CARDO COMPANY eFair Value P500,000 Accounts Pay 240,000 Mortgage Pay 200,000 Ordinary Shat 520,000 Retained Ear

CARDO COMPANY eFair Value P500,000 Accounts Pay 240,000 Mortgage Pay 200,000 Ordinary Shat 520,000 Retained Ear

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4ADM: BBT and Regions Financial: Earnings per share BBT Corporation and Regions Financial Corporation are...

Related questions

Question

This is not a graded question

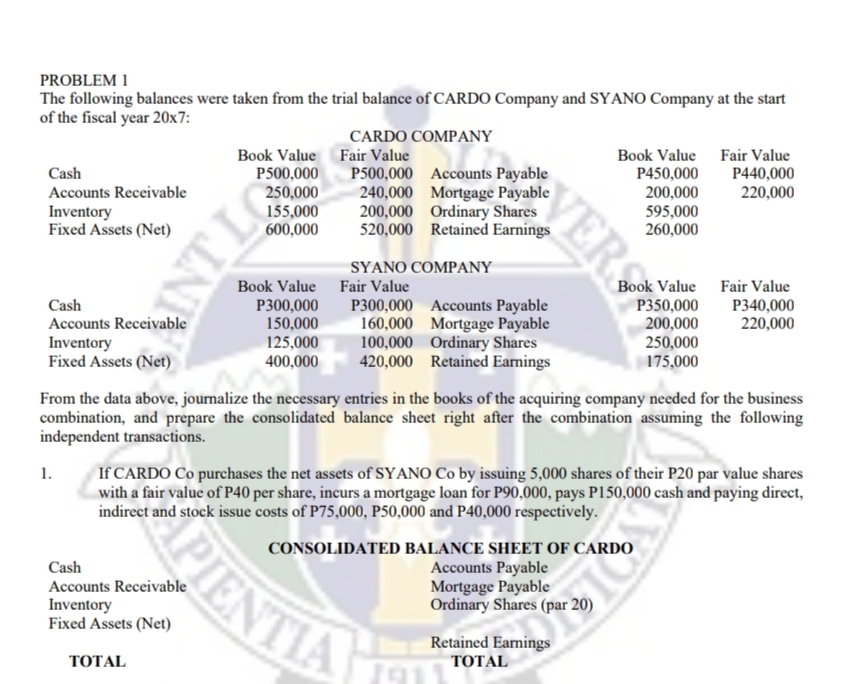

Transcribed Image Text:PROBLEM 1

The following balances were taken from the trial balance of CARDO Company and SYANO Company at the start

of the fiscal year 20x7:

CARDO COMPANY

Book Value Fair Value

P450,000

200,000

595,000

260,000

Book Value

P500,000

Fair Value

Cash

P500,000 Accounts Payable

240,000 Mortgage Payable

200,000 Ordinary Shares

520,000 Retained Earnings

P440,000

220,000

Accounts Receivable

Inventory

Fixed Assets (Net)

250,000

155,000

600,000

SYANO COMPANY

Book Value

Fair Value

Book Value Fair Value

P340,000

220,000

P300,000

150,000

125,000

400,000

Cash

Accounts Receivable

Inventory

Fixed Assets (Net)

P300,000 Accounts Payable

160,000 Mortgage Payable

100,000 Ordinary Shares

420,000 Retained Earnings

P350,000

200,000

250,000

175,000

From the data above, journalize the necessary entries in the books of the acquiring company needed for the business

combination, and prepare the consolidated balance sheet right after the combination assuming the following

independent transactions.

If CARDO Co purchases the net assets of SYANO Co by issuing 5,000 shares of their P20 par value shares

with a fair value of P40 per share, incurs a mortgage loan for P90,000, pays P150,000 cash and paying direct,

indirect and stock issue costs of P75,000, P50,000 and P40,000 respectively.

1.

PIENTIA

CONSOLIDATED BALANCE SHEET OF CARDO

Cash

Accounts Receivable

Inventory

Fixed Assets (Net)

Accounts Payable

Mortgage Payable

Ordinary Shares (par 20)

Retained Earnings

ТОTAL

ТОTAL

1911

VERS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning