can you help me fill out my balance sheets based on my journal.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 97.1C

Related questions

Question

can you help me fill out my balance sheets based on my journal.

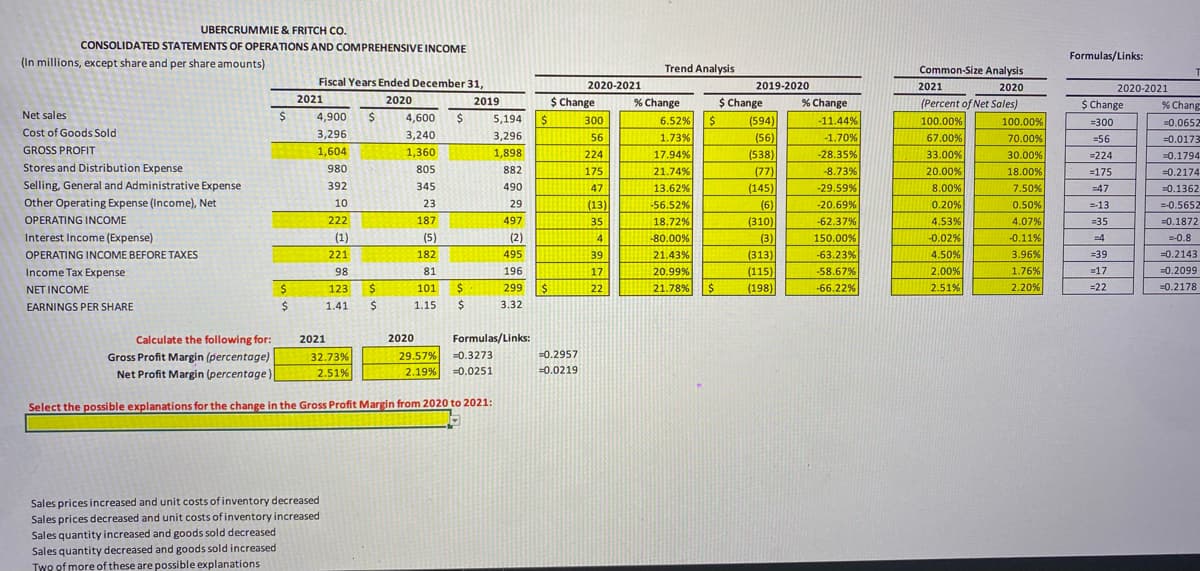

Transcribed Image Text:UBERCRUMMIE & FRITCH CO.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

Formulas/Links:

(In millions, except share and per share amounts)

Trend Analysis

Common-Size Analysis

Fiscal Years Ended December 31,

2020-2021

2020-2021

$ Change

2019-2020

2021

2020

2021

2020

2019

$ Change

% Change

$ Change

% Change

(Percent of Net Sales)

% Chang

Net sales

4,900

4,600

$

6.52%

1.73%

17.94%

21.74%

5,194

300

(594)

-11.44%

100.00%

100.00%

=300

=0.0652

Cost of Goods Sold

3,296

3,240

67.00%

33.00%

3,296

56

(56)

-1.70%

70.00%

=56

=0.0173

GROSS PROFIT

1,604

1,360

1,898

224

(538)

-28.35%

30.00%

18.00%

7.50%

=224

=0.1794

Stores and Distribution Expense

980

805

882

175

(77)

-8.73%

20.00%

=175

=0.2174

Selling, General and Administrative Expense

392

345

490

47

13.62%

(145)

-29.59%

8.00%

=47

=0.1362

Other Operating Expense (Income), Net

10

23

29

(13)

-56.52%

(6)

-20.69%

0.20%

0.50%

=-13

=-0.5652

OPERATING INCOME

222

187

497

35

18.72%

(310)

-62.37%

4.53%

4.07%

=35

=0.1872

Interest Income (Expense)

(1)

(5)

(2)

4

-80.00%

(3)

(313)

150.00%

-0.02%

-0.11%

=4

=-0.8

OPERATING INCOME BEFORE TAXES

221

182

495

39

21.43%

-63.23%

4.50%

3.96%

=39

=0.2143

Income Tax Expense

98

81

196

17

20.99%

(115)

-58.67%

2.00%

1.76%

=17

=0.2099

NET INCOME

123

101

$4

299

$4

22

21.78%

(198)

-66.22%

2.51%

2.20%

=22

=0.2178

EARNINGS PER SHARE

$4

1.41

1.15

3.32

Calculate the following for:

2021

2020

Formulas/Links:

Gross Profit Margin (percentage)

32.73%

29.57%

=0.3273

=0.2957

Net Profit Margin (percentage

2.51%

2.19%

=0.0251

=0.0219

Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021:

Sales prices increased and unit costs of inventory decreased

Sales prices decreased and unit costs of inventory increased

Sales quantity increased and goods sold decreased

Sales quantity decreased and goods sold increased

Two of more of these are possible explanations

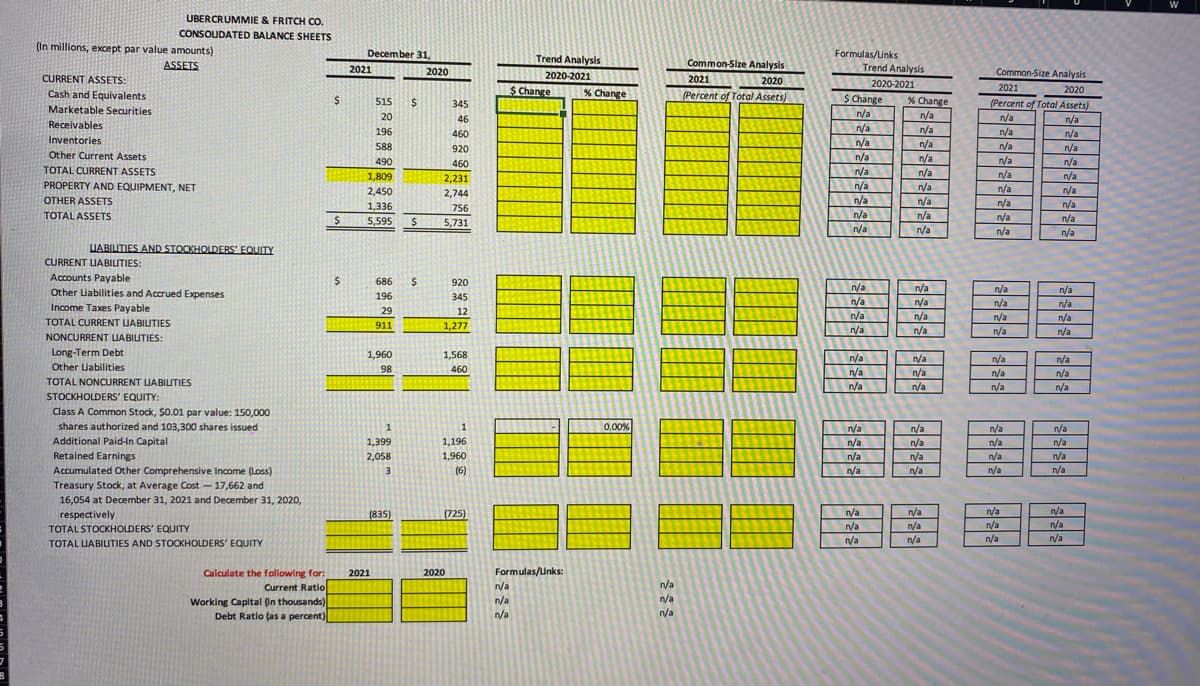

Transcribed Image Text:UBERCRUMMIE & FRITCH CO,

CONSOUDATED BALANCE SHEETS

(In millions, except par value amounts)

December 31,

Formulas/Links

Trend Analysis

2020-2021

S Change

n/a

ASSETS

Trend Analysis

Common-Size Analysis

2021

2020

2020-2021

Common-Size Analysis

CURRENT ASSETS:

2020

(Percent of Total Assets)

2021

$ Change

% Change

2021

2020

Cash and Equivalents

515

345

% Change

(Percent of Total Assets)

n/a

Marketable Securities

20

46

n/a

n/a

n/a

Receivables

196

n/a

n/a

n/a

460

Inventories

n/a

n/a

n/a

588

920

n/a

n/a

n/a

Other Current Assets

n/a

n/a

490

460

n/a

n/a

TOTAL CURRENT ASSETS

1,809

n/a

n/a

2,231

PROPERTY AND EQUIPMENT, NET

2,450

n/a

n/a

n/a

n/a

2,744

OTHER ASSETS

n/a

n/a

n/a

n/a

1,336

756

n/a

n/a

TOTAL ASSETS

n/a

n/a

n/a

5,595

5,731

n/a

n/a

UABIITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES:

Accounts Payable

686

2$

920

n/a

n/a

n/a

n/a

Other Liabilities and Accrued Expenses

Income Taxes Payable

196

345

n/a

n/a

n/a

n/a

29

12

/a

n/a

n/a

n/a

n/a

TOTAL CURRENT UABIUTIES

911

1,277

/a

n/a

n/a

NONCURRENT UABILITIES:

Long-Term Debt

Other Liabilities

1,960

1,568

n/a

n/a

n/a

n/a

n/a

n/a

98

460

n/a

n/a

n/a

TOTAL NONCURRENT UABILITIES

n/a

n/a

n/a

STOCKHOLDERS' EQUITY:

Class A Common Stock, $0.01 par value: 150,000

shares authorized and 103,300 shares issued

1

0.00%

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

Additional Paid-In Capital

1,399

1,196

Retained Earnings

2,058

1,960

n/a

n/a

Accumulated Other Comprehensive Income (Loss)

(6)

n/a

n/a

n/a

n/a

Treasury Stock, at Average Cost – 17,662 and

16,054 at December 31, 2021 and December 31, 2020,

圈

n/a

n/a

/a

n/a

n/a

n/a

respectively

(835)

(725)

n/a

n/a

n/a

/a

TOTAL STOCKHOLDERS' EQUITY

n/a

n/a

TOTAL LIABIUTIES AND STOCKHOLDERS' EQUITY

Formulas/unks:

Calculate the following for:

Current Ratio

Working Capital (in thousands)

Debt Ratio (as a percent)

2021

2020

n/a

n/a

n/a

n/a

r/a

Expert Solution

Step 1

Balance sheet is one of the the financial statement of business which shows all assets, liabilities and equity of the business as on particular date. Ratio analysis is one of the management accounting technique which helps in decision making.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning