Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line for 2017 through to 2021. 2017 expense 2018 expense $ 2019 expense 2020 expense $ 2021 expense $ $ $

Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line for 2017 through to 2021. 2017 expense 2018 expense $ 2019 expense 2020 expense $ 2021 expense $ $ $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 56E: Expenditures After Acquisition Roanoke Manufacturing placed a robotic arm on a large assembly...

Related questions

Question

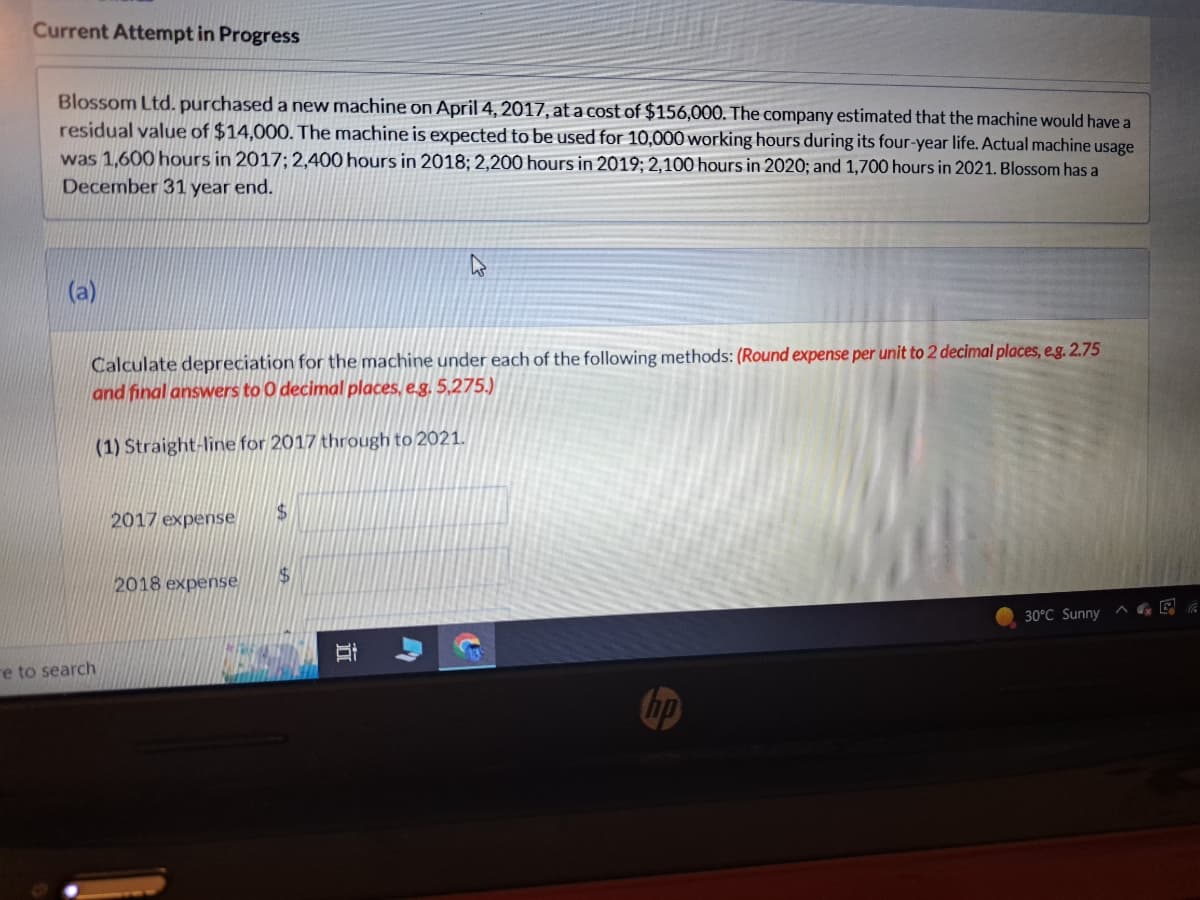

Transcribed Image Text:Current Attempt in Progress

Blossom Ltd. purchased a new machine on April 4, 2017, at a cost of $156,000. The company estimated that the machine would have a

residual value of $14,000. The machine is expected to be used for 10,000 working hours during its four-year life. Actual machine usage

was 1,600 hours in 2017; 2,400 hours in 2018; 2,200 hours in 2019; 2,100 hours in 2020; and 1,700 hours in 2021. Blossom has a

December 31 year end.

(a)

Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75

and final answers to 0 decimal places, e.g. 5,275.)

(1) Straight-line for 2017 through to 2021.

e to search

2017 expense

2018 expense

$

$

Bi

I

A

3

hp

30°C Sunny

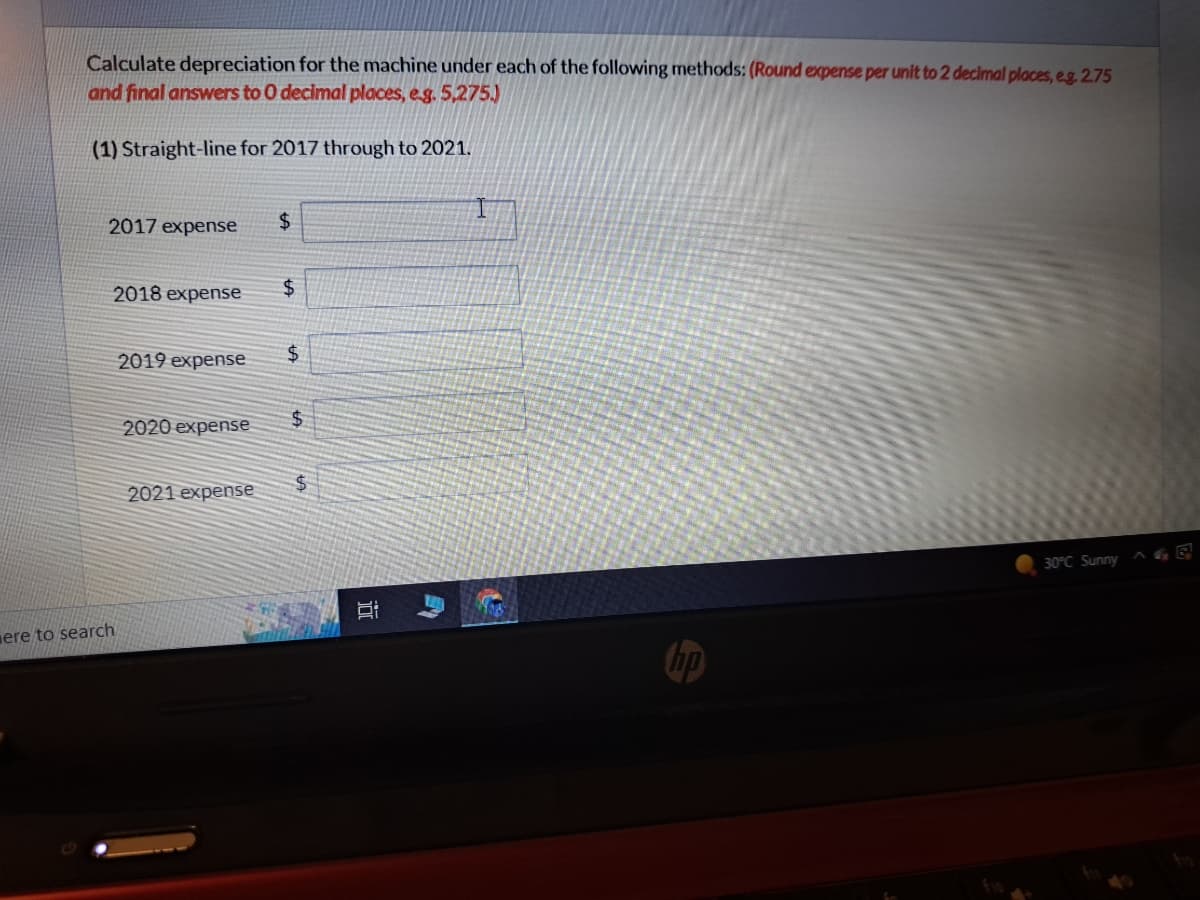

Transcribed Image Text:Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, eg. 2.75

and final answers to 0 decimal places, e.g. 5,275.)

(1) Straight-line for 2017 through to 2021.

2017 expense $

ere to search

2018 expense $

2019 expense

2020 expense

2021 expense

$

$

$

i

E

30°C Sunny

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning