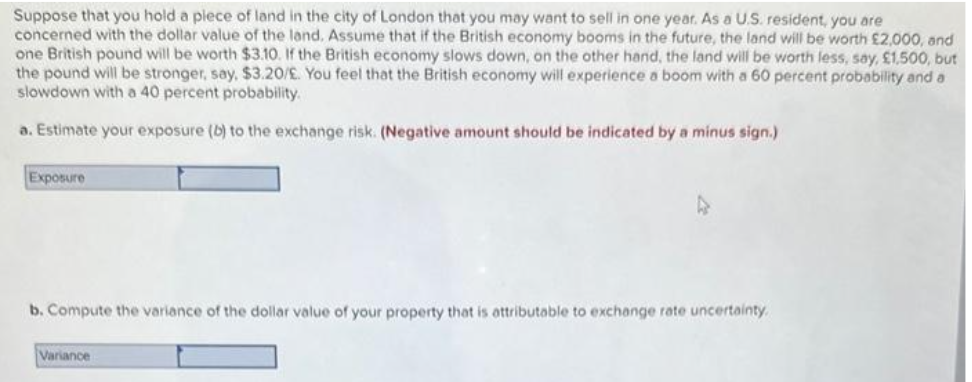

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth £2,000, and one British pound will be worth $3.10. If the British economy slows down, on the other hand, the land will be worth less, say, £1,500, but the pound will be stronger, say, $3.20/£. You feel that the British economy will experience a boom with a 60 percent probability and a slowdown with a 40 percent probability. a. Estimate your exposure (b) to the exchange risk. (Negative amount should be indicated by a minus sign.) Exposure b. Compute the variance of the dollar value of your property that is attributable to exchange rate uncertainty. Variance

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth £2,000, and one British pound will be worth $3.10. If the British economy slows down, on the other hand, the land will be worth less, say, £1,500, but the pound will be stronger, say, $3.20/£. You feel that the British economy will experience a boom with a 60 percent probability and a slowdown with a 40 percent probability. a. Estimate your exposure (b) to the exchange risk. (Negative amount should be indicated by a minus sign.) Exposure b. Compute the variance of the dollar value of your property that is attributable to exchange rate uncertainty. Variance

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter27: Multinational Financial Management

Section: Chapter Questions

Problem 14P

Related questions

Question

Ee 162.

Transcribed Image Text:Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are

concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth £2,000, and

one British pound will be worth $3.10. If the British economy slows down, on the other hand, the land will be worth less, say, £1,500, but

the pound will be stronger, say, $3.20/£. You feel that the British economy will experience a boom with a 60 percent probability and a

slowdown with a 40 percent probability.

a. Estimate your exposure (b) to the exchange risk. (Negative amount should be indicated by a minus sign.)

Exposure

b. Compute the variance of the dollar value of your property that is attributable to exchange rate uncertainty.

Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning