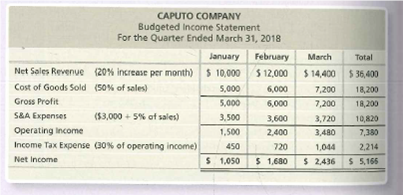

CAPUTO COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Net Sales Revenue (20% increase per month)$ 10,000$ 12,000 $ 14,400 $ 36,400 Cost of Goods Sold (50% of sales) 5,000 6,000 7,200 18,200 Gross Profit 5,000 6,000 7,200 18,200 S&A Expenses ($3,000 + 5% of sales) 3,500 3,600 3,720 10,820 7,380 Operating Income 1,500 2,400 3,480 Income Tax Expense (30% of operating income) 450 720 1,044 2,214 Net Income $ 1,050 $ 1,680 $ 2,436 $ 5,165

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Using sensitivity analysis

Caputo Company prepared the following

Caputo Company is considering two options. Option 1 is to increase advertising by $1,100 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 55% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 25% per month rather than 20%.

Requirements

- Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $10,000. Round all calculations to the nearest dollar.

- Which option should Caputo choose? Explain your reasoning.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images