Additional information: 1) An annual stock count at 30 September showed that the business had stock worth R15 150. 2) Write off a further R3 500 as bad debts. 3) Adjust the provision of bad debts to R23 500. Profit for the year was R84 193. Income tax was provided for as R52 576. It is a business for tax to be paid on the 1st of October each year. 6) Dividends declared were R5 000. 4) 5) Required: Prepare a Statement of Financial Position as at 30 September 2016. NB: Notes are not required. The statement must be prepared in accordance with GAAP or IFRS.

Additional information: 1) An annual stock count at 30 September showed that the business had stock worth R15 150. 2) Write off a further R3 500 as bad debts. 3) Adjust the provision of bad debts to R23 500. Profit for the year was R84 193. Income tax was provided for as R52 576. It is a business for tax to be paid on the 1st of October each year. 6) Dividends declared were R5 000. 4) 5) Required: Prepare a Statement of Financial Position as at 30 September 2016. NB: Notes are not required. The statement must be prepared in accordance with GAAP or IFRS.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 6PB: Ink Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable....

Related questions

Question

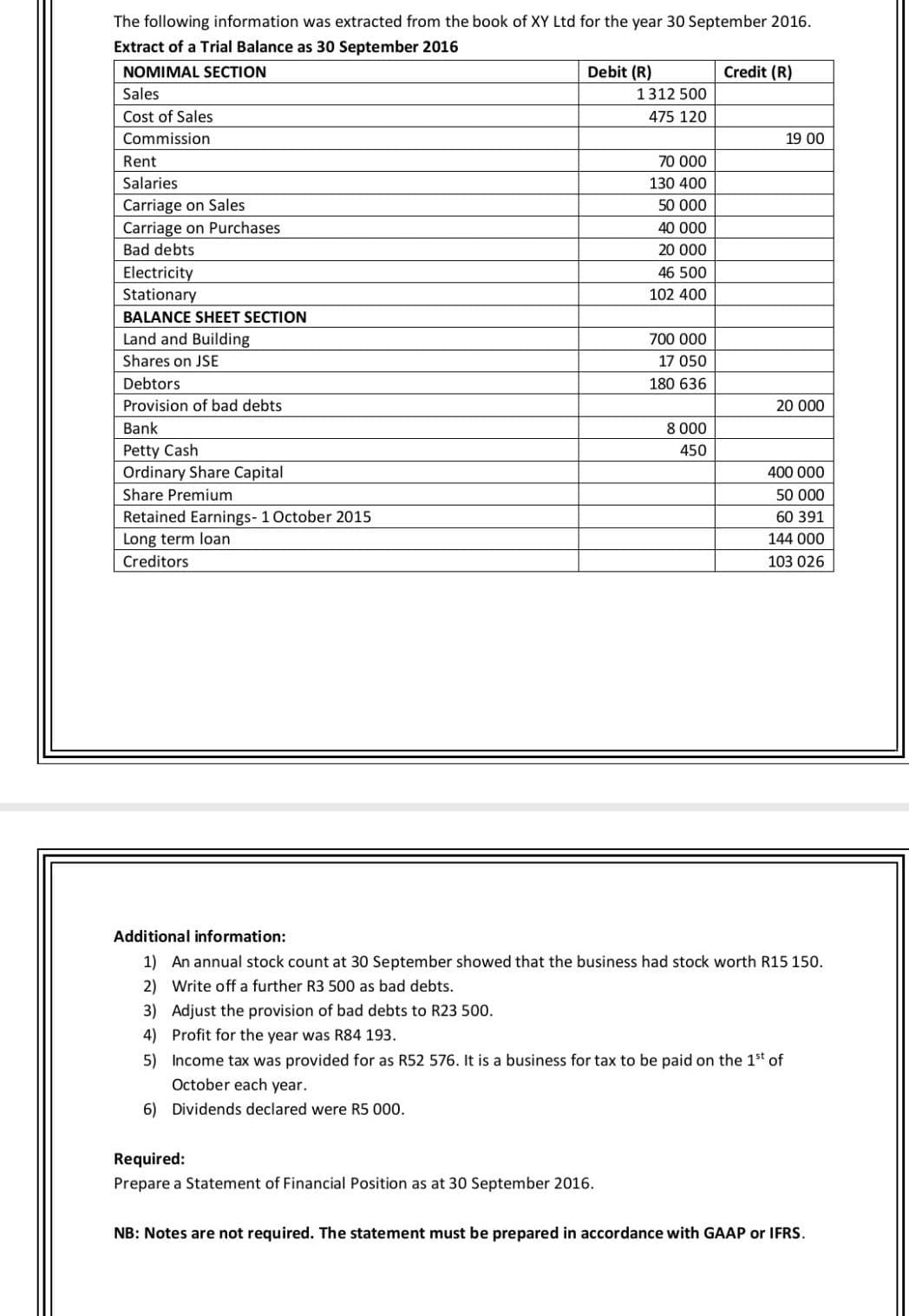

Transcribed Image Text:The following information was extracted from the book of XY Ltd for the year 30 September 2016.

Extract of a Trial Balance as 30 September 2016

NOMIMAL SECTION

Sales

Cost of Sales

Commission

Rent

Salaries

Carriage on Sales

Carriage on Purchases

Bad debts

Electricity

Stationary

BALANCE SHEET SECTION

Land and Building

Shares on JSE

Debtors

Provision of bad debts

Bank

Petty Cash

Ordinary Share Capital

Share Premium

Retained Earnings- 1 October 2015

Long term loan

Creditors

Debit (R)

1312 500

475 120

Required:

Prepare a Statement of Financial Position as at 30 September 2016.

70 000

130 400

50 000

40 000

20 000

46 500

102 400

700 000

17 050

180 636

8 000

450

Credit (R)

19 00

20 000

400 000

50 000

60 391

144 000

103 026

Additional information:

1) An annual stock count at 30 September showed that the business had stock worth R15 150.

2)

Write off a further R3 500 as bad debts.

3) Adjust the provision of bad debts to R23 500.

4) Profit for the year was R84 193.

5) Income tax was provided for as R52 576. It is a business for tax to be paid on the 1st of

October each year.

6) Dividends declared were R5 000.

NB: Notes are not required. The statement must be prepared in accordance with GAAP IFRS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning