Calculate taxable income of SLK (Pty)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 31P

Related questions

Question

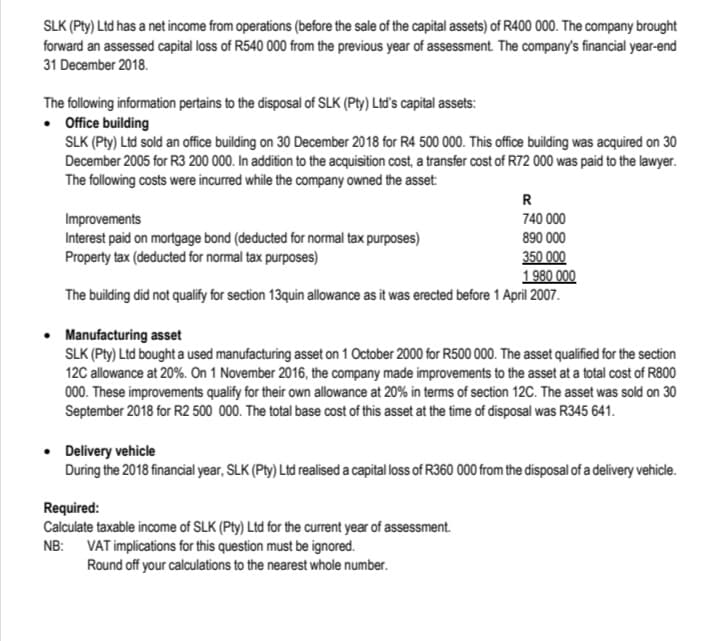

Transcribed Image Text:SLK (Pty) Ltd has a net income from operations (before the sale of the capital assets) of R400 000. The company brought

forward an assessed capital loss of R540 000 from the previous year of assessment. The company's financial year-end

31 December 2018.

The following information pertains to the disposal of SLK (Pty) Ltď's capital assets:

• Office building

SLK (Pty) Ltd sold an office building on 30 December 2018 for R4 500 000. This office building was acquired on 30

December 2005 for R3 200 000. In addition to the acquisition cost, a transfer cost of R72 000 was paid to the lawyer.

The following costs were incurred while the company owned the asset:

R

740 000

Improvements

Interest paid on mortgage bond (deducted for normal tax purposes)

Property tax (deducted for normal tax purposes)

890 000

350 000

1980 000

The building did not qualify for section 13quin allowance as it was erected before 1 April 2007.

Manufacturing asset

SLK (Pty) Ltd bought a used manufacturing asset on 1 October 2000 for R500 000. The asset qualified for the section

12C allowance at 20%. On 1 November 2016, the company made improvements to the asset at a total cost of R800

000. These improvements qualify for their own allowance at 20% in terms of section 12C. The asset was sold on 30

September 2018 for R2 500 000. The total base cost of this asset at the time of disposal was R345 641.

• Delivery vehicle

During the 2018 financial year, SLK (Pty) Ltd realised a capital loss of R360 000 from the disposal of a delivery vehicle.

Required:

Calculate taxable income of SLK (Pty) Ltd for the current year of assessment.

NB: VAT implications for this question must be ignored.

Round off your calculations to the nearest whole number.

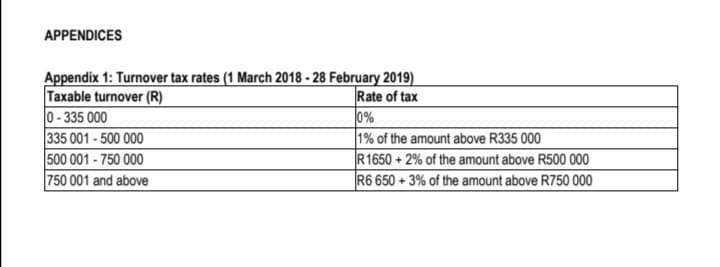

Transcribed Image Text:APPENDICES

Appendix 1: Turnover tax rates (1 March 2018 - 28 February 2019)

Taxable turnover (R)

0- 335 000

335 001 - 500 000

500 001 - 750 000

750 001 and above

Rate of tax

0%

1% of the amount above R335 000

R1650 + 2% of the amount above R500 000

R6 650 + 3% of the amount above R750 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning