to compute holding costs and estimates a cost of 40 kr. for a lost sale if the guidebook is requested when they are out of stock. The expense of placing an order is set to 100 kr. The demand of the guidebook can vary a great deal, but the average during a three-month period has been calculated to 125. The demand can be described

c. The book and paper store also distributes a city guidebook that is ordered from the publisher when needed. The purchase cost is 60 kr., and the store must assume a lead-time of three months from the order is placed and the guidebooks arrive. The store reckons an annual interest rate of 20 % to compute holding costs and estimates a cost of 40 kr. for a lost sale if the guidebook is requested when they are out of stock. The expense of placing an order is set to 100 kr. The demand of the guidebook can vary a great deal, but the average during a three-month period has been calculated to 125. The demand can be described

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter10: Introduction To Simulation Modeling

Section10.4: Simulation With Built-in Excel Tools

Problem 14P

Related questions

Question

Answer on b)

- Sales price = 80 kr

Purchase price = 30 kr

80 – 30 = 50 kr profit

20 magazines * 80 kr = 1.6000 kr which will maximize the profit over time.

Still dont get the answer on question c)

Transcribed Image Text:3. Inventory control subject to uncertain demand

a. In situations with uncertain demand, we distinguish between two different types

of models, namely the (Q, R)-model and the Newsboy model. Explain shortly

the difference between these models and in which situations they should be

used.

b. A book and paper store distributes one specialized monthly magazine. When

looking at the sales the last years, they have concluded that each issue of the

magazine will sell between 1 and 20 copies and the probability is equal for each

of these possibilities. The purchase price for the magazine is 30 kr. and the

sales price is 80 kr. The store has an agreement with a second-hand store that

buys unsold magazines for 10 kr. each. How many magazines should the store

buy of each issue to maximize the profit over time?

c. The book and paper store also distributes a city guidebook that is ordered from

the publisher when needed. The purchase cost is 60 kr., and the store must

assume a lead-time of three months from the order is placed and the guidebooks

arrive. The store reckons an annual interest rate of 20 % to compute holding

costs and estimates a cost of 40 kr. for a lost sale if the guidebook is requested

when they are out of stock. The expense of placing an order is set to 100 kr.

The demand of the guidebook can vary a great deal, but the average during a

three-month period has been calculated to 125. The demand can be described

by a normal distribution and the standard deviation is 15. Find the optimal value

of the lot size, Q, and the reorder point, R, in this case, and calculate the annual

relevant costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,