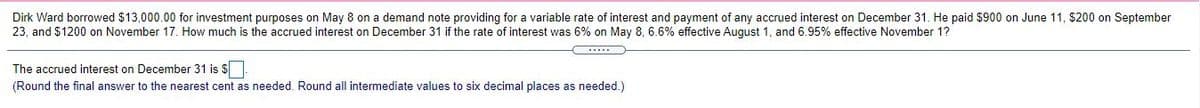

Dirk Ward borrowed $13,000.00 for investment purposes on May 8 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $900 on June 11, $200 on September 23, and $1200 on November 17. How much is the accrued interest on December 31 if the rate of interest was 6% on May 8, 6.6% effective August 1, and 6.95% effective November 1? The accrued interest on December 31 is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Dirk Ward borrowed $13,000.00 for investment purposes on May 8 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $900 on June 11, $200 on September 23, and $1200 on November 17. How much is the accrued interest on December 31 if the rate of interest was 6% on May 8, 6.6% effective August 1, and 6.95% effective November 1? The accrued interest on December 31 is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:Dirk Ward borrowed $13,000.00 for investment purposes on May 8 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $900 on June 11, $200 on September

23, and $1200 on November 17. How much is the accrued interest on December 31 if the rate of interest was 6% on May 8, 6.6% effective August 1, and 6.95% effective November 1?

The accrued interest on December 31 is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning