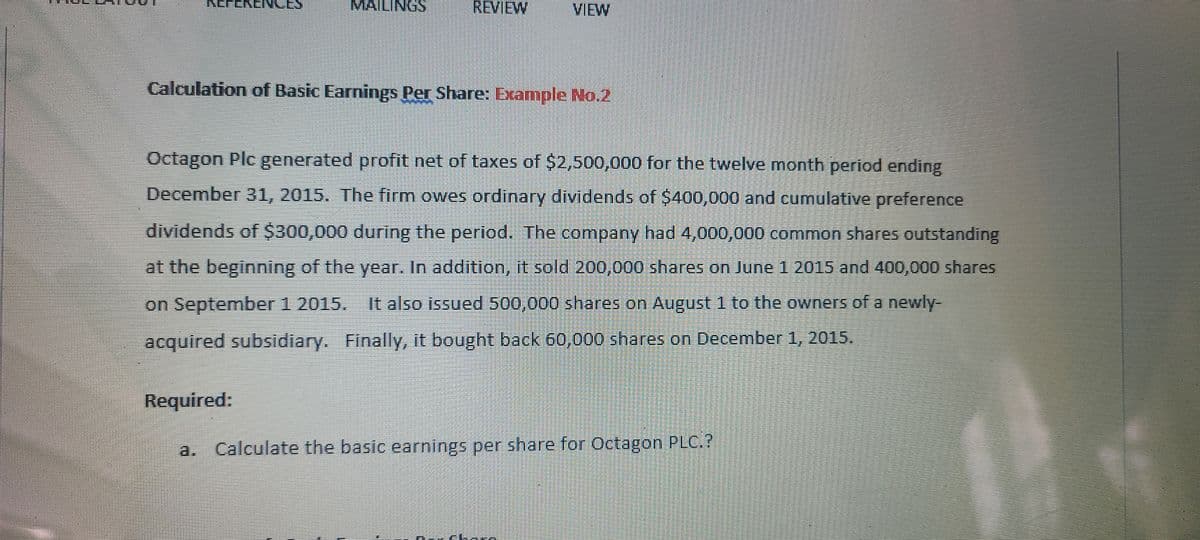

Calculation of Basic Earnings Per Share: Example No.2 Octagon Plc generated profit net of taxes of $2,500,000 for the twelve month period ending December 31, 2015. The firm owes ordinary dividends of $400,000 and cumulative preference dividends of $300,000 during the period. The company had 4,000,000 common shares outstanding at the beginning of the year. In addition, it sold 200,000 shares on June 1 2015 and 400,000 shares on September 1 2015. It also issued 500,000 shares on August 1 to the owners of a newly- acquired subsidiary. Finally, it bought back 60,000 shares on December 1, 2015. Required: a. Calculate the basic earnings per share for Octagon PLC.?

Calculation of Basic Earnings Per Share: Example No.2 Octagon Plc generated profit net of taxes of $2,500,000 for the twelve month period ending December 31, 2015. The firm owes ordinary dividends of $400,000 and cumulative preference dividends of $300,000 during the period. The company had 4,000,000 common shares outstanding at the beginning of the year. In addition, it sold 200,000 shares on June 1 2015 and 400,000 shares on September 1 2015. It also issued 500,000 shares on August 1 to the owners of a newly- acquired subsidiary. Finally, it bought back 60,000 shares on December 1, 2015. Required: a. Calculate the basic earnings per share for Octagon PLC.?

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter11: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 11.8BPE: Earnings per share Financial statement data for the years ended December 31 for Black Bull Inc....

Related questions

Question

Transcribed Image Text:MAILINGS

REVIEW

VIEW

Calculation of Basic Earnings Per Share: Example No.2

Octagon Plc generated profit net of taxes of $2,500,000 for the twelve month period ending

December 31, 2015. The firm owes ordinary dividends of $400,000 and cumulative preference

dividends of $300,000 during the period. The company had 4,000,000 common shares outstanding

at the beginning of the year. In addition, it sold 200,000 shares on June 1 2015 and 400,000 shares

on September 1 2015. It also issued 500,000 shares on August 1 to the owners of a newly-

acquired subsidiary. Finally, it bought back 60,000 shares on December 1, 2015.

Required:

Calculate the basic earnings per share for Octagon PLC.?

EEEEE. SISE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning