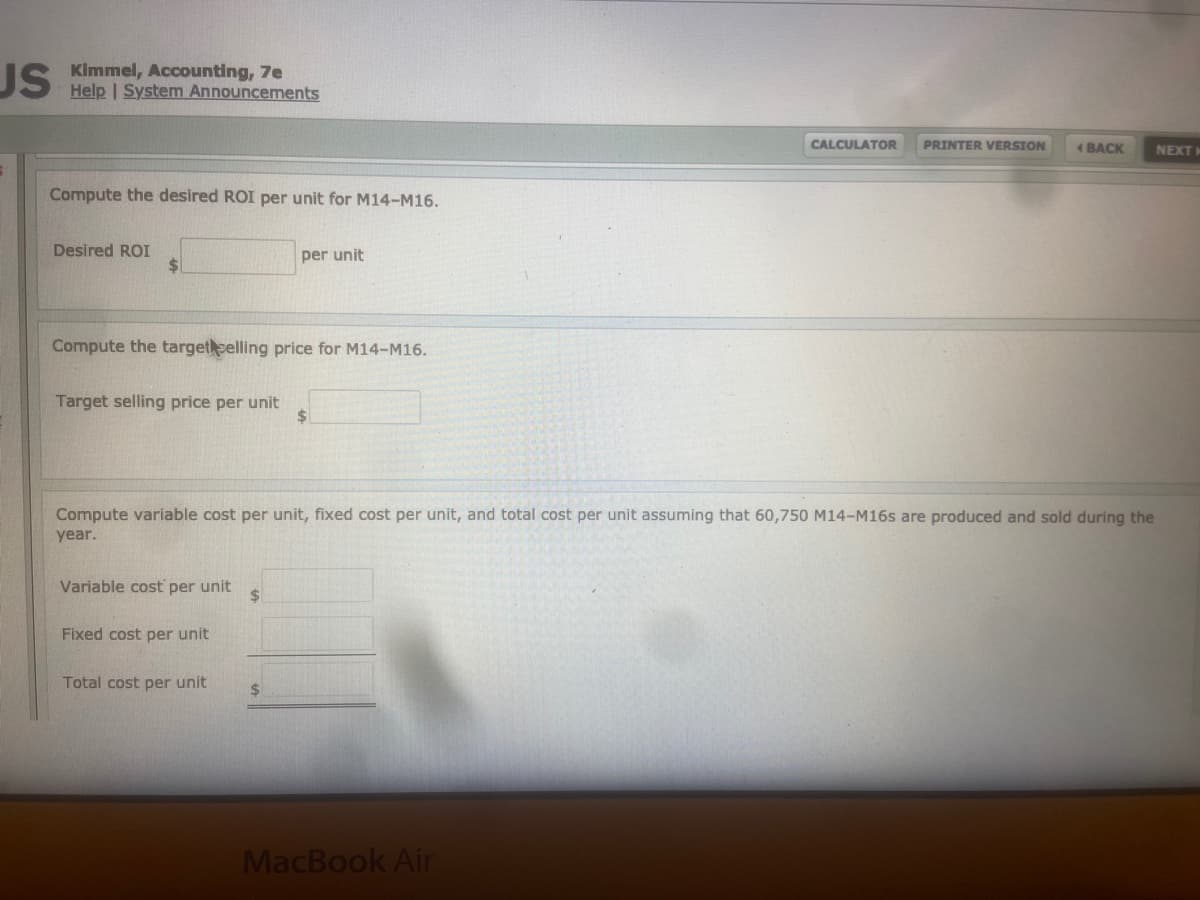

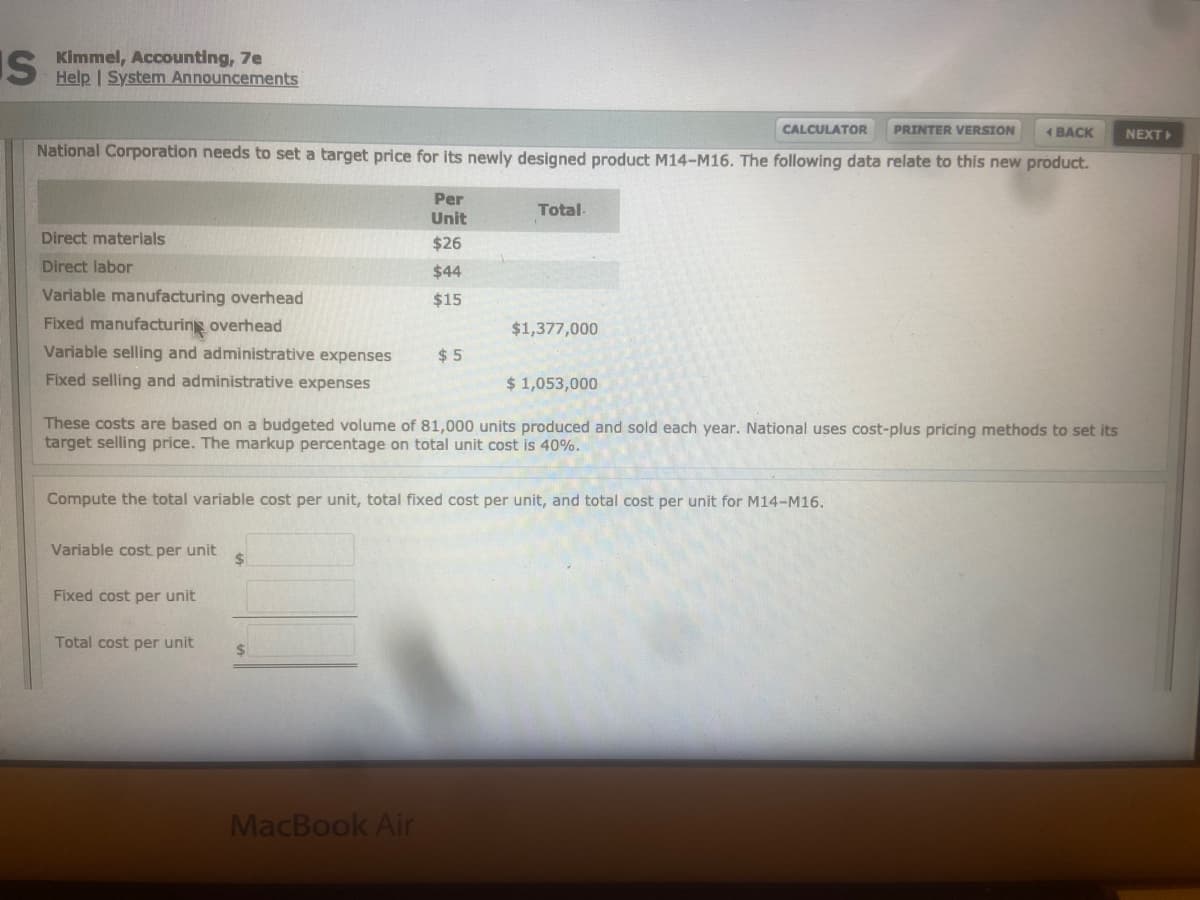

CALCULATOR PRINTER VERSION ( BACK NE National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. Per Unit Total Direct materials $26 Direct labor $44 Variable manufacturing overhead $15 Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $1,377,000 $ 5 $ 1,053,000 These costs are based on a budgeted volume of 81,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, total fixed cost per unit, and total cost per unit for M14-M16. Variable cost per unit %$4 Fixed cost per unit Total cost per unit %24

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps