Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 7E

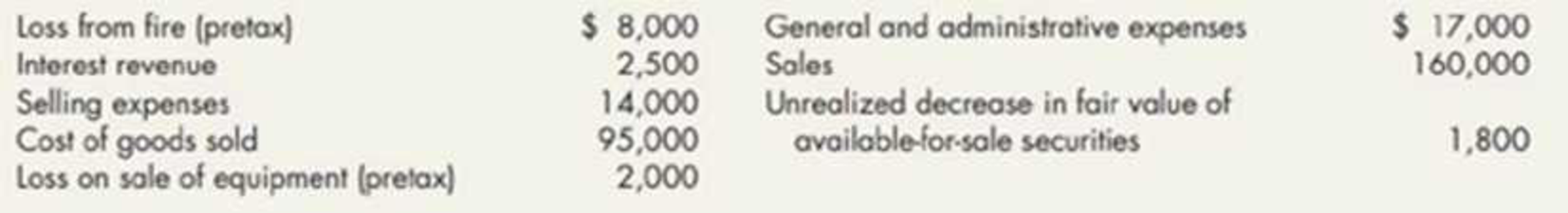

Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December 31, 2019, Opgenorth Company listed the following items in its adjusted

Additional data:

- 1. Seven thousand shares of common stock have been outstanding the entire year.

- 2. The income tax rate is 30% on all items of income.

Required:

- 1. Prepare a 2019 multiple-step income statement.

- 2. Prepare a 2019 single-step income statement.

- 3. Prepare a 2019 statement of comprehensive income.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 5 - In general, how does the income statement help...Ch. 5 - Prob. 2GICh. 5 - Define income under the capital maintenance...Ch. 5 - Prob. 4GICh. 5 - What is net income?Ch. 5 - What three things must a company determine to...Ch. 5 - Prob. 7GICh. 5 - Prob. 8GICh. 5 - Give an example and explanation for each of the...Ch. 5 - Define expenses. What do expenses measure?

Ch. 5 - Prob. 11GICh. 5 - Define gains and losses. Give examples of three...Ch. 5 - Prob. 13GICh. 5 - What items are included in a companys income from...Ch. 5 - How are unusual or infrequent gains or losses...Ch. 5 - What is interperiod tax allocation?Ch. 5 - Prob. 17GICh. 5 - Prob. 18GICh. 5 - Prob. 19GICh. 5 - Prob. 20GICh. 5 - Prob. 21GICh. 5 - Prob. 22GICh. 5 - Prob. 23GICh. 5 - Prob. 24GICh. 5 - Prob. 25GICh. 5 - Prob. 26GICh. 5 - Prob. 27GICh. 5 - Prob. 28GICh. 5 - Prob. 29GICh. 5 - Prob. 30GICh. 5 - What is the rate of return on common equity? What...Ch. 5 - Prob. 32GICh. 5 - Prob. 33GICh. 5 - Which of the following is expensed under the...Ch. 5 - The following information is available for Cooke...Ch. 5 - The following information is available for Wagner...Ch. 5 - Prob. 4MCCh. 5 - A loss from the sale of a component of a business...Ch. 5 - In a statement of cash flows, receipts from sales...Ch. 5 - Brandt Corporation had sales revenue of 500,000...Ch. 5 - Refer to RE5-1. Prepare a single-step income...Ch. 5 - Shaquille Corporation began the current year with...Ch. 5 - Dorno Corporation incurred expenses during the...Ch. 5 - Niler Corporation reported the following after-tax...Ch. 5 - Jordan Corporation reported retained earnings of...Ch. 5 - Prob. 7RECh. 5 - Prob. 8RECh. 5 - Amelias Bookstore reported net income of 62,000...Ch. 5 - Prob. 10RECh. 5 - Prob. 1ECh. 5 - Cost of Goods Sold and Income Statement Schuch...Ch. 5 - Income Statement Calculation OConnor Companys...Ch. 5 - Results of Discontinued Operations On November 30,...Ch. 5 - Multiple-Step and Single-Step In coin Statements...Ch. 5 - Prob. 6ECh. 5 - Multiple-Step and Single-Step Income Statements,...Ch. 5 - Cost of Goods Sold, Income Statement. and...Ch. 5 - Net Cash Flow from Operating Activities The...Ch. 5 - Prob. 10ECh. 5 - Statement of Cash Flows The following items...Ch. 5 - Statement of Cash Flows The following are several...Ch. 5 - Classifications Where would each of the following...Ch. 5 - Rate of Change nalyses eiher Company presents the...Ch. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Income Statement and Retained Earnings Huff...Ch. 5 - Prob. 18ECh. 5 - Interim Reporting (Appendix 5.1) Miller Company...Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Income Statement, Lower Portion Cunningham Company...Ch. 5 - Financial Statement Violations of U.S. GAAP The...Ch. 5 - Misclassiflcations Rox Corporations multiple-step...Ch. 5 - Misclassifications Olson Companys bookkeeper...Ch. 5 - Complex Income Statement The following items were...Ch. 5 - Prob. 8PCh. 5 - Financial Statement Deficiencies The following is...Ch. 5 - Comprehensive: Balance Sheet from Statement of...Ch. 5 - Net Income and Comprehensive Income At the...Ch. 5 - Statement of Cash Flows A list of Fischer Companys...Ch. 5 - Statement of Cash Flows The following are Mueller...Ch. 5 - Prob. 14PCh. 5 - Rate of Change Analyses and Ratios Analyses The...Ch. 5 - Comprehensive: Income Statement and Retained...Ch. 5 - Comprehensive: Income Statement and Supporting...Ch. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Prob. 1CCh. 5 - Prob. 2CCh. 5 - Prob. 3CCh. 5 - Prob. 4CCh. 5 - Nonrecurring Items Lynn Company sells a component...Ch. 5 - Prob. 6CCh. 5 - Accrual Accounting GAAP requires the use of...Ch. 5 - Ethics and Sale of Operating Component It is the...Ch. 5 - Analyzing Starbuckss Income Statement and Cash...Ch. 5 - Prob. 11C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).arrow_forwardComprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forwardComplex Income Statement The following items were derived from Woodbine Circle Corporations adjusted trial balance on December 31, 2019: Other financial data for the year ended December 31, 2019: Required: Using the multiple-step format, prepare a formal income statement for Woodbine for the year ended December 31, 2019, together with the appropriate supporting schedules. All income taxes should be appropriately shown.arrow_forward

- Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives the following items from its adjusted trial balance as of December 31, 2019: The following; additional information is also available. The December 31, 2019, ending inventory is 14,700. During 2019, 4,200 shares of'common stock were outstanding the entire year. The income tax rate 30% on all items of income. Required: 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Gaskins cost of goods sold. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 multiple-step income statement. 4. Prepare a 2019 statement of comprehensive income.arrow_forwardRoseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.arrow_forwardReinhardt Company reported revenues of $122,000 and expenses of $83,000 on its 2019 income statement. In addition, Reinhardt paid of dividends during 2019. On December 31, 2019, Reinhardt prepared closing entries. The net effect of the closing entries on retained earnings was a(n): a. decrease of $4,000. b. increase of $35,000. c. increase of $39,000. d. decrease of $87,000.arrow_forward

- Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.arrow_forwardBalance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)arrow_forwardIncome Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at the beginning of 2019. For the year ended December 31, 2019, the company reports pretax income from continuing operations of 150,500. The following information is also available pertaining to 2019: 1. The company declared and paid a 0.72 cash dividend per share on the 30,000 shares of common stock that were outstanding the entire year. 2. The company incurred a pretax 21,000 loss as a result of an earthquake, which is not unusual for the area. This is included in the 150,500 income from continuing operations. 3. The company sold Division P (a component of the company) in May. From January through May, Division P had incurred a pretax loss from operations of 33,000. A pretax gain of 15,000 was recognized on the sale of Division P. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cunningham's 2019 income statement beginning with Pretax Income from Continuing Operations. Include any related note to the financial statements. 2. Prepare an accompanying retained earnings statement.arrow_forward

- Using the following Company W information, prepare a Retained Earnings Statement. Retained earnings balance January 1, 2019, $43,500 Net income for year 2019, $55,289 Dividends declared and paid for year 2019, $18,000arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License