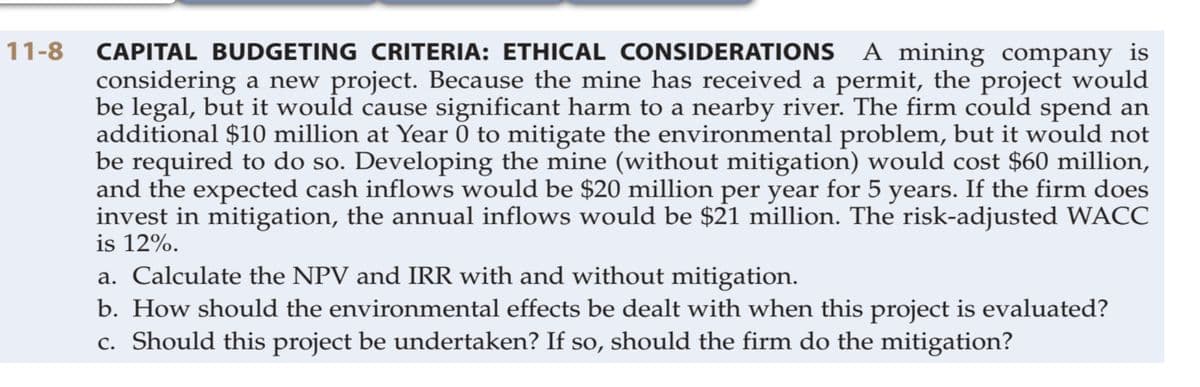

CAPITAL BUDGETING CRITERIA: ETHICAL CONSIDERATIONS A mining company is considering a new project. Because the mine has received a permit, the project would be legal, but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would cost $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with and without mitigation. b. How should the environmental effects be dealt with when this project is evaluated? c. Should this project be undertaken? If so, should the firm do the mitigation?

CAPITAL BUDGETING CRITERIA: ETHICAL CONSIDERATIONS A mining company is considering a new project. Because the mine has received a permit, the project would be legal, but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would cost $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with and without mitigation. b. How should the environmental effects be dealt with when this project is evaluated? c. Should this project be undertaken? If so, should the firm do the mitigation?

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 8P

Related questions

Question

Please show the solution on excel spreadsheet and please indicate the formulas used. Thank you.

Transcribed Image Text:CAPITAL BUDGETING CRITERIA: ETHICAL CONSIDERATIONS A mining company is

considering a new project. Because the mine has received a permit, the project would

be legal, but it would cause significant harm to a nearby river. The firm could spend an

additional $10 million at Year 0 to mitigate the environmental problem, but it would not

be required to do so. Developing the mine (without mitigation) would cost $60 million,

and the expected cash inflows would be $20 million per year for 5 years. If the firm does

invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC

is 12%.

a. Calculate the NPV and IRR with and without mitigation.

b. How should the environmental effects be dealt with when this project is evaluated?

c. Should this project be undertaken? If so, should the firm do the mitigation?

11-8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning