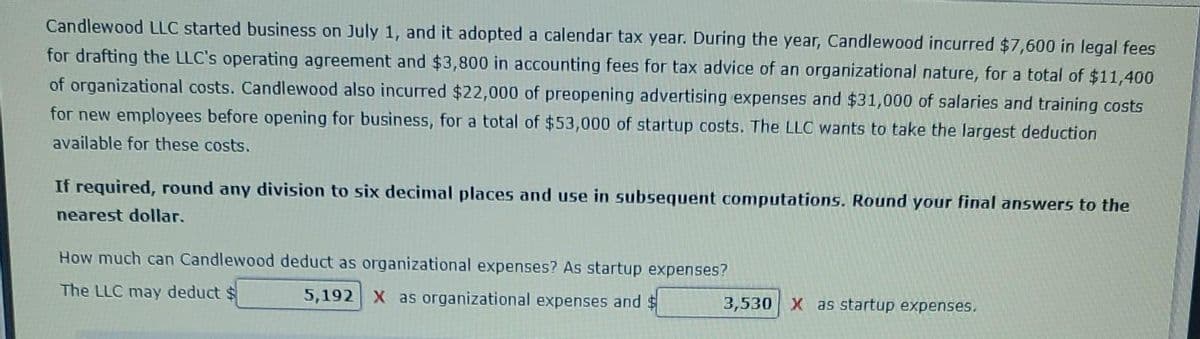

Candlewood LLC started business on July 1, and it adopted a calendar tax year. During the year, Candlewood incurred $7,600 in legal fees for drafting the LLC's operating agreement and $3,800 in accounting fees for tax advice of an organizational nature, for a total of $11,400 of organizational costs. Candlewood also incurred $22,000 of preopening advertising expenses and $31,000 of salaries and training costs for new employees before opening for business, for a total of $53,000 of startup costs. The LLC wants to take the largest deduction available for these costs. If required, round any division to six decimal places and use in subsequent computations. Round your final answers to the nearest dollar. How much can Candlewood deduct as organizational expenses? As startup expenses? The LLC may deduct $ 5,192 X as organizational expenses and $ 3,530 X as startup expenses.

Candlewood LLC started business on July 1, and it adopted a calendar tax year. During the year, Candlewood incurred $7,600 in legal fees for drafting the LLC's operating agreement and $3,800 in accounting fees for tax advice of an organizational nature, for a total of $11,400 of organizational costs. Candlewood also incurred $22,000 of preopening advertising expenses and $31,000 of salaries and training costs for new employees before opening for business, for a total of $53,000 of startup costs. The LLC wants to take the largest deduction available for these costs. If required, round any division to six decimal places and use in subsequent computations. Round your final answers to the nearest dollar. How much can Candlewood deduct as organizational expenses? As startup expenses? The LLC may deduct $ 5,192 X as organizational expenses and $ 3,530 X as startup expenses.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:Candlewood LLC started business on July 1, and it adopted a calendar tax year. During the year, Candlewood incurred $7,600 in legal fees

for drafting the LLC's operating agreement and $3,800 in accounting fees for tax advice of an organizational nature, for a total of $11,400

of organizational costs. Candlewood also incurred $22,000 of preopening advertising expenses and $31,000 of salaries and training costs

for new employees before opening for business, for a total of $53,000 of startup costs. The LLC wants to take the largest deduction

available for these costs.

If required, round any division to six decimal places and use in subsequent computations. Round your final answers to the

nearest dollar.

How much can Candlewood deduct as organizational expenses? As startup expenses?

The LLC may deduct $

5,192 X as organizational expenses and $

3,530 X as startup expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT