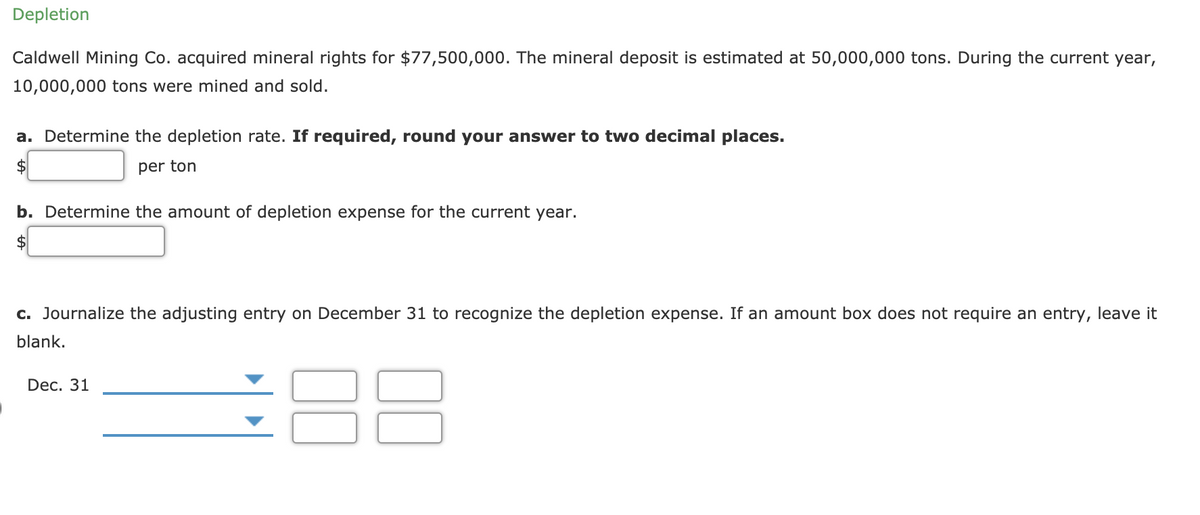

Caldwell Mining Co. acquired mineral rights for $77,500,000. The mineral deposit is estimated at 50,000,000 tons 10,000,000 tons were mined and sold. a. Determine the depletion rate. If required, round your answer to two decimal places. per ton b. Determine the amount of depletion expense for the current year. c. Journalize the adjusting entry on December 31 to recognize the depletion expense. If an amount box does not blank. Dec. 31

Caldwell Mining Co. acquired mineral rights for $77,500,000. The mineral deposit is estimated at 50,000,000 tons 10,000,000 tons were mined and sold. a. Determine the depletion rate. If required, round your answer to two decimal places. per ton b. Determine the amount of depletion expense for the current year. c. Journalize the adjusting entry on December 31 to recognize the depletion expense. If an amount box does not blank. Dec. 31

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

ChapterA: Methods Of Depreciation

Section: Chapter Questions

Problem 1P: A delivery van was bought for 18,000. The estimated life of the van is four years. The trade-in...

Related questions

Question

Transcribed Image Text:Depletion

Caldwell Mining Co. acquired mineral rights for $77,500,000. The mineral deposit is estimated at 50,000,000 tons. During the current year,

10,000,000 tons were mined and sold.

a. Determine the depletion rate. If required, round your answer to two decimal places.

2$

per ton

b. Determine the amount of depletion expense for the current year.

$

c. Journalize the adjusting entry on December 31 to recognize the depletion expense.

an an

bo

oes not require an entry,

it

blank.

88

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College