Calculate the average annual return of the Opportunity fund and the S&P 500. Which performed better over this period? If you had invested $1,000 in each in- vestment at the beginning of 2009, how much money would you have in each investment at the end of 2012? Calculate the standard deviation of the Opportu- nity fund's return and those of the S&P 500. Which is more volatile?

Calculate the average annual return of the Opportunity fund and the S&P 500. Which performed better over this period? If you had invested $1,000 in each in- vestment at the beginning of 2009, how much money would you have in each investment at the end of 2012? Calculate the standard deviation of the Opportu- nity fund's return and those of the S&P 500. Which is more volatile?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 5FPE

Related questions

Question

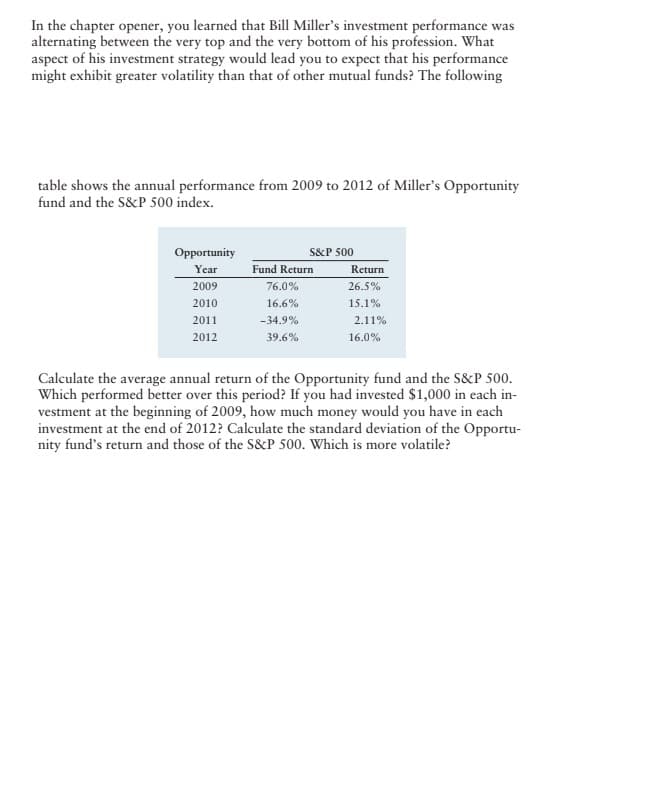

Transcribed Image Text:In the chapter opener, you learned that Bill Miller's investment performance was

alternating between the very top and the very bottom of his profession. What

aspect of his investment strategy would lead you to expect that his performance

might exhibit greater volatility than that of other mutual funds? The following

table shows the annual performance from 2009 to 2012 of Miller's Opportunity

fund and the S&P 500 index.

Opportunity

Year

2009

2010

2011

2012

S&P 500

Fund Return

76.0%

16.6%

-34.9%

39.6%

Return

26.5%

15.1%

2.11%

16.0%

Calculate the average annual return of the Opportunity fund and the S&P 500.

Which performed better over this period? If you had invested $1,000 in each in-

vestment at the beginning of 2009, how much money would you have in each

investment at the end of 2012? Calculate the standard deviation of the Opportu-

nity fund's return and those of the S&P 500. Which is more volatile?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning