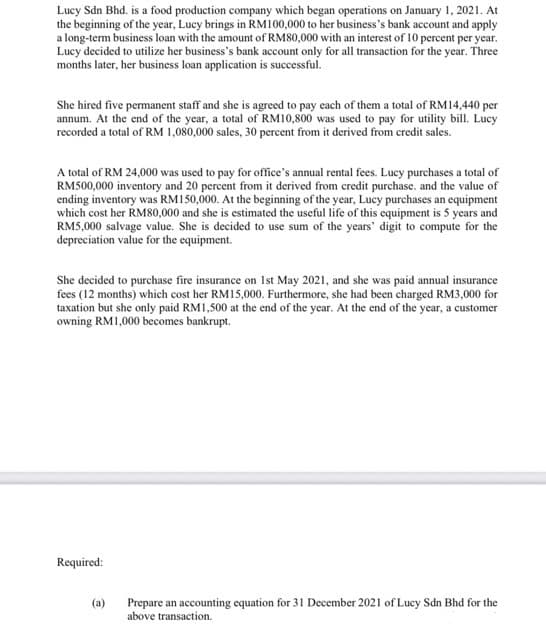

Lucy Sdn Bhd. is a food production company which began operations on January 1, 2021. At the beginning of the year, Lucy brings in RM100,000 to her business's bank account and apply a long-term business loan with the amount of RM80,000 with an interest of 10 percent per year. Lucy decided to utilize her business's bank account only for all transaction for the year. Three months later, her business loan application is successful. She hired five permanent staff and she is agreed to pay each of them a total of RM14,440 per annum. At the end of the year, a total of RM10,800 was used to pay for utility bill. Lucy recorded a total of RM 1,080,000 sales, 30 percent from it derived from credit sales. A total of RM 24,000 was used to pay for office's annual rental fees. Lucy purchases a total of RM500,000 inventory and 20 percent from it derived from credit purchase, and the value of ending inventory was RM150,000. At the beginning of the year, Lucy purchases an equipment which cost her RM80,000 and she is estimated the useful life of this equipment is 5 years and RM5,000 salvage value. She is decided to use sum of the years' digit to compute for the depreciation value for the equipment. She decided to purchase fire insurance on 1st May 2021, and she was paid annual insurance

Lucy Sdn Bhd. is a food production company which began operations on January 1, 2021. At the beginning of the year, Lucy brings in RM100,000 to her business's bank account and apply a long-term business loan with the amount of RM80,000 with an interest of 10 percent per year. Lucy decided to utilize her business's bank account only for all transaction for the year. Three months later, her business loan application is successful. She hired five permanent staff and she is agreed to pay each of them a total of RM14,440 per annum. At the end of the year, a total of RM10,800 was used to pay for utility bill. Lucy recorded a total of RM 1,080,000 sales, 30 percent from it derived from credit sales. A total of RM 24,000 was used to pay for office's annual rental fees. Lucy purchases a total of RM500,000 inventory and 20 percent from it derived from credit purchase, and the value of ending inventory was RM150,000. At the beginning of the year, Lucy purchases an equipment which cost her RM80,000 and she is estimated the useful life of this equipment is 5 years and RM5,000 salvage value. She is decided to use sum of the years' digit to compute for the depreciation value for the equipment. She decided to purchase fire insurance on 1st May 2021, and she was paid annual insurance

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Topic Video

Question

Transcribed Image Text:Lucy Sdn Bhd. is a food production company which began operations on January 1, 2021. At

the beginning of the year, Lucy brings in RM100,000 to her business's bank account and apply

a long-term business loan with the amount of RM80,000 with an interest of 10 percent per year.

Lucy decided to utilize her business's bank account only for all transaction for the year. Three

months later, her business loan application is successful.

She hired five permanent staff and she is agreed to pay each of them a total of RM14,440 per

annum. At the end of the year, a total of RM10,800 was used to pay for utility bill. Lucy

recorded a total of RM 1,080,000 sales, 30 percent from it derived from credit sales.

A total of RM 24,000 was used to pay for office's annual rental fees. Lucy purchases a total of

RM500,000 inventory and 20 percent from it derived from credit purchase. and the value of

ending inventory was RM150,000. At the beginning of the year, Lucy purchases an equipment

which cost her RM80,000 and she is estimated the useful life of this equipment is 5 years and

RM5,000 salvage value. She is decided to use sum of the years' digit to compute for the

depreciation value for the equipment.

She decided to purchase fire insurance on Ist May 2021, and she was paid annual insurance

fees (12 months) which cost her RM15,000. Furthermore, she had been charged RM3,000 for

taxation but she only paid RM1,500 at the end of the year. At the end of the year, a customer

owning RM1,000 becomes bankrupt.

Required:

(a)

Prepare an accounting equation for 31 December 2021 of Lucy Sdn Bhd for the

above transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT