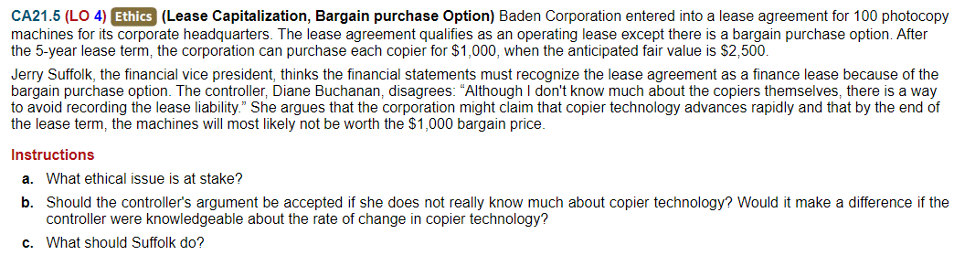

CA21.5 (LO 4) Ethics (Lease Capitalization, Bargain purchase Option) Baden Corporation entered into a lease agreement for 100 photocopy machines for its corporate headquarters. The lease agreement qualifies as an operating lease except there is a bargain purchase option. After the 5-year lease term, the corporation can purchase each copier for $1,000, when the anticipated fair value is $2,500. Jerry Suffolk, the financial vice president, thinks the financial statements must recognize the lease agreement as a finance lease because of the bargain purchase option. The controller, Diane Buchanan, disagrees: "Although I don't know much about the copiers themselves, there is a way to avoid recording the lease liability." She argues that the corporation might claim that copier technology advances rapidly and that by the end of the lease term, the machines will most likely not be worth the $1,000 bargain price. Instructions a. What ethical issue is at stake? b. Should the controller's argument be accepted if she does not really know much about copier technology? Would it make a difference if the controller were knowledgeable about the rate of change in copier technology? c. What should Suffolk do? Attribute Grade of A Grade of B Grade of C Grade of D Grade of F Especially skillful identification and Clear and competent Limited grasp of Inaccurate use of accounting concepts Accurate but limited Accounting Concepts use of accounting use of accounting accounting concepts analysis of accounting concepts concepts concepts Fully developed and supported assertions Developed and supported assertions Assertions exist but Assertions exist but are not developed or supported accurately Lack of assertions, development and/or Assertions are not developed or supported adequately support Particularly clear ideas with logical transitions throughout Paragraph flow and transitions are Weak paragraph structure and illogical transitions Consistent focus and good transitions Lack of focus Structure adequate Free of errors in mechanics. Clear and concise language Minor errors in mechanics. Serious errors in Languageespecially clear and concise with flawless mechanics. Fundamental mechanics errors. Language mechanics. Lack on clarity and concision. Lack of clarity and Sentences could be more effective concision

Additionally, regarding the project, please do not assume that the reader is familiar with the subject areas that you are writing about. Therefore, definitions, assumptions, facts, and analyses are required in this assignment.

Further, there are four questions that are being asked. Three questions need supporting calculations to validate your answers. Please help me by showing the calculations and assumptions in each of the answers, otherwise I will receive an 0. Kindly show your calculations. Also, a review of Learning Objective 4 in chapter 21 would be a good place to start with this assignment (Lease Capitalization, Bargain purchase Option.) Below are the questions for your convenience.

- What ethical issue is at stake?

- Should the controller's argument be accepted if she does not really know much about copier technology? Would it make a difference if the controller were knowledgeable about the rate of change in copier technology?

- What should Suffolk do?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps