Cablephones Inc., which is not a member of an affiliated group, had $390,000 gross income from

Cablephones Inc., which is not a member of an affiliated group, had $390,000 gross income from

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 80P

Related questions

Question

Sh3

Please help me

Solution

Thankyou

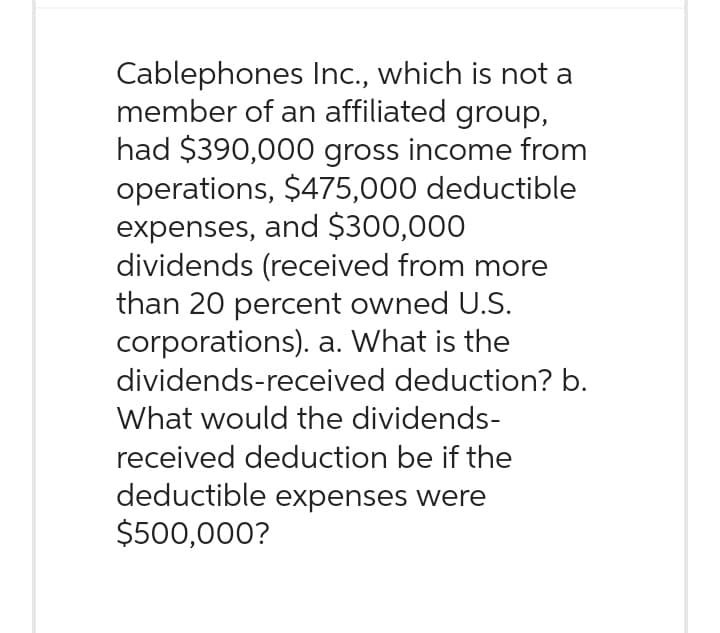

Transcribed Image Text:Cablephones Inc., which is not a

member of an affiliated group,

had $390,000 gross income from

operations, $475,000 deductible

expenses, and $300,000

dividends (received from more

than 20 percent owned U.S.

corporations). a. What is the

dividends-received deduction? b.

What would the dividends-

received deduction be if the

deductible expenses were

$500,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning