Capital gains tax) The J. Harris Corporation is considering selling one of its old a alue of zero. Assume Harris uses simplified straight-line depreciation (depreciat What would be the taxes associated with this sale? . If the old machine were sold for $25,000, what would be the taxes associated If the old machine were sold for $15,000, what would be the taxes associated . If the old machine were sold for $12,000, what would be the taxes associated

Capital gains tax) The J. Harris Corporation is considering selling one of its old a alue of zero. Assume Harris uses simplified straight-line depreciation (depreciat What would be the taxes associated with this sale? . If the old machine were sold for $25,000, what would be the taxes associated If the old machine were sold for $15,000, what would be the taxes associated . If the old machine were sold for $12,000, what would be the taxes associated

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 5PROB

Related questions

Question

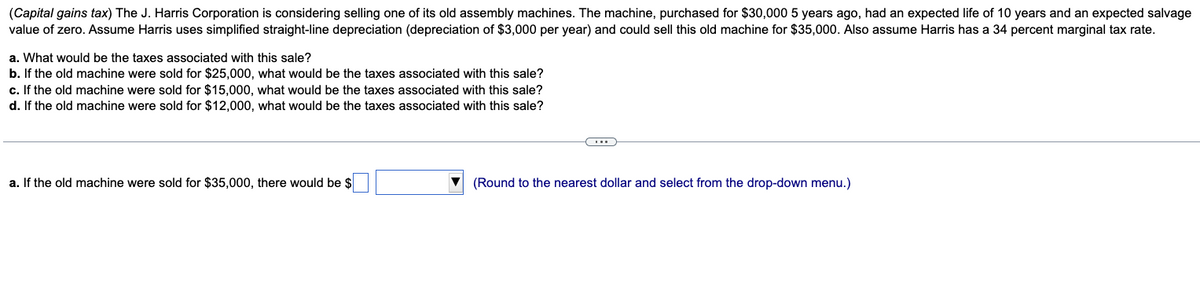

Transcribed Image Text:(Capital gains tax) The J. Harris Corporation is considering selling one of its old assembly machines. The machine, purchased for $30,000 5 years ago, had an expected life of 10 years and an expected salvage

value of zero. Assume Harris uses simplified straight-line depreciation (depreciation of $3,000 per year) and could sell this old machine for $35,000. Also assume Harris has a 34 percent marginal tax rate.

a. What would be the taxes associated with this sale?

b. If the old machine were sold for $25,000, what would be the taxes associated with this sale?

c. If the old machine were sold for $15,000, what would be the taxes associated with this sale?

d. If the old machine were sold for $12,000, what would be the taxes associated with this sale?

a. If the old machine were sold for $35,000, there would be $

(...)

(Round to the nearest dollar and select from the drop-down menu.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning