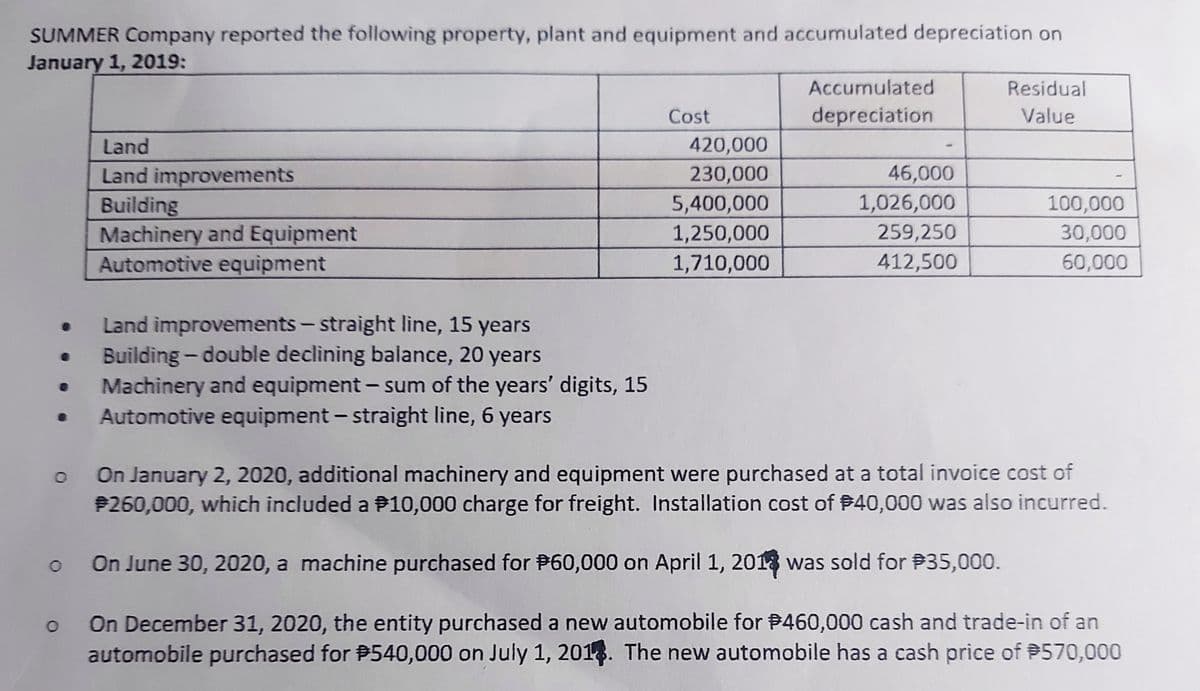

Can you please show me the solution? Thank you so much in advance! For the year ended, December 31, 2019. -Depreciation for land improvements -Depreciation for building -Depreciation for machinery and equipment -Depreciation for automotive equipment

Can you please show me the solution? Thank you so much in advance! For the year ended, December 31, 2019. -Depreciation for land improvements -Depreciation for building -Depreciation for machinery and equipment -Depreciation for automotive equipment

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Can you please show me the solution? Thank you so much in advance!

For the year ended, December 31, 2019.

-

-Depreciation for building

-Depreciation for machinery and equipment

-Depreciation for automotive equipment

Transcribed Image Text:SUMMER Company reported the following property, plant and equipment and accumulated depreciation on

January 1, 2019:

Accumulated

Residual

Cost

depreciation

Value

Land

420,000

230,000

46,000

1,026,000

Land improvements

Building

Machinery and Equipment

Automotive equipment

5,400,000

100,000

1,250,000

259,250

30,000

1,710,000

412,500

60,000

Land improvements - straight line, 15 years

Building - double declining balance, 20 years

Machinery and equipment - sum of the years' digits, 15

Automotive equipment - straight line, 6 years

On January 2, 2020, additional machinery and equipment were purchased at a total invoice cost of

P260,000, which included a P10,000 charge for freight. Installation cost of P40,000 was also incurred.

On June 30, 2020, a machine purchased for P60,000 on April 1, 2013 was sold for P35,000.

On December 31, 2020, the entity purchased a new automobile for P460,000 cash and trade-in of an

automobile purchased for P540,000 on July 1, 2018. The new automobile has a cash price of P570,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT