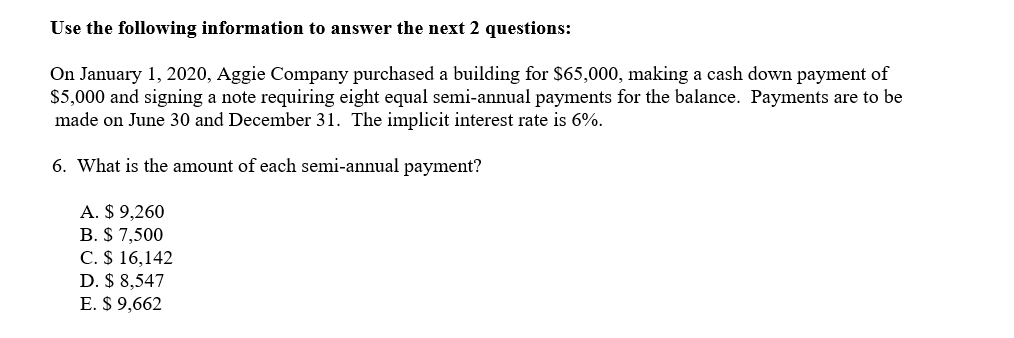

On January 1, 2020, Aggie Company purchased a building for $65,000, making a cash down payment of $5,000 and signing a note requiring eight equal semi-annual payments for the balance. Payments are to be made on June 30 and December 31. The implicit interest rate is 6%. 6. What is the amount of each semi-annual payment? A. $ 9,260 B. $ 7,500 C. $ 16,142 D. $ 8,547 E. $ 9,662

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

please help with attached

Trending now

This is a popular solution!

Step by step

Solved in 2 steps