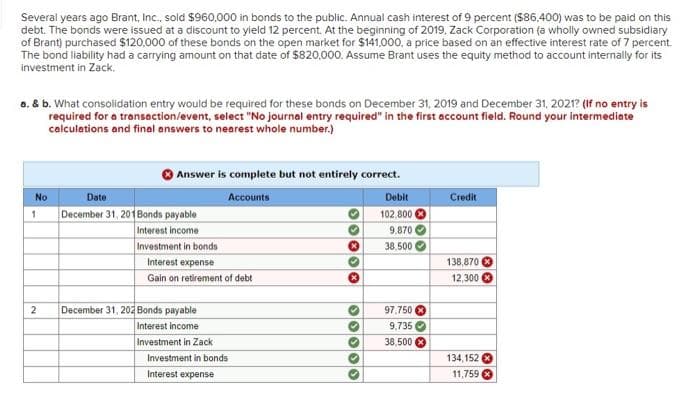

Several years ago Brant, Inc., sold $960,000 in bonds to the public. Annual cash interest of 9 percent ($86,400) was to be paid on this debt. The bonds were issued at a discount to yield 12 percent. At the beginning of 2019, Zack Corporation (a wholly owned subsidiary of Brant) purchased $120,000 of these bonds on the open market for $141,000, a price based on an effective interest rate of 7 percent. The bond liability had a carrying amount on that date of $820,000. Assume Brant uses the equity method to account internally for its investment in Zack.

Several years ago Brant, Inc., sold $960,000 in bonds to the public. Annual cash interest of 9 percent ($86,400) was to be paid on this debt. The bonds were issued at a discount to yield 12 percent. At the beginning of 2019, Zack Corporation (a wholly owned subsidiary of Brant) purchased $120,000 of these bonds on the open market for $141,000, a price based on an effective interest rate of 7 percent. The bond liability had a carrying amount on that date of $820,000. Assume Brant uses the equity method to account internally for its investment in Zack.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Several years ago Brant, Inc., sold $960,000 in bonds to the public. Annual cash interest of 9 percent ($86,400) was to be paid on this

debt. The bonds were issued at a discount to yield 12 percent. At the beginning of 2019, Zack Corporation (a wholly owned subsidiary

of Brant) purchased $120,000 of these bonds on the open market for $141,000, a price based on an effective interest rate of 7 percent.

The bond liability had a carrying amount on that date of $820,000. Assume Brant uses the equity method to account internally for its

investment in Zack.

a. & b. What consolidation entry would be required for these bonds on December 31, 2019 and December 31, 2021? (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate

calculations and final answers to nearest whole number.)

No

1

2

Answer is complete but not entirely correct.

Accounts

Date

December 31, 201 Bonds payable

Interest income

Investment in bonds

Interest expense

Gain on retirement of debt

December 31, 202 Bonds payable

Interest income

Investment in Zack

Investment in bonds

Interest expense

*****

00000

Debit

102,800

9,870

38.500

97,750

9,735

38,500

Credit

138,870

12,300

134,152

11,759

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning