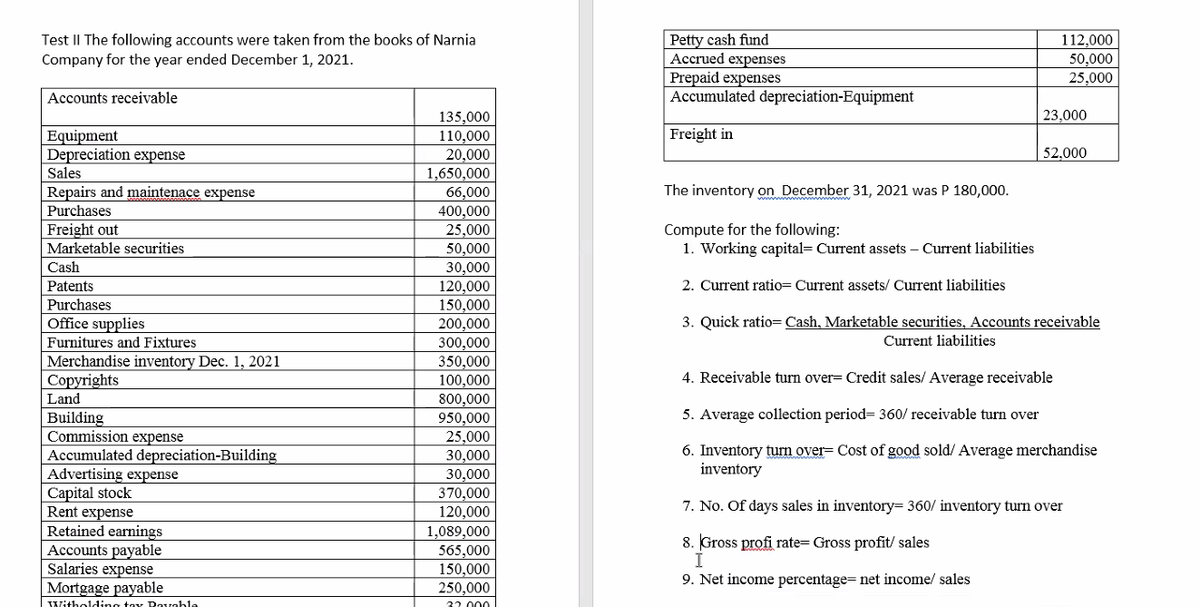

Petty cash fund Accrued expenses Prepaid expenses Accumulated depreciation-Equipment Test II The following accounts were taken from the books of Narnia Company for the year ended December 1, 2021. 112,000 50,000 25,000 Accounts receivable 23.000 135,000 110,000 20,000 1,650,000 66,000 400,000 25,000 50,000 30,000 120,000 150,000 Freight in Equipment Depreciation expense Sales 52,000 The inventory on December 31, 2021 was P 180,00. Repairs and maintenace expense Purchases Freight out Marketable securities Compute for the following: 1. Working capital= Current assets – Current liabilities Cash Patents 2. Current ratio= Current assets/ Current liabilities Purchases Office supplies 3. Quick ratio= Cash, Marketable securities, Accounts receivable 200,000 300,000 350,000 100,000 800,000 950,000 25,000 30,000 Furnitures and Fixtures Current liabilities Merchandise inventory Dec. 1, 2021 |Copyrights 4. Receivable turn over= Credit sales/ Average receivable Land 5. Average collection period= 360/ receivable turn over Building Commission expense Accumulated depreciation-Building Advertising expense Capital stock Rent expense Retained earnings Accounts payable Salaries expense Mortgage payable 6. Inventory turn over= Cost of good sold/ Average merchandise inventory 30,000 370,000 120,000 7. No. Of days sales in inventory= 360/ inventory turn over 1,089,000 565,000 150,000 250,000 8. Gross profi rate= Gross profit/ sales I 9. Net income percentage= net income/ sales

Petty cash fund Accrued expenses Prepaid expenses Accumulated depreciation-Equipment Test II The following accounts were taken from the books of Narnia Company for the year ended December 1, 2021. 112,000 50,000 25,000 Accounts receivable 23.000 135,000 110,000 20,000 1,650,000 66,000 400,000 25,000 50,000 30,000 120,000 150,000 Freight in Equipment Depreciation expense Sales 52,000 The inventory on December 31, 2021 was P 180,00. Repairs and maintenace expense Purchases Freight out Marketable securities Compute for the following: 1. Working capital= Current assets – Current liabilities Cash Patents 2. Current ratio= Current assets/ Current liabilities Purchases Office supplies 3. Quick ratio= Cash, Marketable securities, Accounts receivable 200,000 300,000 350,000 100,000 800,000 950,000 25,000 30,000 Furnitures and Fixtures Current liabilities Merchandise inventory Dec. 1, 2021 |Copyrights 4. Receivable turn over= Credit sales/ Average receivable Land 5. Average collection period= 360/ receivable turn over Building Commission expense Accumulated depreciation-Building Advertising expense Capital stock Rent expense Retained earnings Accounts payable Salaries expense Mortgage payable 6. Inventory turn over= Cost of good sold/ Average merchandise inventory 30,000 370,000 120,000 7. No. Of days sales in inventory= 360/ inventory turn over 1,089,000 565,000 150,000 250,000 8. Gross profi rate= Gross profit/ sales I 9. Net income percentage= net income/ sales

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.6: Buying Intangible Assets And Calculating Amortization Expense

Problem 1OYO

Related questions

Question

Transcribed Image Text:Petty cash fund

Accrued expenses

Prepaid expenses

Accumulated depreciation-Equipment

112,000

50,000

25,000

Test II The following accounts were taken from the books of Narnia

Company for the year ended December 1, 2021.

Accounts receivable

23,000

135,000

110,000

20,000

1,650,000

66,000

Freight in

Equipment

Depreciation expense

Sales

52,000

Repairs and maintenace expense

The inventory on December 31, 2021 was P 180,000.

wwwwwwww

Purchases

400,000

25,000

50,000

30,000

120,000

150,000

200,000

300,000

350,000

100,000

Freight out

Marketable securities

Compute for the following:

1. Working capital= Current assets – Current liabilities

Cash

Patents

2. Current ratio= Current assets/ Current liabilities

Purchases

Office supplies

Furnitures and Fixtures

3. Quick ratio= Cash, Marketable securities, Accounts receivable

Current liabilities

Merchandise inventory Dec. 1, 2021

Copyrights

Land

4. Receivable turn over= Credit sales/ Average receivable

800,000

950,000

25,000

5. Average collection period= 360/ receivable turn over

Building

Commission expense

Accumulated depreciation-Building

Advertising expense

Capital stock

Rent expense

Retained earnings

Accounts payable

Salaries expense

Mortgage payable

6. Inventory turn over= Cost of good sold/ Average merchandise

inventory

30,000

30,000

370,000

120,000

7. No. Of days sales in inventory= 360/ inventory turn over

1,089,000

565,000

150,000

250,000

8. Gross profi rate= Gross profit/ sales

I

9. Net income percentage= net income/ sales

Witholding tox Doveble

32.000

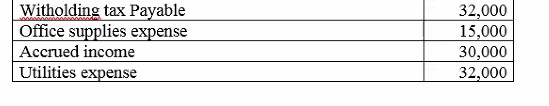

Transcribed Image Text:Witholding tax Payable

Office supplies expense

32,000

15,000

30,000

32,000

Accrued income

Utilities expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage