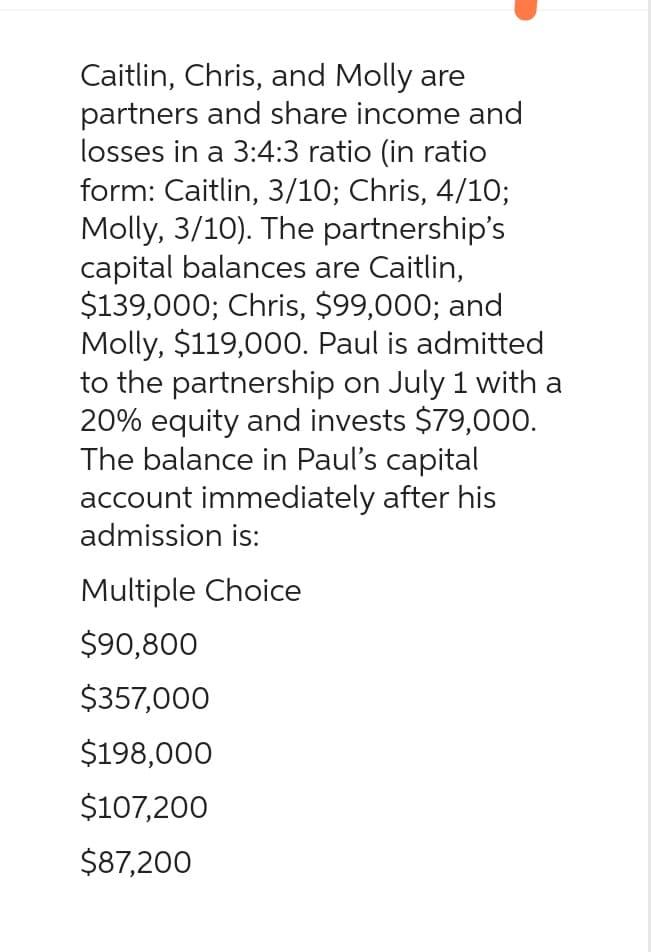

Caitlin, Chris, and Molly are partners and share income and losses in a 3:4:3 ratio (in ratio form: Caitlin, 3/10; Chris, 4/10; Molly, 3/10). The partnership's capital balances are Caitlin, $139,000; Chris, $99,000; and Molly, $119,000. Paul is admitted to the partnership on July 1 with a 20% equity and invests $79,000. The balance in Paul's capital account immediately after his admission is: Multiple Choice $90,800 $357,000 $198,000 $107,200 $87,200

Caitlin, Chris, and Molly are partners and share income and losses in a 3:4:3 ratio (in ratio form: Caitlin, 3/10; Chris, 4/10; Molly, 3/10). The partnership's capital balances are Caitlin, $139,000; Chris, $99,000; and Molly, $119,000. Paul is admitted to the partnership on July 1 with a 20% equity and invests $79,000. The balance in Paul's capital account immediately after his admission is: Multiple Choice $90,800 $357,000 $198,000 $107,200 $87,200

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

Subject - account

Transcribed Image Text:Caitlin, Chris, and Molly are

partners and share income and

losses in a 3:4:3 ratio (in ratio

form: Caitlin, 3/10; Chris, 4/10;

Molly, 3/10). The partnership's

capital balances are Caitlin,

$139,000; Chris, $99,000; and

Molly, $119,000. Paul is admitted

to the partnership on July 1 with a

20% equity and invests $79,000.

The balance in Paul's capital

account immediately after his

admission is:

Multiple Choice

$90,800

$357,000

$198,000

$107,200

$87,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College