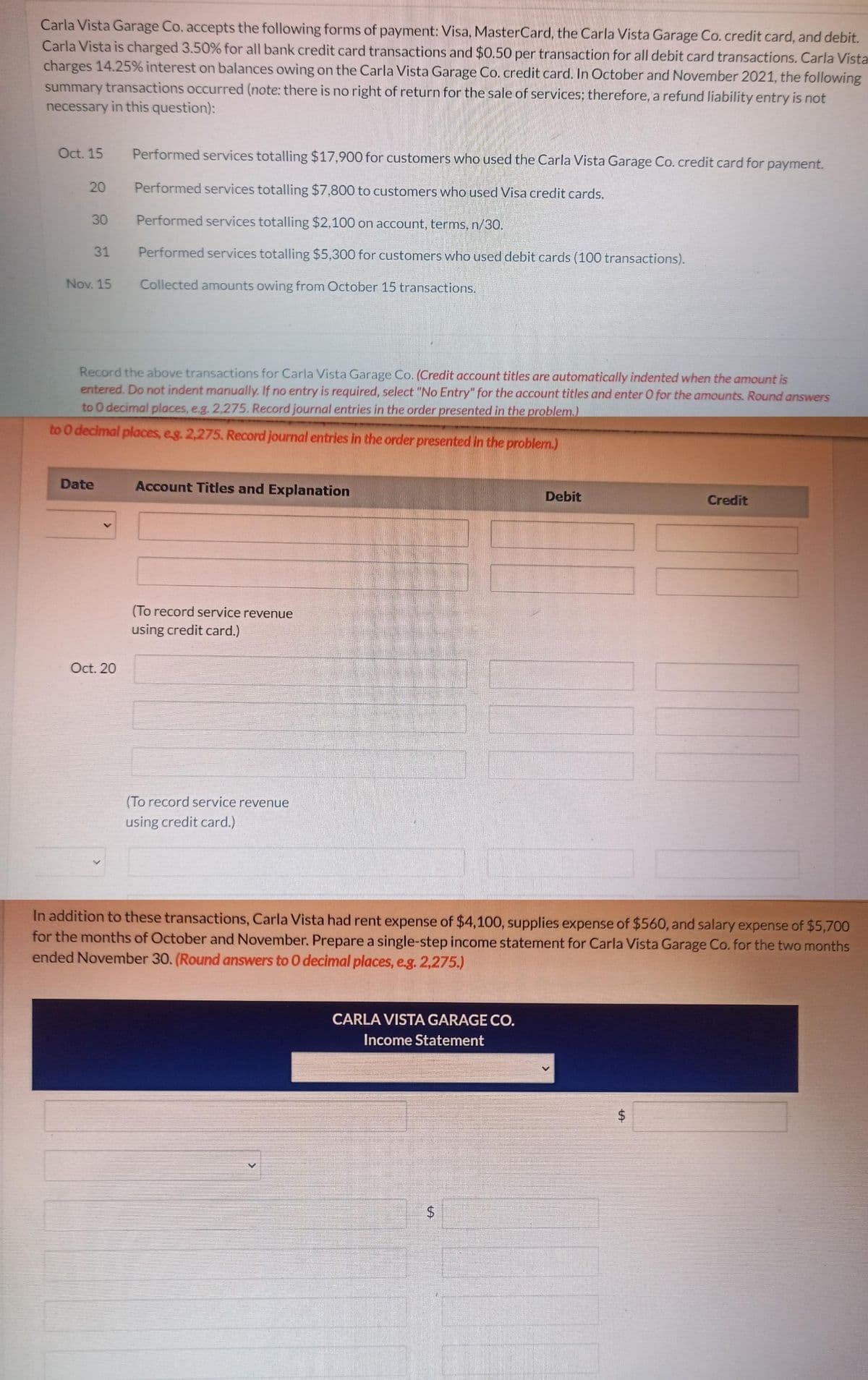

Carla Vista Garage Co. accepts the following forms of payment: Visa, MasterCard, the Carla Vista Garage Co. credit card, and debit. Carla Vista is charged 3.50% for all bank credit card transactions and $0.50 per transaction for all debit card transactions. Carla Vista charges 14.25% interest on balances owing on the Carla Vista Garage Co. credit card. In October and November 2021, the following summary transactions occurred (note: there is no right of return for the sale of services; therefore, a refund liability entry is not necessary in this question): Oct. 15 20 30 31 Nov. 15 Performed services totalling $17,900 for customers who used the Carla Vista Garage Co. credit card for payment. Performed services totalling $7,800 to customers who used Visa credit cards. Performed services totalling $2,100 on account, terms, n/30. Performed services totalling $5,300 for customers who used debit cards (100 transactions). Collected amounts owing from October 15 transactions. Record the above transactions for Carla Vista Garage Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 2,275. Record journal entries in the order presented in the problem.) to 0 decimal places, eg. 2,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit

Carla Vista Garage Co. accepts the following forms of payment: Visa, MasterCard, the Carla Vista Garage Co. credit card, and debit. Carla Vista is charged 3.50% for all bank credit card transactions and $0.50 per transaction for all debit card transactions. Carla Vista charges 14.25% interest on balances owing on the Carla Vista Garage Co. credit card. In October and November 2021, the following summary transactions occurred (note: there is no right of return for the sale of services; therefore, a refund liability entry is not necessary in this question): Oct. 15 20 30 31 Nov. 15 Performed services totalling $17,900 for customers who used the Carla Vista Garage Co. credit card for payment. Performed services totalling $7,800 to customers who used Visa credit cards. Performed services totalling $2,100 on account, terms, n/30. Performed services totalling $5,300 for customers who used debit cards (100 transactions). Collected amounts owing from October 15 transactions. Record the above transactions for Carla Vista Garage Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 2,275. Record journal entries in the order presented in the problem.) to 0 decimal places, eg. 2,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 86BPSB

Related questions

Question

Transcribed Image Text:Carla Vista Garage Co. accepts the following forms of payment: Visa, MasterCard, the Carla Vista Garage Co. credit card, and debit.

Carla Vista is charged 3.50% for all bank credit card transactions and $0.50 per transaction for all debit card transactions. Carla Vista

charges 14.25% interest on balances owing on the Carla Vista Garage Co. credit card. In October and November 2021, the following

summary transactions occurred (note: there is no right of return for the sale of services; therefore, a refund liability entry is not

necessary in this question):

Oct. 15

20

30

31

Nov. 15

Record the above transactions for Carla Vista Garage Co. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers

to 0 decimal places, e.g. 2,275. Record journal entries in the order presented in the problem.)

to 0 decimal places, eg. 2,275. Record journal entries in the order presented in the problem.)

Date

Performed services totalling $17,900 for customers who used the Carla Vista Garage Co. credit card for payment.

Performed services totalling $7,800 to customers who used Visa credit cards.

Performed services totalling $2,100 on account, terms, n/30.

Performed services totalling $5,300 for customers who used debit cards (100 transactions).

Collected amounts owing from October 15 transactions.

Oct. 20

Account Titles and Explanation

(To record service revenue

using credit card.)

(To record service revenue

using credit card.)

CARLA VISTA GARAGE CO.

Income Statement

Debit

$

Credit

In addition to these transactions, Carla Vista had rent expense of $4,100, supplies expense of $560, and salary expense of $5,700

for the months of October and November. Prepare a single-step income statement for Carla Vista Garage Co. for the two months

ended November 30. (Round answers to 0 decimal places, e.g. 2,275.)

III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT