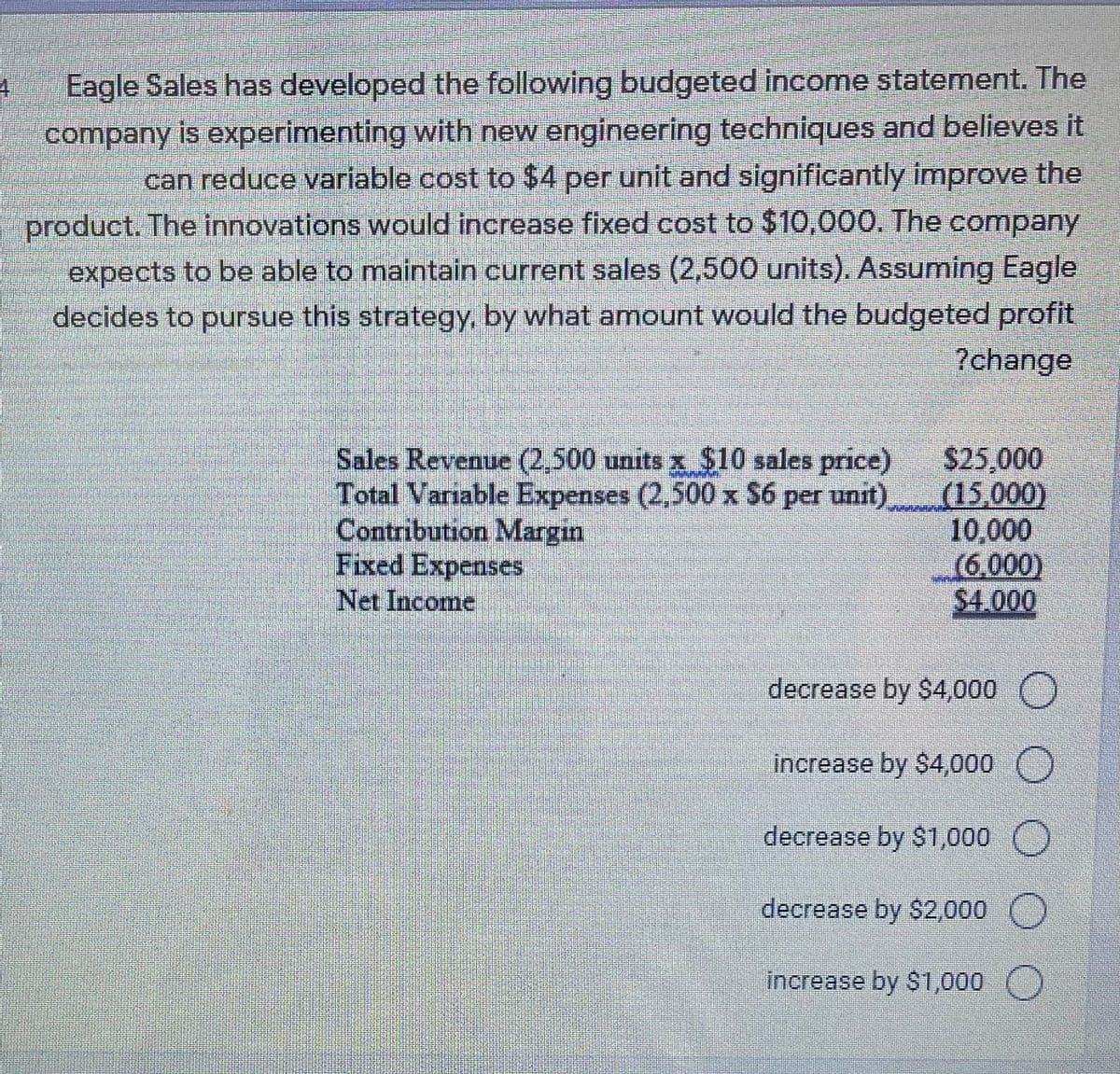

Eagle Sales has developed the following budgeted income statement. The company is experimenting with new engineering techniques and believes it can reduce variable cost to $4 per unit and significantly improve the product. The innovations would increase fixed cost to $10,000. The company expects to be able to maintain current sales (2,500 units). Assuming Eagle decides to pursue this strategy, by what amount would the budgeted profit ?change Sales Revenue (2,500 units x $10 sales price) Total Variable Expenses (2,500 x $6 per unit). Contribution Margin Fixed Expenses $25,000 (15,000) 10,000 (6.000) $4.000 Net Income decrease by $4,000 O increase by $4,000 decrease by $1,000 O decrease by $2,000 O increase by $1,000

Eagle Sales has developed the following budgeted income statement. The company is experimenting with new engineering techniques and believes it can reduce variable cost to $4 per unit and significantly improve the product. The innovations would increase fixed cost to $10,000. The company expects to be able to maintain current sales (2,500 units). Assuming Eagle decides to pursue this strategy, by what amount would the budgeted profit ?change Sales Revenue (2,500 units x $10 sales price) Total Variable Expenses (2,500 x $6 per unit). Contribution Margin Fixed Expenses $25,000 (15,000) 10,000 (6.000) $4.000 Net Income decrease by $4,000 O increase by $4,000 decrease by $1,000 O decrease by $2,000 O increase by $1,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 34P: Hammond Company runs a driving range and golf shop. The budgeted income statement for the coming...

Related questions

Question

Transcribed Image Text:Eagle Sales has developed the following budgeted income statement. The

company is experimenting with new engineering techniques and believes it

can reduce variable cost to $4 per unit and significantly improve the

product. The innovations would increase fixed cost to $10,000. The company

expects to be able to maintain current sales (2,500 units). Assuming Eagle

decides to pursue this strategy, by what amount would the budgeted profit

?change

Sales Revenue (2.500 units x $10 sales price)

Total Variable Expenses (2,500 x S6 per unit).

Contribution Margin

Fixed Expenses

Net Income

S25,000

(15,000)

10,000

(6,000)

$4.000

decrease by $4,000 )

increase by S4,000

decrease by $1,000 O

decrease by $2,000

increase by $1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub