Can you tell me how did they get RM18785.79 as a future value by using a formula? Suppose we should use FVA formula right? ***I'm asking about the Uncle Murray questions that promised to give RM1000 a month for 18 months starting today and save it in a bank account that pays 6% compounded monthly.** Thank you for helping me :)

Can you tell me how did they get RM18785.79 as a future value by using a formula? Suppose we should use FVA formula right? ***I'm asking about the Uncle Murray questions that promised to give RM1000 a month for 18 months starting today and save it in a bank account that pays 6% compounded monthly.** Thank you for helping me :)

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 34P

Related questions

Question

100%

Can you tell me how did they get RM18785.79 as a future value by using a formula? Suppose we should use FVA formula right?

***I'm asking about the Uncle Murray questions that promised to give RM1000 a month for 18 months starting today and save it in a bank account that pays 6% compounded monthly.**

Thank you for helping me :)

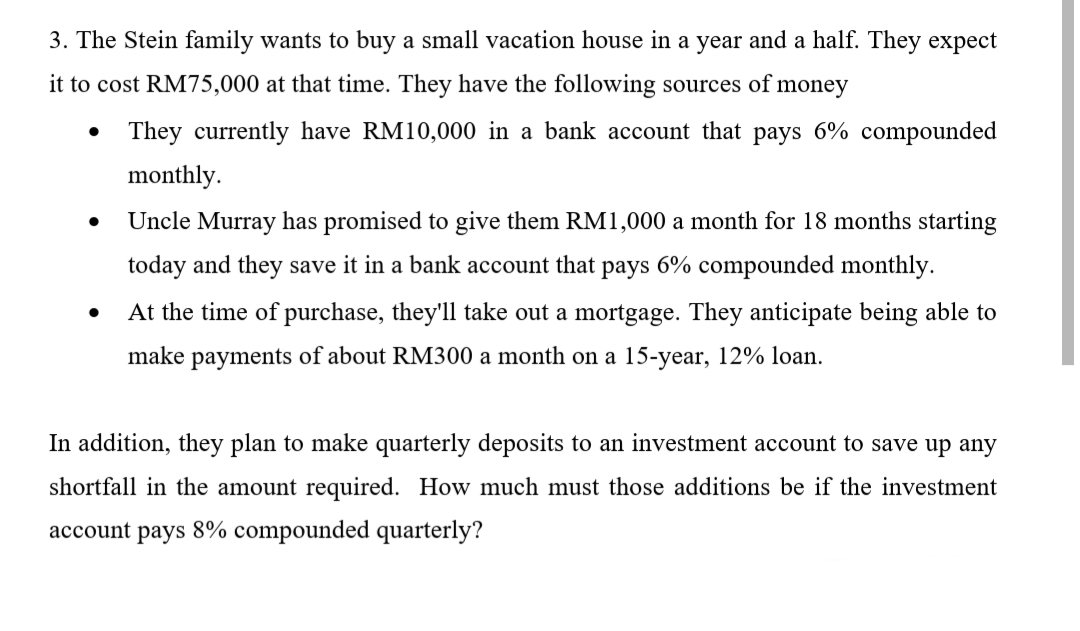

Transcribed Image Text:3. The Stein family wants to buy a small vacation house in a year and a half. They expect

it to cost RM75,000 at that time. They have the following sources of money

They currently have RM10,000 in a bank account that pays 6% compounded

monthly.

Uncle Murray has promised to give them RM1,000 a month for 18 months starting

today and they save it in a bank account that pays 6% compounded monthly.

At the time of purchase, they'll take out a mortgage. They anticipate being able to

make payments of about RM300 a month on a 15-year, 12% loan.

In addition, they plan to make quarterly deposits to an investment account to save up any

shortfall in the amount required. How much must those additions be if the investment

account pays 8% compounded quarterly?

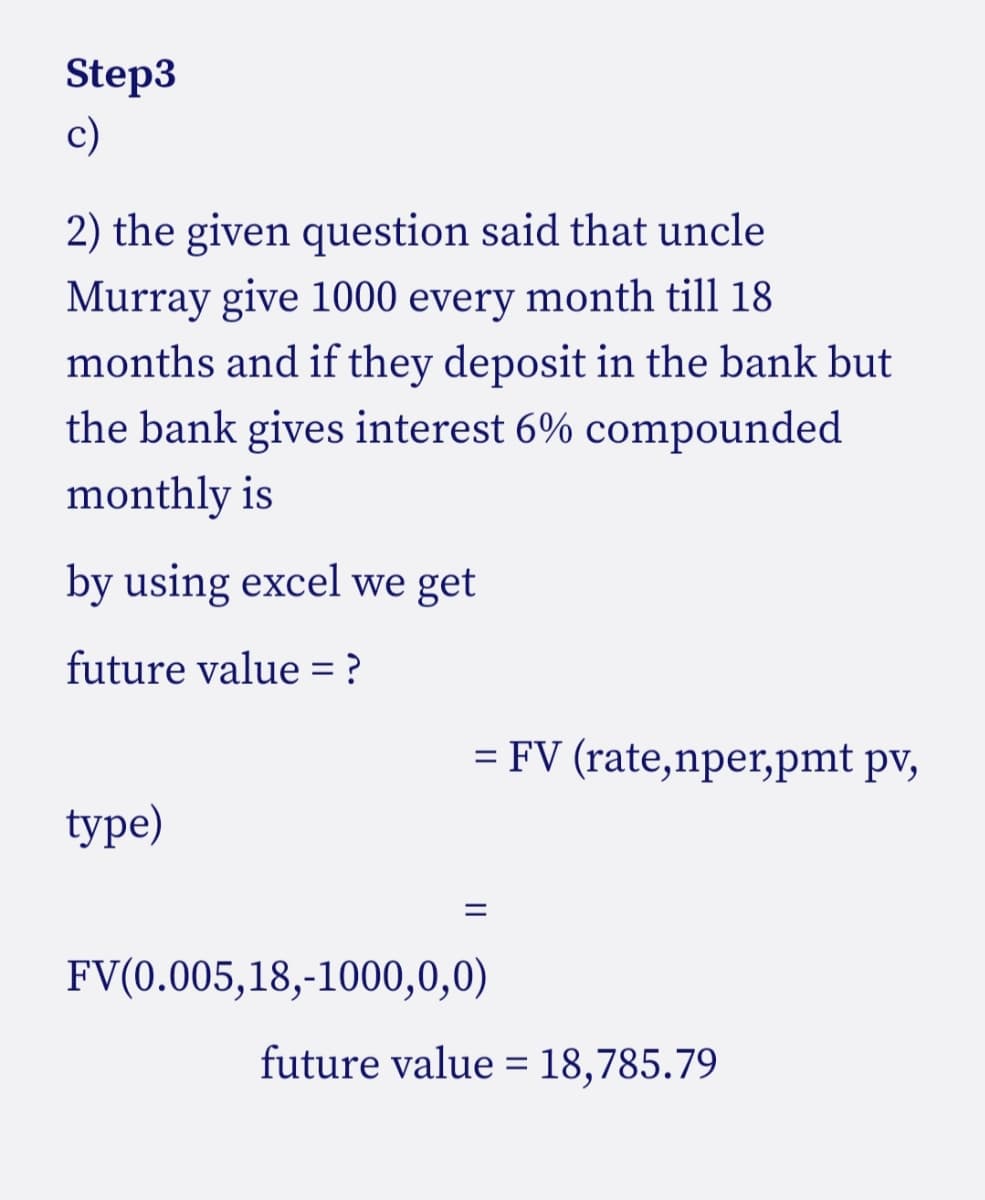

Transcribed Image Text:Step3

c)

2) the given question said that uncle

Murray give 1000 every month till 18

months and if they deposit in the bank but

the bank gives interest 6% compounded

monthly is

by using excel we get

future value = ?

= FV (rate,nper,pmt pv,

type)

FV(0.005,18,-1000,0,0)

future value = 18,785.79

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning