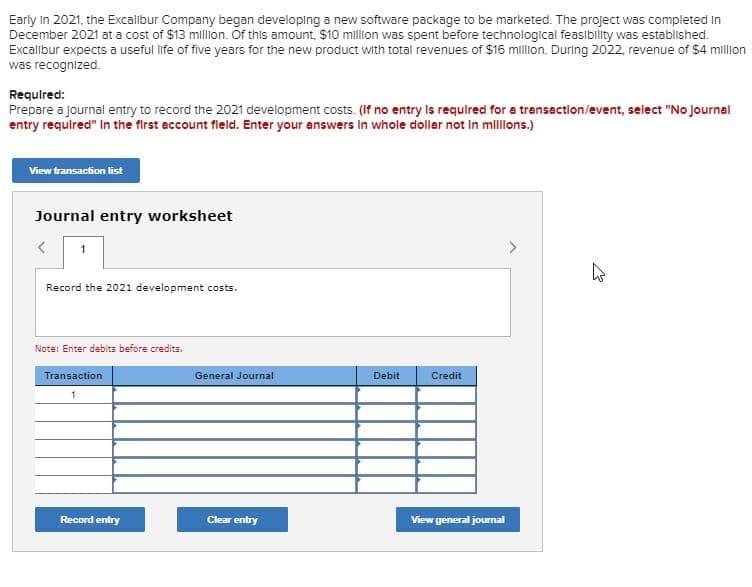

Early In 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $13 million. Of this amount, $10 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $16 million. During 2022, revenue of $4 million was recognized. Required: Prepare a journal entry to record the 2021 development costs. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account fleld. Enter your answers in whole dollar not in millions.)

Early In 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $13 million. Of this amount, $10 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $16 million. During 2022, revenue of $4 million was recognized. Required: Prepare a journal entry to record the 2021 development costs. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account fleld. Enter your answers in whole dollar not in millions.)

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 5R

Related questions

Question

Transcribed Image Text:Early In 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in

December 2021 at a cost of $13 million. Of this amount, $10 million was spent before technological feasibility was established.

Excalibur expects a useful life of five years for the new product with total revenues of $16 million. During 2022, revenue of $4 million

was recognized.

Required:

Prepare a journal entry to record the 2021 development costs. (If no entry is required for a transaction/event, select "No Journal

entry required" in the first account field. Enter your answers in whole dollar not in millions.)

View transaction list

Journal entry worksheet

<

1

Record the 2021 development costs.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT