Carla borrowed $1002.00 from the Merchant Bank at 8.4% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $220.00 per month. Construct a complete repayment schedule for the loan including totals Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Payment Number Balance Before Payment TT Balance After Payment $1002.00 Amount Paid Interest Paid Principal Repaid $1002.00 $220.00 2 $220.00 3 $220.00 4 $220.00 $0.00 Totals:

Carla borrowed $1002.00 from the Merchant Bank at 8.4% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $220.00 per month. Construct a complete repayment schedule for the loan including totals Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Payment Number Balance Before Payment TT Balance After Payment $1002.00 Amount Paid Interest Paid Principal Repaid $1002.00 $220.00 2 $220.00 3 $220.00 4 $220.00 $0.00 Totals:

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1EB: Everglades Consultants takes out a loan in the amount of $375,000 on April 1. The terms of the loan...

Related questions

Question

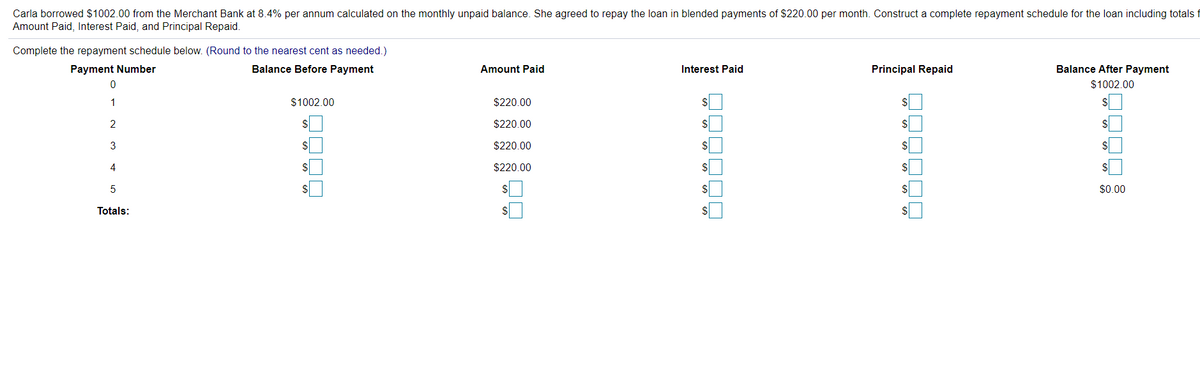

Transcribed Image Text:Carla borrowed $1002.00 from the Merchant Bank at 8.4% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $220.00 per month. Construct a complete repayment schedule for the loan including totals

Amount Paid, Interest Paid, and Principal Repaid.

Complete the repayment schedule below. (Round to the nearest cent as needed.)

Payment Number

Balance Before Payment

Amount Paid

Interest Paid

Principal Repaid

Balance After Payment

$1002.00

1

$1002.00

$220.00

2

$220.00

$

3

$220.00

$

$

4

$

$220.00

%$4

%$4

$0.00

Totals:

$1

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning