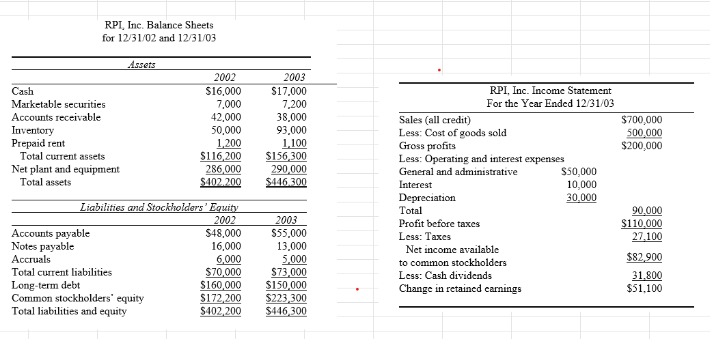

RPI, Inc. Balance Sheets for 12/31/02 and 12/31/03 2002 $16,000 7,000 42,000 50,000 1,200 $116,200 286,000 $402.200 Liabilities and Stockholders' Equity 2002 $48,000 16,000 6,000 $70,000 $160,000 $172,200 $402,200 Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stockholders' equity Total liabilities and equity 2003 $17,000 7,200 38,000 93,000 1,100 $156,300 290,000 $446.300 2003 $55,000 13,000 5,000 $73,000 $150,000 $223,300 $446,300 RPI, Inc. Income Statement For the Year Ended 12/31/03 Sales (all credit) Less: Cost of goods sold Gross profits Less: Operating and interest expenses General and administrative Interest Depreciation Total Profit before taxes Less: Taxes Net income available to common stockholders Less: Cash dividends Change in retained earnings $50,000 10,000 30,000 $700,000 500,000 $200,000 90,000 $110,000 27,100 $82,900 31,800 $51,100

RPI, Inc. Balance Sheets for 12/31/02 and 12/31/03 2002 $16,000 7,000 42,000 50,000 1,200 $116,200 286,000 $402.200 Liabilities and Stockholders' Equity 2002 $48,000 16,000 6,000 $70,000 $160,000 $172,200 $402,200 Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stockholders' equity Total liabilities and equity 2003 $17,000 7,200 38,000 93,000 1,100 $156,300 290,000 $446.300 2003 $55,000 13,000 5,000 $73,000 $150,000 $223,300 $446,300 RPI, Inc. Income Statement For the Year Ended 12/31/03 Sales (all credit) Less: Cost of goods sold Gross profits Less: Operating and interest expenses General and administrative Interest Depreciation Total Profit before taxes Less: Taxes Net income available to common stockholders Less: Cash dividends Change in retained earnings $50,000 10,000 30,000 $700,000 500,000 $200,000 90,000 $110,000 27,100 $82,900 31,800 $51,100

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 10MCQ

Related questions

Question

- Given the financial statements below, do COMMON SIZE STATEMENT (Vertical Method of FS Analysis for both Income Statement and Balance Sheet), and a HORIZONTAL Method of Analysis for the Balance Sheet.

- With the results, analyze and do some interventions where needed and as needed.

- You can do calculations through EXCEL

Transcribed Image Text:RPI, Inc. Balance Sheets

for 12/31/02 and 12/31/03

Assets

2002

$16,000

7,000

42,000

50,000

1,200

$116,200

286,000

$402.200

Liabilities and Stockholders' Equity

2002

$48,000

16,000

6,000

$70,000

$160,000

$172,200

$402,200

Cash

Marketable securities

Accounts receivable

Inventory

Prepaid rent

Total current assets

Net plant and equipment

Total assets

Accounts payable

Notes payable

Accruals

Total current liabilities

Long-term debt

Common stockholders' equity

Total liabilities and equity

2003

$17,000

7,200

38,000

93,000

1,100

$156,300

290,000

$446.300

2003

$55,000

13,000

5,000

$73,000

$150,000

$223,300

$446,300

RPI, Inc. Income Statement

For the Year Ended 12/31/03

$50,000

10,000

30,000

Sales (all credit)

Less: Cost of goods sold

Gross profits

Less: Operating and interest expenses

General and administrative

Interest

Depreciation

Total

Profit before taxes

Less: Taxes

Net income available

to common stockholders

Less: Cash dividends

Change in retained earnings

$700,000

500,000

$200,000

90,000

$110,000

27,100

$82,900

31,800

$51,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning