Calculate all the 3subparts A,B,C.if answered within 40mins,it would be appreciable!! A) Calculate the book values of both the swap account and the note in each of the three years. B) Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.) C) Suppose the fair value of the note at December 31, 2021, had been $267,000 rather than $276,441 with the additional decline in fair value due to investors’ perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values?

Calculate all the 3subparts A,B,C.if answered within 40mins,it would be appreciable!! A) Calculate the book values of both the swap account and the note in each of the three years. B) Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.) C) Suppose the fair value of the note at December 31, 2021, had been $267,000 rather than $276,441 with the additional decline in fair value due to investors’ perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 30P

Related questions

Question

Calculate all the 3subparts A,B,C.if answered within 40mins,it would be appreciable!!

A) Calculate the book values of both the swap account and the note in each of the three years.

B) Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.)

C) Suppose the fair value of the note at December 31, 2021, had been $267,000 rather than $276,441 with the additional decline in fair value due to investors’ perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values?

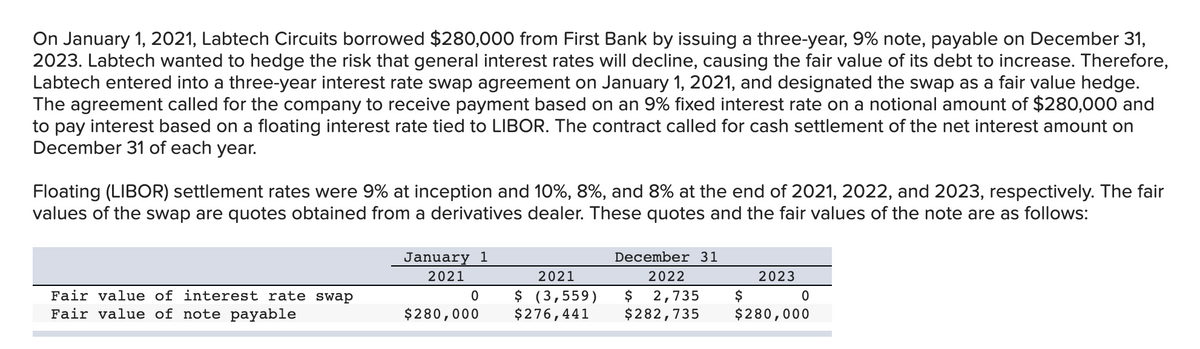

Transcribed Image Text:On January 1, 2021, Labtech Circuits borrowed $280,000 from First Bank by issuing a three-year, 9% note, payable on December 31,

2023. Labtech wanted to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. Therefore,

Labtech entered into a three-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge.

The agreement called for the company to receive payment based on an 9% fixed interest rate on a notional amount of $280,000 and

to pay interest based on a floating interest rate tied to LIBOR. The contract called for cash settlement of the net interest amount on

December 31 of each year.

Floating (LIBOR) settlement rates were 9% at inception and 10%, 8%, and 8% at the end of 2021, 2022, and 2023, respectively. The fair

values of the swap are quotes obtained from a derivatives dealer. These quotes and the fair values of the note are as follows:

January 1

December 31

2021

2021

2022

2023

Fair value of interest rate swap

$ (3,559)

$276,441

$

2,735

$

Fair value of note payable

$280,000

$282,735

$280,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT