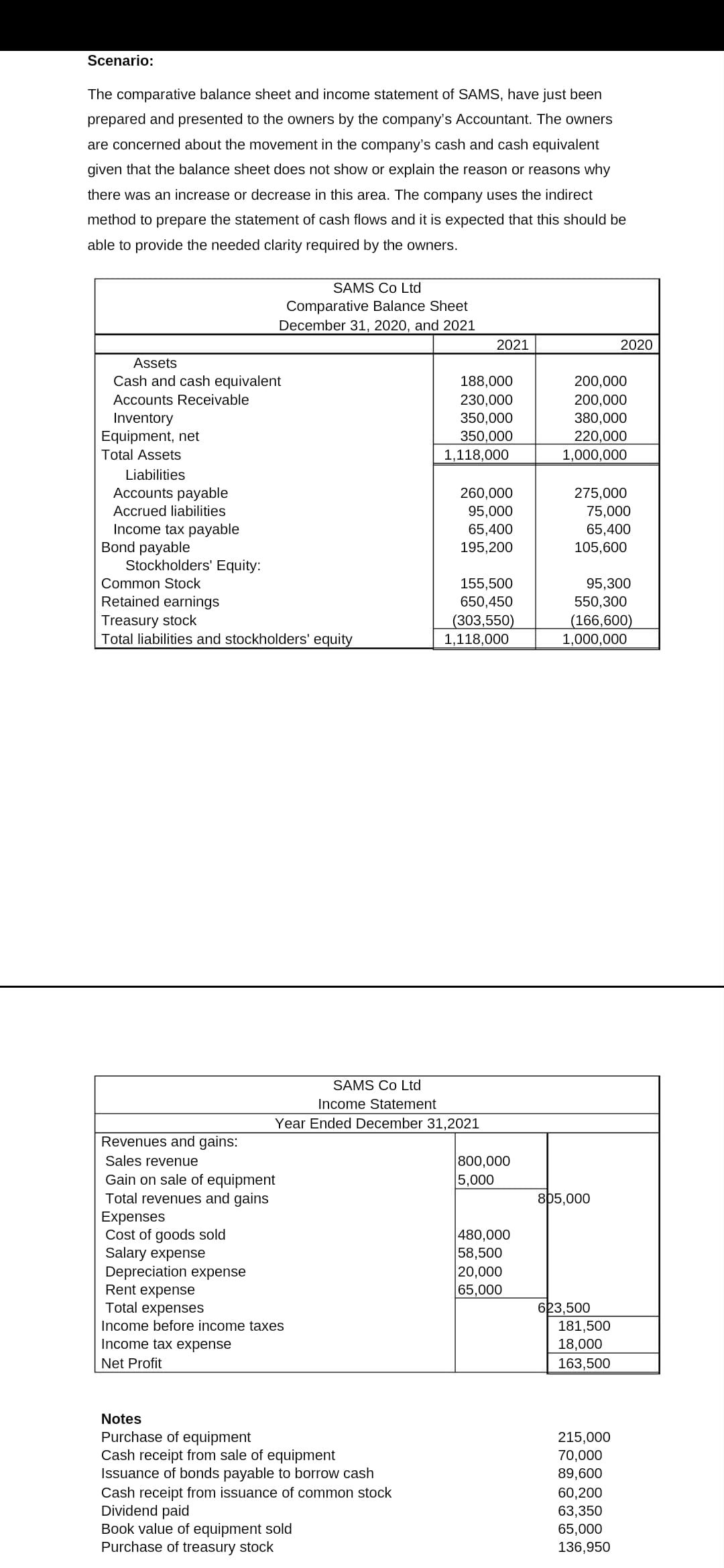

Scenario: The comparative balance sheet and income statement of SAMS, have just been prepared and presented to the owners by the company's Accountant. The owners are concerned about the movement in the company's cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. Assets Cash and cash equivalent Accounts Receivable Inventory Equipment, net Total Assets Liabilities Accounts payable Accrued liabilities Income tax payable Bond payable Stockholders' Equity: SAMS Co Ltd Comparative Balance Sheet December 31, 2020, and 2021 Common Stock Retained earnings Treasury stock Total liabilities and stockholders' equity Revenues and gains: Sales revenue Gain on sale of equipment Total revenues and gains Expenses Cost of goods sold Salary expense Depreciation expense Rent expense Total expenses Income before income taxes. Income tax expense Net Profit Notes Purchase of equipment Cash receipt from sale of equipment Issuance of bonds payable to borrow cash Cash receipt from issuance of common stock Dividend paid Book value of equipment sold Purchase of treasury stock 2021 188,000 230,000 350,000 350,000 1,118,000 SAMS Co Ltd Income Statement Year Ended December 31,2021 260,000 95,000 65,400 195,200 155,500 650,450 (303,550) 1,118,000 800,000 5,000 480,000 58,500 20,000 65,000 200,000 200,000 380,000 220,000 1,000,000 275,000 75,000 65,400 105,600 95,300 550,300 (166,600) 1,000,000 805,000 623,500 2020 181,500 18,000 163,500 215,000 70,000 89,600 60,200 63,350 65,000 136,950

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

Using the attached image.

Prepare a complete statement of cash flows for December 2021 using the indirect method based on the information and guidance provided above.

Step by step

Solved in 2 steps with 1 images

Can you explain how you got the figure for purchase of equipment (215,000) and also please answer the below multiple choice:

- The term cash as used on the statement of cash flows includes all the following EXCEPT:

- A) cash due from customers within 30 days.

- B) cash on hand.

- C) cash equivalents.

- D) cash in bank

- Which of the following statements accurately describes the statement of cash flows?

- A) It shows the relative proportion of debt and assets.

- B) It shows the link between accrual-based income and the cash reported on the balance sheet.

- C) It indicates when long-term debt will mature.

- D) It shows the link between book income and earnings per share.

- Which of the following is NOT a true statement about the statement of cash flows?

- A) It shows where cash came from and how it was spent.

- B) It reports why cash increased or decreased.

- C) It covers a specific span of time the same as the income statement.

- D) It shows how the

profits or losses of the company were generated.

- Which one of the following is a principal function of the statement of cash flows?

- A) To predict future net income

- B) To evaluate management decisions

- C) To evaluate the company's earnings per share

- D) To predict the growth of company assets