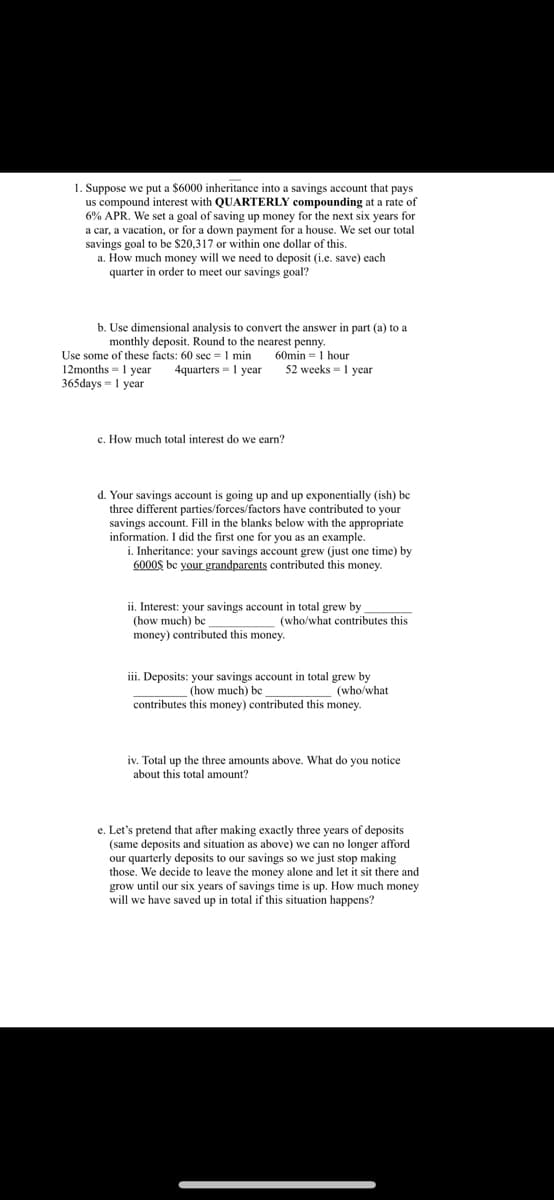

1. Suppose we put a $6000 inheritance into a savings account that pays us compound interest with QUARTERLY compounding at a rate of 6% APR. We set a goal of saving up money for the next six years for a car, a vacation, or for a down payment for a house. We set our total savings goal to be $20,317 or within one dollar of this. a. How much money will we need to deposit (i.e. save) each quarter in order to meet our savings goal? b. Use dimensional analysis to convert the answer in part (a) to a monthly deposit. Round to the nearest penny. Use some of these facts: 60 sec = 1 min 60min - 1 hour 4quarters - 1 year 12months = 1 year 365days - 1 year 52 weeks - 1 year c. How much total interest do we earn? d. Your savings account is going up and up exponentially (ish) be three different parties/forces/factors have contributed to your savings account. Fill in the blanks below with the appropriate information. I did the first one for you as an example. i. Inheritance: your savings account grew (just one time) by 6000$ be your grandparents contributed this money. ii. Interest: your savings account in total grew by (how much) be money) contributed this money. (who/what contributes this iii. Deposits: your savings account in total grew by (how much) be (who/what contributes this money) contributed this money. iv. Total up the three amounts above. What do you notice about this total amount?

1. Suppose we put a $6000 inheritance into a savings account that pays us compound interest with QUARTERLY compounding at a rate of 6% APR. We set a goal of saving up money for the next six years for a car, a vacation, or for a down payment for a house. We set our total savings goal to be $20,317 or within one dollar of this. a. How much money will we need to deposit (i.e. save) each quarter in order to meet our savings goal? b. Use dimensional analysis to convert the answer in part (a) to a monthly deposit. Round to the nearest penny. Use some of these facts: 60 sec = 1 min 60min - 1 hour 4quarters - 1 year 12months = 1 year 365days - 1 year 52 weeks - 1 year c. How much total interest do we earn? d. Your savings account is going up and up exponentially (ish) be three different parties/forces/factors have contributed to your savings account. Fill in the blanks below with the appropriate information. I did the first one for you as an example. i. Inheritance: your savings account grew (just one time) by 6000$ be your grandparents contributed this money. ii. Interest: your savings account in total grew by (how much) be money) contributed this money. (who/what contributes this iii. Deposits: your savings account in total grew by (how much) be (who/what contributes this money) contributed this money. iv. Total up the three amounts above. What do you notice about this total amount?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Transcribed Image Text:1. Suppose we put a $6000 inheritance into a savings account that pays

us compound interest with QUARTERLY compounding at a rate of

6% APR. We set a goal of saving up money for the next six years for

a car, a vacation, or for a down payment for a house. We set our total

savings goal to be $20,317 or within one dollar of this.

a. How much money will we need to deposit (i.e. save) each

quarter in order to meet our savings goal?

b. Use dimensional analysis to convert the answer in part (a) to a

monthly deposit. Round to the nearest penny.

Use some of these facts: 60 sec 1 min 60min 1 hour

12months = 1 year 4quarters - 1 year

365days - 1 year

52 weeks 1 year

c. How much total interest do we earn?

d. Your savings account is going up and up exponentially (ish) be

three different parties/forces/factors have contributed to your

savings account. Fill in the blanks below with the appropriate

information. I did the first one for you as an example.

i. Inheritance: your savings account grew (just one time) by

6000$ be your grandparents contributed this money.

ii. Interest: your savings account in total grew by

(how much)

money) contributed this money.

(who/what contributes this

iii. Deposits: your savings account in total grew by

(how much) be

(who/what

contributes this money) contributed this money.

iv. Total up the three amounts above. What do you notice

about this total amount?

e. Let's pretend that after making exactly three years of deposits

(same deposits and situation as above) we can no longer afford

our quarterly deposits to our savings so we just stop making

those. We decide to leave the money alone and let it sit there and

grow until our six years of savings time is up. How much money

will we have saved up in total if this situation happens?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT