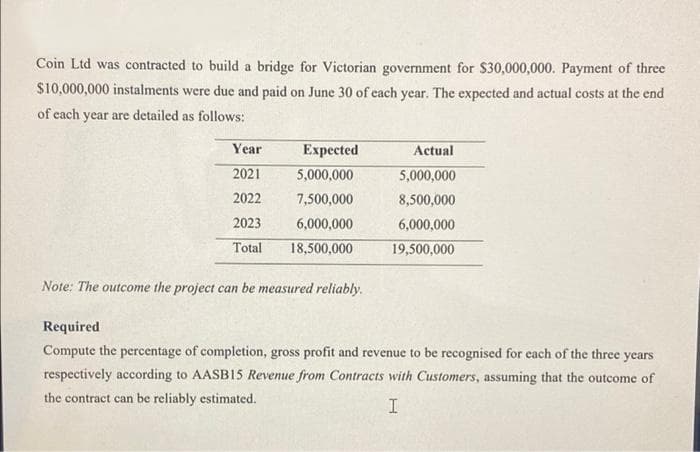

Required Compute the percentage of completion, gross profit and revenue to be recognised for each of the three years respectively according to AASBI5 Revenue from Contracts with Customers, assuming that the outcome of the contract can be reliably estimated.

Q: Butrico Manufacturing Corporation uses a standard cost system, records materials price variances whe...

A: Answer - Direct Materials Price Variance - Direct material price variance is the difference betwee...

Q: QUESTION 2 Anzalna now needs RM20,000 to start from a bank for 3 years at 6.8% bank discount rate. f...

A: solution Question 2 has been solved as per your requirement given Present value needed 20000 ...

Q: ! Required information Use the following information to answer questions. (Algo) [The following info...

A: 1. DIRECT LABOR USED : = TOTAL FACTORY PAYROLL - INDIRECT LABOR = $250,000 - $57,500 = $192,500 ...

Q: For each transaction, (1) analyze the transaction using the accounting equation, (2) record the tran...

A: Bookkeeping: Bookkeeping alludes to the most common way of checking the monetary exchanges of an ass...

Q: QS 2-6 Analyzing transactions and preparing journal entries LO P1 For each transaction, (1) analyze ...

A: The accounting equation states that assets equal to sum of liabilities and equity. The journal entri...

Q: Required information Problem 3-3A (Statie) Preparing adjusting entrles, odjusted trlal balance, and ...

A: 1. Ledgers - Ledgers are the tabular form of representing accounts. Accounts are represented in the ...

Q: Show how the following items will appear in the capital accounts of the partners Ali and Ahmed when ...

A: Introduction:- The capital account tracks the net flow of investment into an economy. It is one of t...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: 1. What is the carrying amount of the biological assets on December 31? а. 3,160,000 b. 2,350,000 c...

A: Biological Assets Biological assets which is described as living assets such as trees, animals etc. ...

Q: Why continuous auditing is growing in popularity

A: A continuous audit is one : where the auditor or his staff is constantly engaged in checking the ac...

Q: During the year, a company purchased raw materials of $77,320, and incurred direct cost. These are t...

A: Calculation of Cost of materials used in production Beginning Raw materials Inventory $17,433 ...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: Your Fan retails computer fans in two sizes: small and large. The business has provided you with the...

A: Contribution Margin = Sales - Variable Cost Notes: Since you have posted a question with multiple ...

Q: Net operating income $34,875 Required: 1. Compute payback period of the truck. Is the investment in ...

A: The question is related to Capital Budgeting. The Net Present Value is calculated with the help of f...

Q: Q5- Amber Manufacturing provided the following information for last month: $20,000 6,000 9,000 Opera...

A: “Since you have asked multiple question, we will solve the first question for you. If you want any s...

Q: he company could save $6,000 per year in engineering costs by purchasing a new machine. The new mach...

A: Given, rate = 9% year = 12 periodic payment = $6000

Q: Information for Duncan Corporation is shown below: 20X1 Net Income ₱ 400,000 Average Inv...

A: Formula: Capital Turnover = Sales Revenue/Average Investment

Q: Bonita Company sells tablet PCs combined with Internet service, which permits the tablet to connect ...

A: Journal entry is used to record a business during an accounting year showing double-entry accounting...

Q: P6-1. Compute for the price earnings ratio if the earnings per share is Php5.50: Market Value per sh...

A: P:E Ratio = Market value per share / Earnings per share where, Earnings per share = (Net income - Pr...

Q: Problem 13-9 (IAA) At year-end, a storm surge damaged the warehouse of Braveheart Company. The entir...

A: Cost of goods sold is actual cost of goods that is being sold to the customers. It includes beginnin...

Q: P6-6. Ancient Times Corp., a closed corporation and selling its shares to ar investor. The statement...

A: 1. EBITDA = Net income + Income tax + Interest + Depreciation + Amortization Given: Net Income = P22...

Q: The following are selected budgeted data for Green Company for the coming year: Budgeted sales ₱60...

A: Breakeven point is point at which no profit no loss, means total cost is equal to total revenue. For...

Q: 4) An asset was purchased for P100,000 and would retire at the end of 15 years with a salvage value ...

A: The following image shows the calculation of capitalized cost of asset :

Q: The following information is available to reconcile Branch Company’s book balance of cash with its b...

A: Bank reconciliation statements are referred as a statement which is made by the company/organisation...

Q: Cash Payback Method This method identifies how long it will take (in years) to recover the initial i...

A: Pay Back period refers to that in how many years is required to get the initial investment will be b...

Q: Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. R...

A: As per our protocol we provide solution to the one question only but you have asked multiple questio...

Q: On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,540 in...

A:

Q: /12 In the final settlement, how much would D receive?4 26 a. P651,250 b. P368,000 c. P815,750 d. P6...

A: Joint venture can be described as a business arrangement between two individuals or two parties who ...

Q: E19.12 (LO 1) (Deferred Tax Asset) Callaway SA has a deferred tax asset account with a balance of €1...

A: Calculation of Temporary difference for 2022: Temporary difference = 500,000 – 375,000 = 125,000

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of ath

A: Present value = Annuity amount x present value of annuity due at $ 1 at 4% for 3 years Present value...

Q: 7. ABC Co. provided you the following information for the purpose of determining the amount of its i...

A: solution concept Goods in transit , FOB shipping point is inventory of buyer Goods in transit , FOB ...

Q: SOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wire...

A: Perpetual inventory system or method for inventory/stock method which records the sale and purchase ...

Q: Ey Freezer accepts a ote is for 180 days a 30 at 9%. Find the pr

A: To compute the net proceeds it is required to compute the maturity value.

Q: ust Time Which of the following is most likely to be true? O a. An existing CEO facing removal is li...

A: Earnings management is a strategy exclusively used by the CEO to deliberately manipulate the earning...

Q: Exercise 16-17 (Algo) Weighted average: Production cost report LO P2 Oslo Company produces large qua...

A: Equivalent unit express in terms of number of partially completed unit has smaller unit that is full...

Q: Factory Overhead account shows total debits of $684,000 and total credits of $708,000 at the enc e u...

A: Factory overhead, also known as manufacturing overhead, work overhead, or factory burden in American...

Q: Walsh & Coggins, a professional accounting firm, collects cost information about the services they p...

A: Cost Data It is important to collect required cost information which are pertained with the business...

Q: grow 7% per year. Callahan's common stock currently sells for $29.75 per share; its last dividend wa...

A: Discounted cash flow method is used to determine the cost of equity by using future cash flows. This...

Q: The following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaini...

A: An intangible asset is one which cannot be touched or seen and do not have any physical appearance o...

Q: On July 16, 2020, Logan acquires land and a building for $500,000 to use in his sole proprietorship....

A: The adjusted basis for land and building at the acquisition date is Land : $100,000 Building : $400,...

Q: APPLY THE CONCEPTS: Internal rate of return The Sutherland purchasing department has made revisions ...

A: Internal Rate of Return- Internal rate of return refers to the rate at which the net present value o...

Q: Prepare budgetary entries, using general ledger control accounts only, for each of the following unr...

A: The question is based on the concept of Financial Accounting.

Q: Oriole Cupcakes Co. is selling cupcakes for $10 for a box of one dozen. Oriole has fixed costs equal...

A:

Q: Required information Use the following information for the Exercises below. (Algo) 1 [The following ...

A:

Q: Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture....

A: Predetermined overhead rate refers to the rate which is determined at the beginning of accounting pe...

Q: Lebron Co. manufactures product X with the following standard costs: Direct materials, 20 yards @ ₱...

A: Given data, Standard price of material (SP)=P13.50 Production during may=500 units Therefore, Standa...

Q: On December 31, 2021 what is the adjusted cash in bank? In an audit of Danao Company on Dec. 31, 202...

A: Answer - Adjusted Book Balance - A bank reconciliation is a schedule each company prepares to re...

Q: Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to Indivduals w...

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred b...

Q: Average Rate of Return The average rate of return is another method that does not use present value ...

A: Solution Concept Formulas used Net income =income – expenses Average net income =total ...

Step by step

Solved in 3 steps

- Consultant Inc. is a firm of consulting engineers, newly established to advise on a large project taking three years to complete. Their fee for this work is a percentage of the total project costs, payable on completion of the project. In the interim, advances on the final fee are made at six-monthly intervals. The total project costs will not be known until the project is completed. The following advances were received by Consultant Inc. during the three-year period: Year ended 31 December 20x0 K25, 000 Year ended 31 December 20x1 K30, 000 Year ended 31 December 20x2 K30, 000 When the total costs were computed during the year ended 31 December 20x0, it was found that a further sum of K50, 000 was due to Consultant Inc. REQUIRED; Explain how Consultant Inc. would show the payments made during the periods covered by the project. Justify your explanation…The Market Company won a contract to build a shopping center at a price of $300 million. The following schedule details the estimated and actual costs of construction each year as well as the total estimated cost. What amount of revenue will be recognized in Yr. 1 using the percentage completion method? Yr 1 $40,000,000 Yr. 2 $60,000,000 Yr. 3 $70,000,000 Yr. 4 $30,000,000 Total $200,000,000 Select one: a. $60,000,000 b. $50,000,000 c. $0 d. $40,000,000 e. $300,000,000A steel mill estimates that one of its furnace will require maintenance of P20, 000.00 at the end of year 2, P40, 000.00 at the end of year 4 and P80, 000.00 at the end of year 8. What uniform semi-annual amounts could it set aside over the next eight years at the end of each period to meet these requirements of maintenance cost if all the funds would earn interest at the rate of 6% per year compounded semi-annually?

- An aggregate crasher is expected to cost P60, 000 and has an estimatedlife of 5 years. Maintenance cost are as follows: 1styear = P 15, 000 2ndyear = P 17, 000 3rdyear =P 19, 000 4thyear = P 21, 000 5thyear = P 23, 000 How much be budgeted and deposited in a fund that earns 9% per year compounded annually in order to pay for the machine.SMDC Construction signed a contract to build a building over a period 3 years for a price of P10,000,000. Information relating to the performance of the contract is summarized as follows: 2017 2018 2019 contribution costs incurred during the year 2,500,000 2,400,000 1,800,000 estimated costs to complete 4,500,000 1,800,000 - buildings during the year 2,200,000 2,800,000 5,000,000 collections during the year 2,000,000 2,500,000 5,500,000 Prepare the entries under the percentage of completion.Paul Constructions has entered into a contract beginning January 1, 2020, to build a pool. It has been estimated that the pool will cost P300,000, and will take three years to construct. The pool will be billed to the purchasing at P450,000. The following data pertain to the construction period. 2020 135,000 165,000 2021 210,000 90,000 2022 0 Cost to date: Estimated cost to complete. Progress billing to date. Cash collected to date 135.000 120.000 275.000 250,000 450,000 450.000 During 2020, Costs incurred include P15,000 standard materials stored at the site to be used in 2022 to complete the project. Using the percentage of completion method, compute the recognize gross profit for 2022: a. 52,500 b. 45,000 c. 97.500 d. 150,000 2. The CIP net of Progress billing is a. 27.500 current liability b. 32,500 current asset c. 167,500 current asset. d. 102,500 current liability

- In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2020. Information related to the contract is as follows: Cost incurred during the year $ 2,016,000 $ 2,808,000 $ 2,613,600 Estimated costs to complete as of year-end 5,184,000 2,376,000 0 Billings during the year 2,180,000 2,644,000 5,176,000 Cash collections during the year 1,890,000 2,500,000 5,610,000 Westgate recognizes revenue over time according to percentage of completion. 4. Compute the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts should be indicated with a minus sign.) Cost incurred during the year $ 2,016,000 $ 3,890,000 $ 3,290,000…In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2021. Information related to the contract is as follows. Cost incurred during year $2,016,000 $2,808,000 $2,613,000 Estimated costs to complete as of year-end 5,184,000 2,376,000 0 Billings during the year 2,180,000 2,644,000 5,176,000 Cash collections during the year 1,890,000 2,500,000 5,610,000 Westgate recognizes revenue over time according to percentage of completion Required 1.- Calculate the amount of revenue and gross profit (loss) to be organized in each of three years. (Do not round intermediate calculations. Loss amounts should be indicated with a minus sign.)…On February 1, 2024, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,000,000. During 2024, costs of $2,000,000 were incurred with estimated costs of $4,000,000 yet to be incurred. Billings of $2,500,000 were sent, and cash collected was $2,250,000. In 2025, costs incurred were $2,500,000 with remaining costs estimated to be $3,600,000. 2025 billings were $2,750,000, and $2,475,000 cash was collected. The project was completed in 2026 after additional costs of $3,800,000 were incurred. The company’s fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage of completion. Required: 1. Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. 2a. Prepare journal entries for 2024 to record the transactions described (credit "Cash, Materials, etc." for construction costs incurred). 2b. Prepare journal entries for 2025 to record the transactions…

- DPWH had the following transactions related to a construction project of school building worth P28,000,000 during the year 2021:January 25. Payment of mobilization fee equivalent to 15% of the contract price.March 10. Received 1st progress billing from the contractor equivalent to 40% completion of contract price.March 25. Paid the amount due to the contractor for the 1st progress billing. Deductions are: Recoupment of advances based on % of completion (deducted upon payment) Retention, 5% of the billings Withholding taxes (EWT & Final VAT) The entry to recognize the payment of mobilization fee includes a: a. Debit to Advances to Contractors, P4,200,000 b. Debit to Advances to Officers and Employees, P4,200,000 c. Debit to Accounts Receivable, P4,200,000 d. Debit to Advances to SDO, P4,200,000On February 1, 2024, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,375,000. During 2024, costs of $2,150,000 were incurred, with estimated costs of $4,150,000 yet to be incurred. Billings of $2,680,000 were sent, and cash collected was $2,400,000. In 2025, costs incurred were $2,680,000 with remaining costs estimated to be $3,825,000. 2025 billings were $2,930,000, and $2,625,000 cash was collected. The project was completed in 2026 after additional costs of $3,950,000 were incurred. The company’s fiscal year-end is December 31. This project does not qualify for revenue recognition over time. Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years.On February 1, 2024, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,375,000. During 2024, costs of $2,150,000 were incurred, with estimated costs of $4,150,000 yet to be incurred. Billings of $2,680,000 were sent, and cash collected was $2,400,000. In 2025, costs incurred were $2,680,000 with remaining costs estimated to be $3,825,000. 2025 billings were $2,930,000, and $2,625,000 cash was collected. The project was completed in 2026 after additional costs of $3,950,000 were incurred. The company’s fiscal year-end is December 31. This project does not qualify for revenue recognition over time. . Prepare journal entries for 2024 and 2025 to record the transactions described (credit "Cash, Materials, etc." for construction costs incurred).