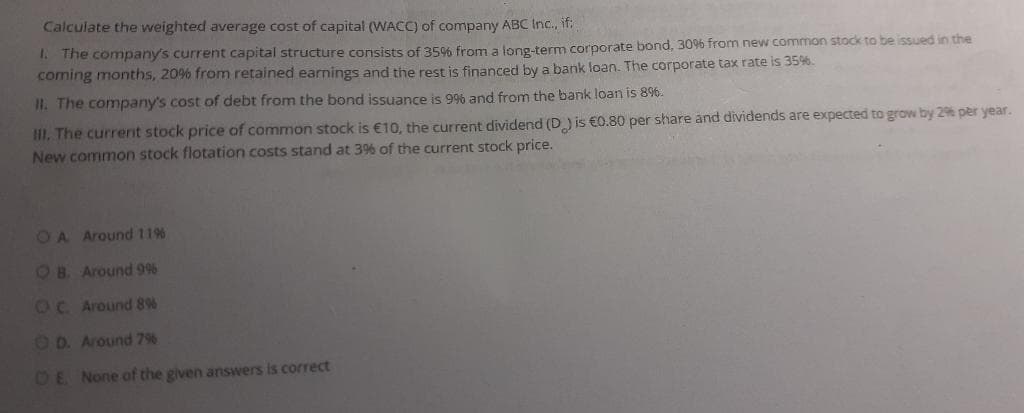

Calculate the weighted average cost of capital (WACC) of company ABC Inc., if: 1. The company's current capital structure consists of 35% from a long-term corporate bond, 30% from new common stock to be issued in the coming months, 20% from retained earnings and the rest is financed by a bank loan. The corporate tax rate is 35%. II. The company's cost of debt from the bond issuance is 9% and from the bank loan is 8%. III. The current stock price of common stock is €10, the current dividend (D) is €0.80 per share and dividends are expected to grow by 2% per year. New common stock flotation costs stand at 3% of the current stock price.

Calculate the weighted average cost of capital (WACC) of company ABC Inc., if: 1. The company's current capital structure consists of 35% from a long-term corporate bond, 30% from new common stock to be issued in the coming months, 20% from retained earnings and the rest is financed by a bank loan. The corporate tax rate is 35%. II. The company's cost of debt from the bond issuance is 9% and from the bank loan is 8%. III. The current stock price of common stock is €10, the current dividend (D) is €0.80 per share and dividends are expected to grow by 2% per year. New common stock flotation costs stand at 3% of the current stock price.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter11: Risk-adjusted Expected Rates Of Return And The Dividends Valuation Approach

Section: Chapter Questions

Problem 1BIC

Related questions

Question

Transcribed Image Text:Calculate the weighted average cost of capital (WACC) of company ABC Inc., if:

1.

The company's current capital structure consists of 35% from a long-term corporate bond, 30% from new common stock to be issued in the

coming months, 20% from retained earnings and the rest is financed by a bank loan. The corporate tax rate is 35%.

II. The company's cost of debt from the bond issuance is 9% and from the bank loan is 8%.

III. The current stock price of common stock is €10, the current dividend (D) is €0.80 per share and dividends are expected to grow by 2% per year.

New common stock flotation costs stand at 3% of the current stock price.

OA Around 11%

OB. Around 9%

OC. Around 8%

OD. Around 7%

OE. None of the given answers is correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning