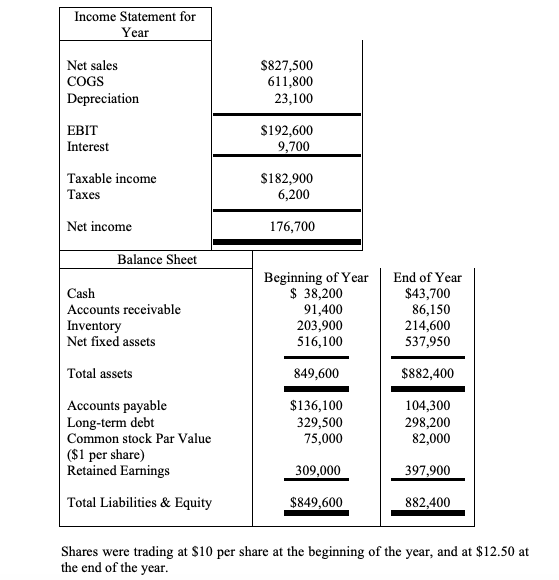

Calculate the firm’s Liquidity Ratios (Current Ratio and Quick Ratio), Profitability Ratios (for Net Income as well as EBIT), Efficiency (Total Assets Turnover, as well as A/C Receivables Turnover and Days in Accounts Receivables, Inventory Turnover Ratio and Days in Inventory), Debt Usage (Debt to Equity and Coverage Ratio), and Market-Value Based Ratios. For some ratios you can calculate only one value (for example, Profitability or Interest Coverage), and for some ratios you can calculate two values (one at the beginning and the other at the end of the year). Explain all calculations.

Calculate the firm’s Liquidity Ratios (Current Ratio and Quick Ratio), Profitability Ratios (for Net Income as well as EBIT), Efficiency (Total Assets Turnover, as well as A/C Receivables Turnover and Days in Accounts Receivables, Inventory Turnover Ratio and Days in Inventory), Debt Usage (Debt to Equity and Coverage Ratio), and Market-Value Based Ratios. For some ratios you can calculate only one value (for example, Profitability or Interest Coverage), and for some ratios you can calculate two values (one at the beginning and the other at the end of the year). Explain all calculations.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Calculate the firm’s

Transcribed Image Text:Income Statement for

Year

Net sales

COGS

Depreciation

EBIT

Interest

Taxable income

Taxes

Net income

Balance Sheet

Cash

Accounts receivable

Inventory

Net fixed assets

Total assets

Accounts payable

Long-term debt

Common stock Par Value

($1 per share)

Retained Earnings

Total Liabilities & Equity

$827,500

611,800

23,100

$192,600

9,700

$182,900

6,200

176,700

Beginning of Year

$ 38,200

91,400

203,900

516,100

849,600

$136,100

329,500

75,000

309,000

$849,600

End of Year

$43,700

86,150

214,600

537,950

$882,400

104,300

298,200

82,000

397,900

882,400

Shares were trading at $10 per share at the beginning of the year, and at $12.50 at

the end of the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning