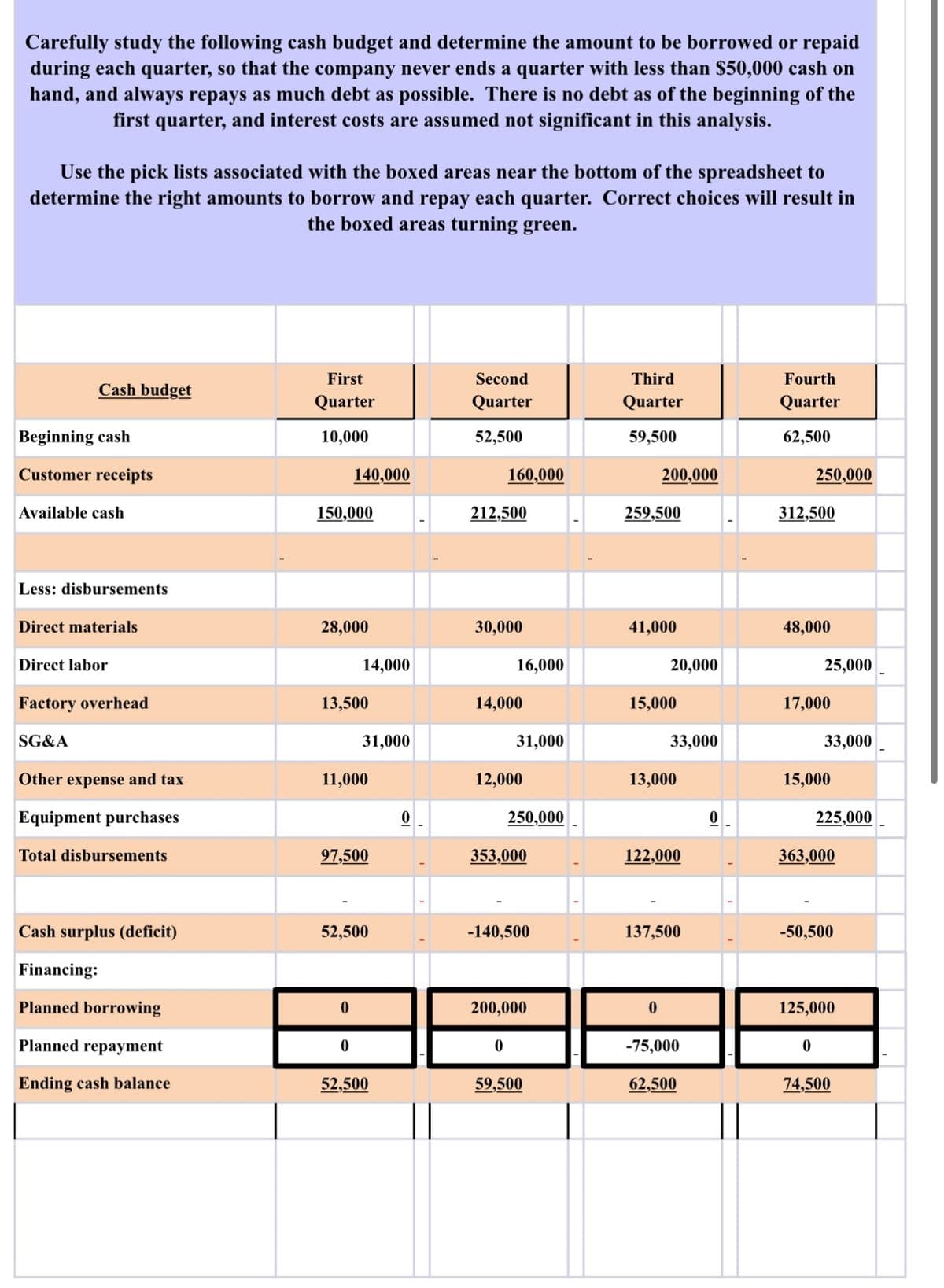

Carefully study the following cash budget and determine the amount to be borrowed or repaid during each quarter, so that the company never ends a quarter with less than $50,000 cash on hand, and always repays as much debt as possible. There is no debt as of the beginning of the first quarter, and interest costs are assumed not significant in this analysis. Use the pick lists associated with the boxed areas near the bottom of the spreadsheet to determine the right amounts to borrow and repay each quarter. Correct choices will result in the boxed areas turning green. Cash budget Beginning cash Customer receipts Available cash Less: disbursements Direct materials Direct labor Factory overhead SG&A Other expense and tax Equipment purchases Total disbursements Cash surplus (deficit) Financing: Planned borrowing Planned repayment Ending cash balance First Quarter 10,000 150,000 140,000 28,000 13,500 14,000 11,000 0 31,000 97,500 0 52,500 52,500 0 Second Quarter 52,500 160,000 212,500 30,000 16,000 14,000 31,000 12,000 0 250,000 353,000 -140,500 200,000 59,500 Third Quarter 59,500 200,000 259,500 41,000 20,000 15,000 33,000 13,000 0 122,000 137,500 -75,000 62,500 0 Fourth Quarter 62,500 250,000 312,500 48,000 25,000 17,000 33,000 15,000 0 225,000 363,000 -50,500 125,000 74,500

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images