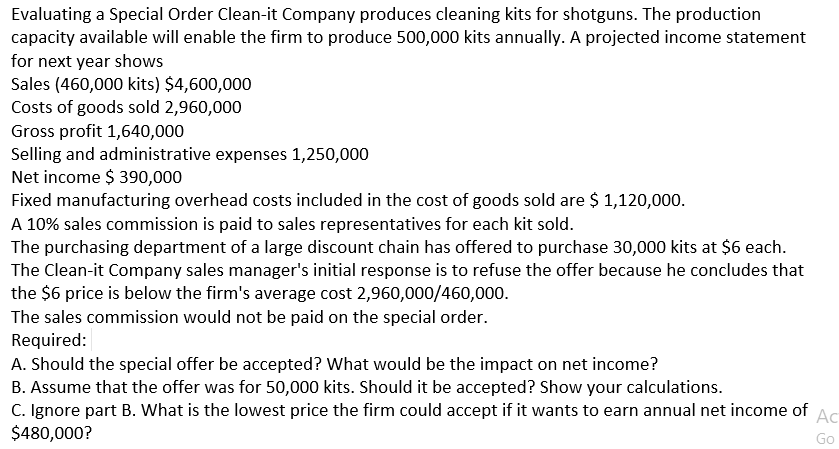

Evaluating a Special Order Clean-it Company produces cleaning kits for shotguns. The production capacity available will enable the firm to produce 500,000 kits annually. A projected income statement for next year shows Sales (460,000 kits) $4,600,000 Costs of goods sold 2,960,000 Gross profit 1,640,000 Selling and administrative expenses 1,250,000 Net income $ 390,000 Fixed manufacturing overhead costs included in the cost of goods sold are $ 1,120,000. A 10% sales commission is paid to sales representatives for each kit sold. The purchasing department of a large discount chain has offered to purchase 30,000 kits at $6 each. The Clean-it Company sales manager's initial response is to refuse the offer because he concludes that the $6 price is below the firm's average cost 2,960,000/460,000. The sales commission would not be paid on the special order. Required: A. Should the special offer be accepted? What would be the impact on net income? B. Assume that the offer was for 50,000 kits. Should it be accepted? Show your calculations. C. Ignore part B. What is the lowest price the firm could accept if it wants to earn annual net income of $480,000?

Evaluating a Special Order Clean-it Company produces cleaning kits for shotguns. The production capacity available will enable the firm to produce 500,000 kits annually. A projected income statement for next year shows Sales (460,000 kits) $4,600,000 Costs of goods sold 2,960,000 Gross profit 1,640,000 Selling and administrative expenses 1,250,000 Net income $ 390,000 Fixed manufacturing overhead costs included in the cost of goods sold are $ 1,120,000. A 10% sales commission is paid to sales representatives for each kit sold. The purchasing department of a large discount chain has offered to purchase 30,000 kits at $6 each. The Clean-it Company sales manager's initial response is to refuse the offer because he concludes that the $6 price is below the firm's average cost 2,960,000/460,000. The sales commission would not be paid on the special order. Required: A. Should the special offer be accepted? What would be the impact on net income? B. Assume that the offer was for 50,000 kits. Should it be accepted? Show your calculations. C. Ignore part B. What is the lowest price the firm could accept if it wants to earn annual net income of $480,000?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 40P: Olin Company manufactures and distributes carpentry tools. Production of the tools is in the mature...

Related questions

Question

Transcribed Image Text:Evaluating a Special Order Clean-it Company produces cleaning kits for shotguns. The production

capacity available will enable the firm to produce 500,000 kits annually. A projected income statement

for next year shows

Sales (460,000 kits) $4,600,000

Costs of goods sold 2,960,000

Gross profit 1,640,000

Selling and administrative expenses 1,250,000

Net income $ 390,000

Fixed manufacturing overhead costs included in the cost of goods sold are $ 1,120,000.

A 10% sales commission is paid to sales representatives for each kit sold.

The purchasing department of a large discount chain has offered to purchase 30,000 kits at $6 each.

The Clean-it Company sales manager's initial response is to refuse the offer because he concludes that

the $6 price is below the firm's average cost 2,960,000/460,000.

The sales commission would not be paid on the special order.

Required:

A. Should the special offer be accepted? What would be the impact on net income?

B. Assume that the offer was for 50,000 kits. Should it be accepted? Show your calculations.

C. Ignore part B. What is the lowest price the firm could accept if it wants to earn annual net income of

$480,000?

Ac

Go

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning