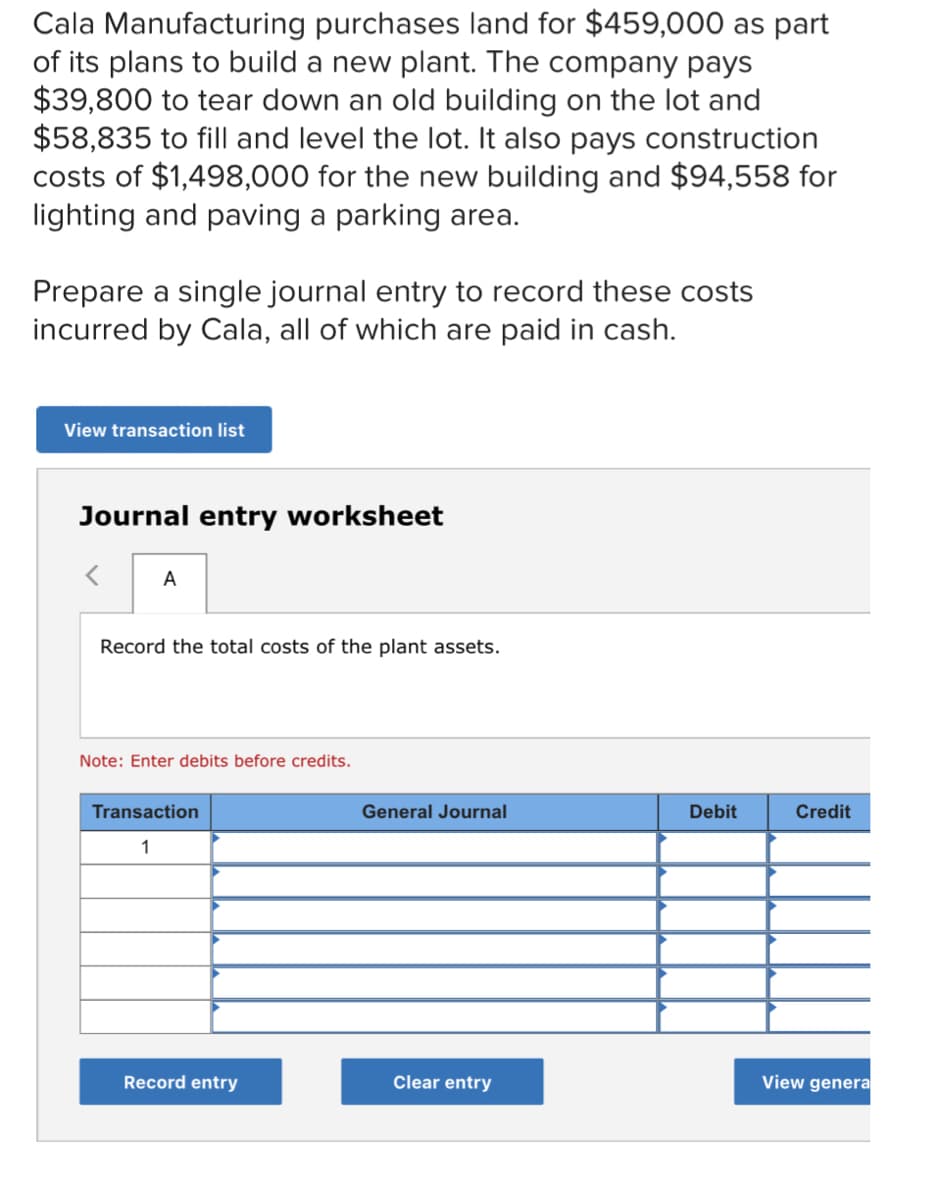

Cala Manufacturing purchases land for $459,000 as part of its plans to build a new plant. The company pays $39,800 to tear down an old building on the lot and $58,835 to fill and level the lot. It also pays construction costs of $1,498,000 for the new building and $94,558 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash.

Cala Manufacturing purchases land for $459,000 as part of its plans to build a new plant. The company pays $39,800 to tear down an old building on the lot and $58,835 to fill and level the lot. It also pays construction costs of $1,498,000 for the new building and $94,558 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash.

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 46P

Related questions

Question

Transcribed Image Text:Cala Manufacturing purchases land for $459,000 as part

of its plans to build a new plant. The company pays

$39,800 to tear down an old building on the lot and

$58,835 to fill and level the lot. It also pays construction

costs of $1,498,000 for the new building and $94,558 for

lighting and paving a parking area.

Prepare a single journal entry to record these costs

incurred by Cala, all of which are paid in cash.

View transaction list

Journal entry worksheet

A

Record the total costs of the plant assets.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View genera

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT