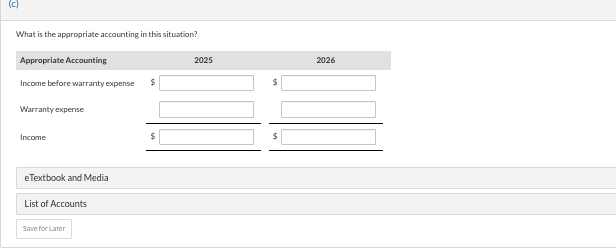

Skysong Inc has recently reported steadily increase income. The company reported income of $20,720 in 2022, $27,030 in 2023, and $31,580 in 2024. A number of market analysts have recommended that investors buy the stock becuase they expect the steady growth in income to continue. Skysong is approaching the end of its fiscal year in 2025, and it again appears to be a good year. However, it has not yet recorded warranty expense. Based on prior experience, this years warranty expense should be around $4,540 but some managers have approached the controller to suggest a larger, more conservative warranty expense should be recorded this year. Income before warranty expense is $42,660. Specifically, by recording a $6,980 warranty accrual this year. Skysong could report an increase for this year and still be in a position to cover its warranty costs in future years.

Vd

Subject -acounting

Skysong Inc has recently reported steadily increase income. The company reported income of $20,720 in 2022, $27,030 in 2023, and $31,580 in 2024. A number of market analysts have recommended that investors buy the stock becuase they expect the steady growth in income to continue. Skysong is approaching the end of its fiscal year in 2025, and it again appears to be a good year. However, it has not yet recorded warranty expense. Based on prior experience, this years warranty expense should be around $4,540 but some managers have approached the controller to suggest a larger, more conservative warranty expense should be recorded this year. Income before warranty expense is $42,660. Specifically, by recording a $6,980 warranty accrual this year. Skysong could report an increase for this year and still be in a position to cover its warranty costs in future years.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps