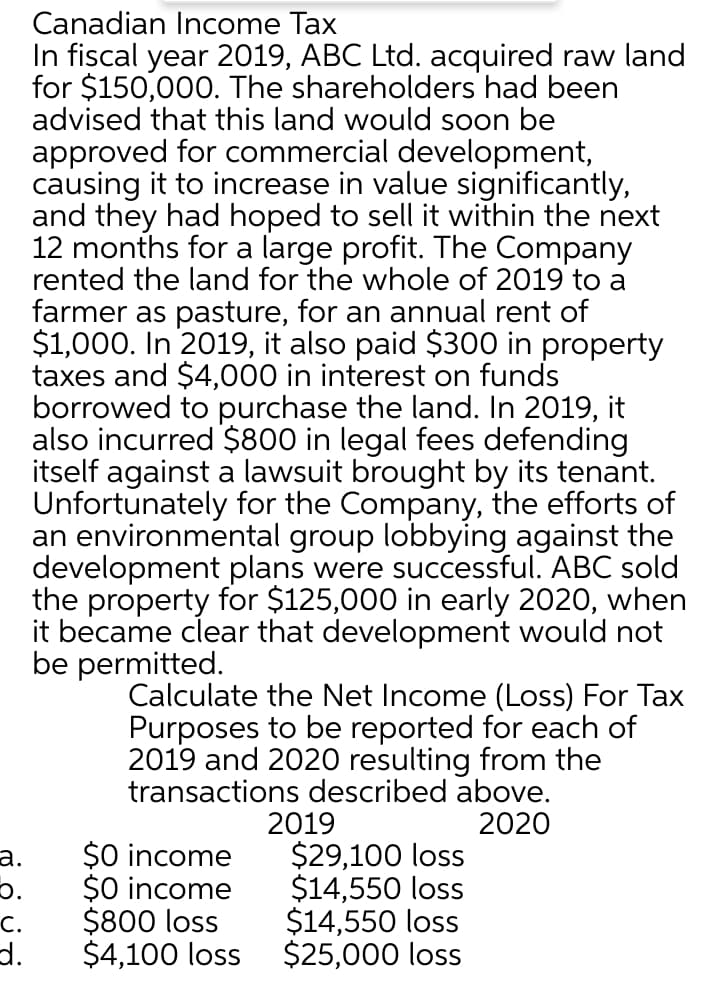

Canadian Income Tax In fiscal year 2019, ABC Ltd. acquired raw lan for $150,000. The shareholders had been advised that this land would soon be approved for commercial development, causing it to increase in value significantly, and they had hoped to sell it within the next 12 months for a large profit. The Company rented the land for the whole of 2019 to a farmer as pasture, for an annual rent of $1,000. In 2019, it also paid $300 in property taxes and $4000 in interest on funds borrowed to purchase the land. In 2019, it also incurred $800 in legal fees defending itself against a lawsuit brought by its tenant. Unfortunately for the Company, the efforts o an environmental group lobbying against the development plans were successful. ABC sold the property for $125,000 in early 2020, whe it became clear that development would not be permitted. Calculate the Net Income (Loss) For Ta Purposes to be reported for each of 2019 and 2020 resulting from the transactions described above. 2019 2020 $0 income $0 income $800 loss $4,100 loss $29,100 loss $14,550 loss $14,550 loss $25,000 loss

Canadian Income Tax In fiscal year 2019, ABC Ltd. acquired raw lan for $150,000. The shareholders had been advised that this land would soon be approved for commercial development, causing it to increase in value significantly, and they had hoped to sell it within the next 12 months for a large profit. The Company rented the land for the whole of 2019 to a farmer as pasture, for an annual rent of $1,000. In 2019, it also paid $300 in property taxes and $4000 in interest on funds borrowed to purchase the land. In 2019, it also incurred $800 in legal fees defending itself against a lawsuit brought by its tenant. Unfortunately for the Company, the efforts o an environmental group lobbying against the development plans were successful. ABC sold the property for $125,000 in early 2020, whe it became clear that development would not be permitted. Calculate the Net Income (Loss) For Ta Purposes to be reported for each of 2019 and 2020 resulting from the transactions described above. 2019 2020 $0 income $0 income $800 loss $4,100 loss $29,100 loss $14,550 loss $14,550 loss $25,000 loss

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 17PC

Related questions

Question

Transcribed Image Text:Canadian Income Tax

In fiscal year 2019, ABC Ltd. acquired raw land

for $150,000. The shareholders had been

advised that this land would soon be

approved for commercial development,

causing it to increase in value significantly,

and they had hoped to sell it within the next

12 months for a large profit. The Company

rented the land for the whole of 2019 to a

farmer as pasture, for an annual rent of

$1,000. In 2019, it also paid $300 in property

taxes and $4,000 in interest on funds

borrowed to purchase the land. In 2019, it

also incurred $800 in legal fees defending

itself against a lawsuit brought by its tenant.

Unfortunately for the Company, the efforts of

an environmental group lobbying against the

development plans were successful. ABC sold

the property for $125,000 in early 2020, when

it became clear that development would not

be permitted.

Calculate the Net Income (Loss) For Tax

Purposes to be reported for each of

2019 and 2020 resulting from the

transactions described above.

2019

$29,100 loss

$14,550 loss

$14,550 loss

$25,000 loss

2020

$0 income

$0 income

$800 loss

а.

C.

d.

$4,100 loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT