Calculate the following ratios for 2025 and 2026. (Round current ratio to 2 decimal places, e.g. 12.61, debts to assets and gross profit rate to 0 decimal places, e.g.12, and all other answers to 1 decimal place, e.g. 12.6%) Please show your work. 1. Current ratio 2. Debts to assets 3. Gross profit rate 4. Profit margin 5. Return on assets (Total assets at November 1, 2024, were $35,180) 6. Return on common stockholder's equity (Total common stockholders' equity at November 1, 2024, was $25, 180. Dividends on preferred stock were $16,800 in 2025 and $18,000 in 2026)

Calculate the following ratios for 2025 and 2026. (Round current ratio to 2 decimal places, e.g. 12.61, debts to assets and gross profit rate to 0 decimal places, e.g.12, and all other answers to 1 decimal place, e.g. 12.6%) Please show your work. 1. Current ratio 2. Debts to assets 3. Gross profit rate 4. Profit margin 5. Return on assets (Total assets at November 1, 2024, were $35,180) 6. Return on common stockholder's equity (Total common stockholders' equity at November 1, 2024, was $25, 180. Dividends on preferred stock were $16,800 in 2025 and $18,000 in 2026)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 77E

Related questions

Question

Calculate the following ratios for 2025 and 2026. (Round

1. Current ratio

2. Debts to assets

3. Gross profit rate

4. Profit margin

5. Return on assets (Total assets at November 1, 2024, were $35,180)

6. Return on common

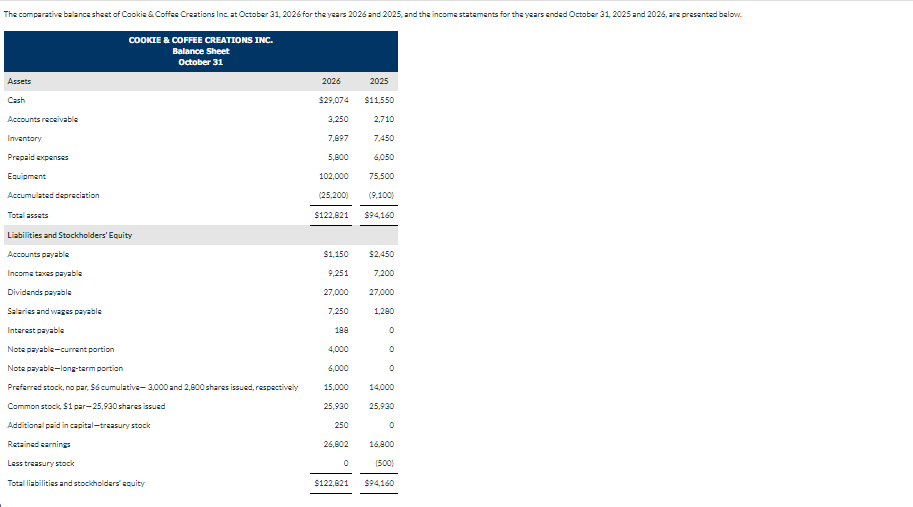

Transcribed Image Text:The comparative balance sheet of Cookie & Coffee Creations Inc. at October 31, 2026 for the years 2026 and 2025, and the income statements for the years ended October 31, 2025 and 2026, are presented below.

Assets

Cash

Accounts receivable

Inventory

Prepaid expenses

Equipment

Accumulated depreciation

Total assets

COOKIE & COFFEE CREATIONS INC.

Balance Sheet

October 31

Liabilities and Stockholders' Equity

Accounts payable

Income taxes payable

Dividends payable

Salaries and wages payable

Interest payable

Note payable-current portion

Note payable-long-term portion

Preferred stock, no par, $6 cumulative-3,000 and 2,800 shares issued, respectively

Common stock, $1 par-25,930 shares issued

Additional paid in capital-treasury stock

Retained earnings

Less treasury stock

Total liabilities and stockholders' equity

2026

2025

$11,550

2,710

7,450

6,050

102,000 75,500

(25,200)

(9,100)

$122,821

$29,074

3,250

7,897

5,800

$1,150

9,251

27,000

7,250

4,000

6,000

15,000

25,930

250

26,802

$122,821

$94,160

$2,450

7,200

27,000

1,280

0

0

0

14,000

25,930

0

16,800

(500)

$94,160

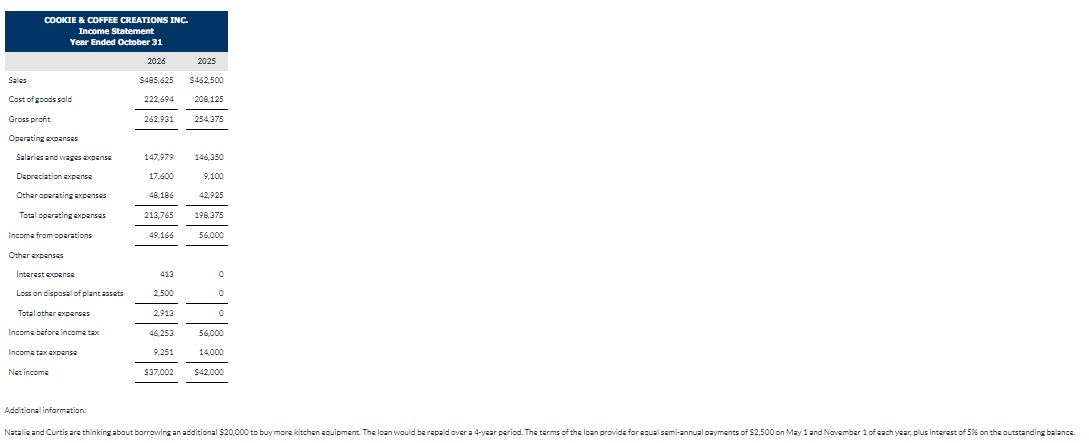

Transcribed Image Text:COOKIE & COFFEE CREATIONS INC.

Income Statement

Year Ended October 31

2026

$485,625 $462.500

222,694

208,125

262,931 254,375

Sales

Cast of goods sold

Gross proft

Operating expenses

Salaries and wages expense

Depreciation expense

Other operating expenses

Total operating expenses

Income from operations

Other expenses

Interest expense

Loss on disposal of plant assets

Total other expenses

Income before income tax

Income tax expense

Net income

Additional information:

147,979 146,350

9,100

42,925

198,375

17,600

48,186

213,765

49.166

413

2,500

2,913

46,253

9,251

2025

$37,002

56,000

0

0

56,000

14,000

$42,000

Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual payments of $2,500 on May 1 and November 1 of each year, plus interest of 536 on the outstanding balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College