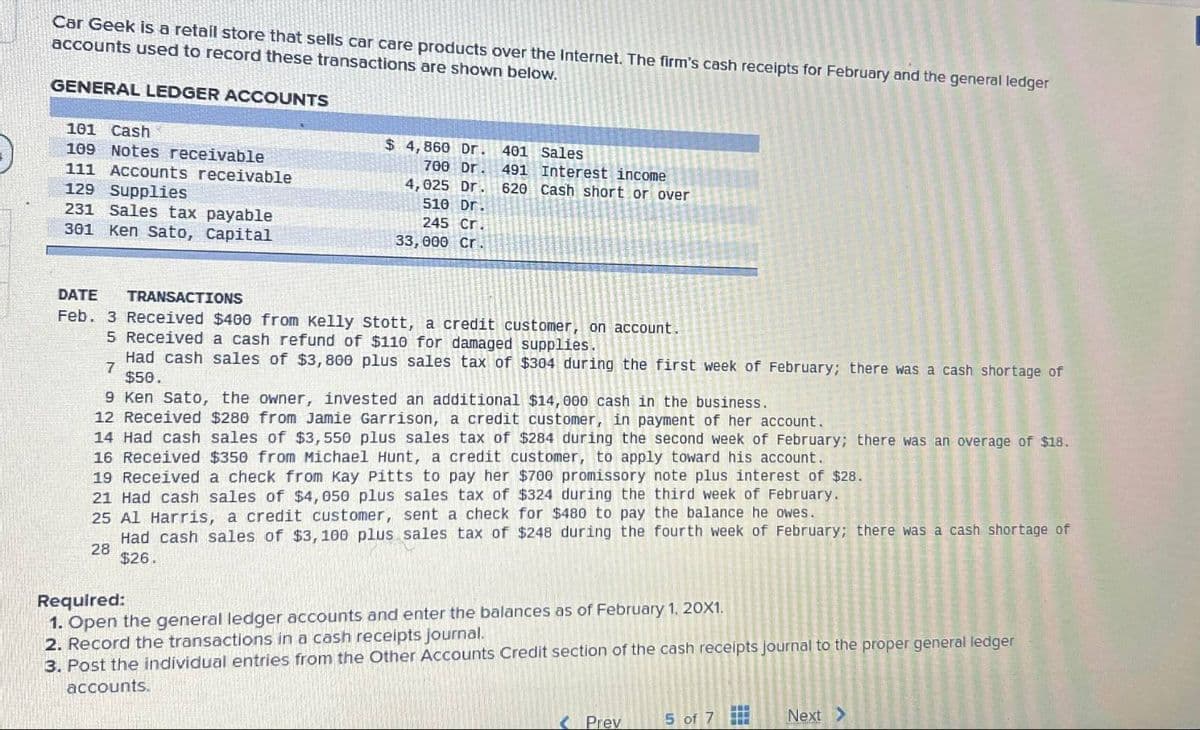

Car Geek is a retail store that sells car care products over the Internet. The firm's cash receipts for February and the general ledger accounts used to record these transactions are shown below. GENERAL LEDGER ACCOUNTS 101 Cash 109 Notes receivable 111 Accounts receivable 129 Supplies 231 Sales tax payable 301 Ken Sato, Capital Interest income $ 4,860 Dr 700 Dr 4,025 Dr. 510 Dr. 401 491 Sales 620 Cash short or over 245 Cr 33,000 cr. DATE TRANSACTIONS Feb. 3 Received $400 from Kelly Stott, a credit customer, on account. 5 Received a cash refund of $110 for damaged supplies. 7 Had cash sales of $3,800 plus sales tax of $304 during the first week of February; there was a cash shortage of $50. 9 Ken Sato, the owner, invested an additional $14,000 cash in the business. 12 Received $280 from Jamie Garrison, a credit customer, in payment of her account. 14 Had cash sales of $3,550 plus sales tax of $284 during the second week of February; there was an overage of $18. 16 Received $350 from Michael Hunt, a credit customer, to apply toward his account. 19 Received a check from Kay Pitts to pay her $700 promissory note plus interest of $28. 21 Had cash sales of $4,050 plus sales tax of $324 during the third week of February. 25 Al Harris, a credit customer, sent a check for $480 to pay the balance he owes. 28 Required: Had cash sales of $3,100 plus sales tax of $248 during the fourth week of February; there was a cash shortage of $26. 1. Open the general ledger accounts and enter the balances as of February 1, 20X1. 2. Record the transactions in a cash receipts journal. 3. Post the individual entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger accounts. Prev 5 of 7 Next >

Car Geek is a retail store that sells car care products over the Internet. The firm's cash receipts for February and the general ledger accounts used to record these transactions are shown below. GENERAL LEDGER ACCOUNTS 101 Cash 109 Notes receivable 111 Accounts receivable 129 Supplies 231 Sales tax payable 301 Ken Sato, Capital Interest income $ 4,860 Dr 700 Dr 4,025 Dr. 510 Dr. 401 491 Sales 620 Cash short or over 245 Cr 33,000 cr. DATE TRANSACTIONS Feb. 3 Received $400 from Kelly Stott, a credit customer, on account. 5 Received a cash refund of $110 for damaged supplies. 7 Had cash sales of $3,800 plus sales tax of $304 during the first week of February; there was a cash shortage of $50. 9 Ken Sato, the owner, invested an additional $14,000 cash in the business. 12 Received $280 from Jamie Garrison, a credit customer, in payment of her account. 14 Had cash sales of $3,550 plus sales tax of $284 during the second week of February; there was an overage of $18. 16 Received $350 from Michael Hunt, a credit customer, to apply toward his account. 19 Received a check from Kay Pitts to pay her $700 promissory note plus interest of $28. 21 Had cash sales of $4,050 plus sales tax of $324 during the third week of February. 25 Al Harris, a credit customer, sent a check for $480 to pay the balance he owes. 28 Required: Had cash sales of $3,100 plus sales tax of $248 during the fourth week of February; there was a cash shortage of $26. 1. Open the general ledger accounts and enter the balances as of February 1, 20X1. 2. Record the transactions in a cash receipts journal. 3. Post the individual entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger accounts. Prev 5 of 7 Next >

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 3AP

Related questions

Question

Transcribed Image Text:Car Geek is a retail store that sells car care products over the Internet. The firm's cash receipts for February and the general ledger

accounts used to record these transactions are shown below.

GENERAL LEDGER ACCOUNTS

101 Cash

109 Notes receivable

111 Accounts receivable

129 Supplies

231 Sales tax payable

301 Ken Sato, Capital

Interest income

$ 4,860 Dr

700 Dr

4,025 Dr.

510 Dr.

401

491

Sales

620 Cash short or over

245 Cr

33,000 cr.

DATE

TRANSACTIONS

Feb. 3 Received $400 from Kelly Stott, a credit customer, on account.

5 Received a cash refund of $110 for damaged supplies.

7

Had cash sales of $3,800 plus sales tax of $304 during the first week of February; there was a cash shortage of

$50.

9 Ken Sato, the owner, invested an additional $14,000 cash in the business.

12 Received $280 from Jamie Garrison, a credit customer, in payment of her account.

14 Had cash sales of $3,550 plus sales tax of $284 during the second week of February; there was an overage of $18.

16 Received $350 from Michael Hunt, a credit customer, to apply toward his account.

19 Received a check from Kay Pitts to pay her $700 promissory note plus interest of $28.

21 Had cash sales of $4,050 plus sales tax of $324 during the third week of February.

25 Al Harris, a credit customer, sent a check for $480 to pay the balance he owes.

28

Required:

Had cash sales of $3,100 plus sales tax of $248 during the fourth week of February; there was a cash shortage of

$26.

1. Open the general ledger accounts and enter the balances as of February 1, 20X1.

2. Record the transactions in a cash receipts journal.

3. Post the individual entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger

accounts.

Prev

5 of 7

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning