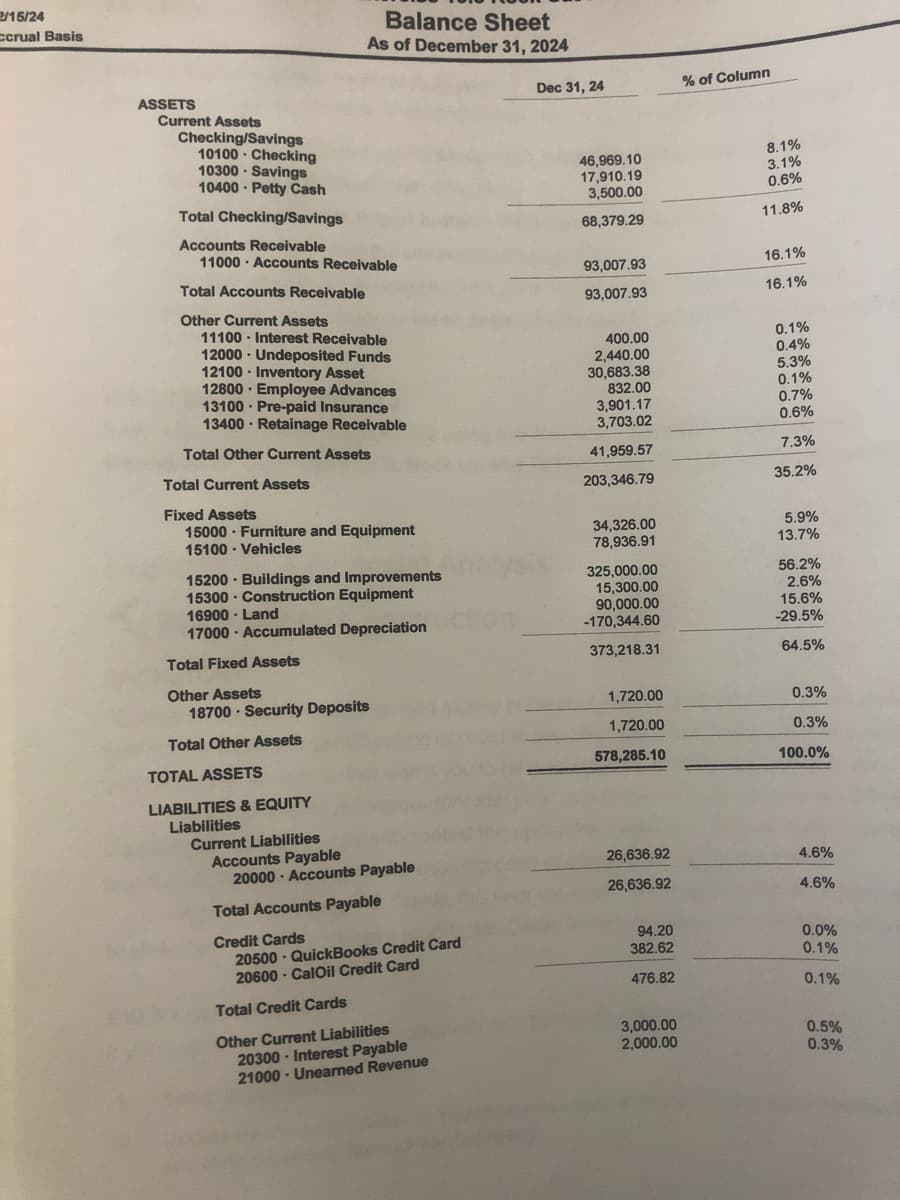

Calculate the debt ratio total liabilities/ total assets for Rock Castle Construction. What’s the percentage

Calculate the debt ratio total liabilities/ total assets for Rock Castle Construction. What’s the percentage

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.3BE: Journalize period payroll The payroll register of Heritage Co. indicates 3,900 of social security...

Related questions

Question

Calculate the debt ratio total liabilities/ total assets for Rock Castle Construction. What’s the percentage

Transcribed Image Text:2/15/24

Balance Sheet

As of December 31, 2024

ccrual Basis

Dec 31, 24

% of Column

ASSETS

Current Assets

Checking/Savings

10100 - Checking

10300 · Savings

10400 · Petty Cash

8.1%

3.1%

46,969.10

17,910.19

3,500.00

0.6%

Total Checking/Savings

68,379.29

11.8%

Accounts Receivable

11000 · Accounts Receivable

93,007.93

16.1%

Total Accounts Receivable

93,007.93

16.1%

Other Current Assets

11100 - Interest Receivable

12000 · Undeposited Funds

12100 · Inventory Asset

12800 · Employee Advances

13100 Pre-paid Insurance

13400 Retainage Receivable

0.1%

400.00

2.440.00

30,683.38

832.00

3,901.17

3,703.02

0.4%

5.3%

0.1%

0.7%

0.6%

Total Other Current Assets

41,959.57

7.3%

Total Current Assets

203,346.79

35.2%

Fixed Assets

15000 · Furniture and Equipment

15100 - Vehicles

34,326.00

78,936.91

5.9%

13.7%

15200 Buildings and Improvements

15300 - Construction Equipment

16900 - Land

17000 · Accumulated Depreciation

325,000.00

15.300.00

90,000.00

-170,344.60

56.2%

2.6%

15.6%

-29.5%

Total Fixed Assets

373,218.31

64.5%

Other Assets

18700 - Security Deposits

1,720.00

0.3%

Total Other Assets

1,720.00

0.3%

TOTAL ASSETS

578,285.10

100.0%

LIABILITIES & EQUITY

Liabilities

Current Liablities

Accounts Payable

20000 - Accounts Payable

26,636.92

4.6%

26,636.92

4.6%

Total Accounts Payable

Credit Cards

20500 · QuickBooks Credit Card

20600 - CalOil Credit Card

94.20

382.62

0.0%

0.1%

476.82

0.1%

Total Credit Cards

Other Current Liabilities

20300 - Interest Payable

21000 - Unearned Revenue

3,000.00

2,000.00

0.5%

0.3%

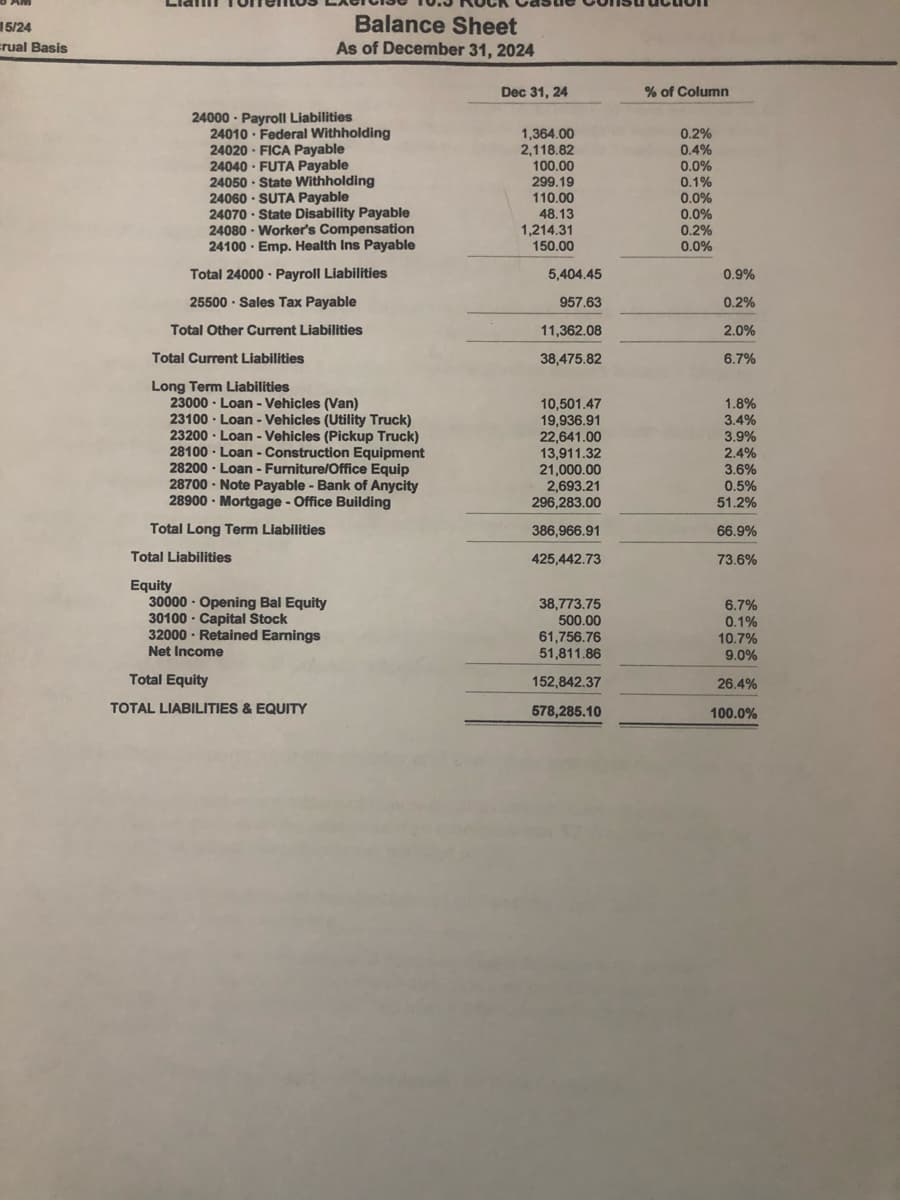

Transcribed Image Text:Balance Sheet

15/24

crual Basis

As of December 31, 2024

Dec 31, 24

% of Column

24000 - Payroll Liabilities

24010 · Federal Withholding

24020 · FICA Payable

24040 · FUTA Payable

24050 · State Withholding

24060 - SUTA Payable

24070 · State Disability Payable

24080 - Worker's Compensation

24100 · Emp. Health Ins Payable

1,364.00

2,118.82

100.00

0.2%

299.19

110.00

48.13

1,214.31

150.00

0.4%

0.0%

0.1%

0.0%

0.0%

0.2%

0.0%

Total 24000 - Payroll Liabilities

5,404.45

0.9%

25500 · Sales Tax Payable

957.63

0.2%

Total Other Current Liabilities

11,362.08

2.0%

Total Current Liabilities

38,475.82

6.7%

Long Term Liabilities

23000 · Loan - Vehicles (Van)

23100 · Loan - Vehicles (Utility Truck)

23200 · Loan - Vehicles (Pickup Truck)

28100 · Loan - Construction Equipment

28200 · Loan - Furniture/Office Equip

28700 - Note Payable - Bank of Anycity

28900 · Mortgage - Office Building

10,501.47

19,936.91

22,641.00

13,911.32

21,000.00

2,693.21

296,283.00

1.8%

3.4%

3.9%

2.4%

3.6%

0.5%

51.2%

Total Long Term Liabilities

386,966.91

66.9%

Total Liabilities

425,442.73

73.6%

Equity

30000 · Opening Bal Equity

30100 - Capital Stock

32000 · Retained Earnings

Net Income

38,773.75

500.00

6.7%

61,756.76

51,811.86

0.1%

10.7%

9.0%

Total Equity

152,842.37

26.4%

TOTAL LIABILITIES & EQUITY

578,285.10

100.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,