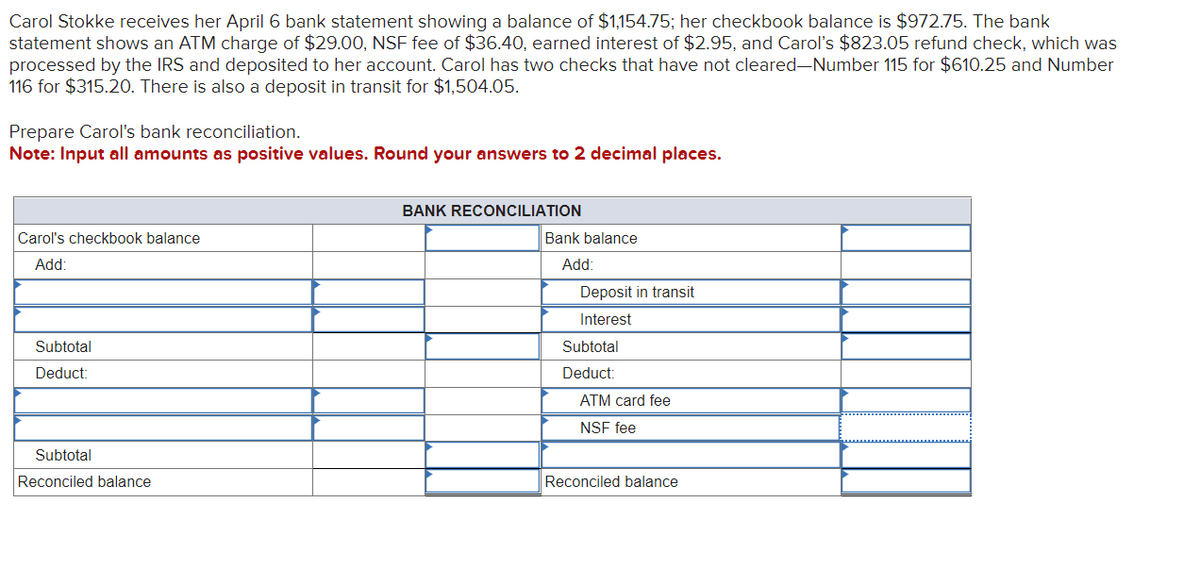

Carol Stokke receives her April 6 bank statement showing a balance of $1,154.75; her checkbook balance is $972.75. The bank statement shows an ATM charge of $29.00, NSF fee of $36.40, earned interest of $2.95, and Carol's $823.05 refund check, which was processed by the IRS and deposited to her account. Carol has two checks that have not cleared-Number 115 for $610.25 and Number 116 for $315.20. There is also a deposit in transit for $1,504.05. Prepare Carol's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Carol's checkbook balance Add: Subtotal Deduct: Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Deposit in transit Interest Subtotal Deduct: ATM card fee NSF fee Reconciled balance

Carol Stokke receives her April 6 bank statement showing a balance of $1,154.75; her checkbook balance is $972.75. The bank statement shows an ATM charge of $29.00, NSF fee of $36.40, earned interest of $2.95, and Carol's $823.05 refund check, which was processed by the IRS and deposited to her account. Carol has two checks that have not cleared-Number 115 for $610.25 and Number 116 for $315.20. There is also a deposit in transit for $1,504.05. Prepare Carol's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Carol's checkbook balance Add: Subtotal Deduct: Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Deposit in transit Interest Subtotal Deduct: ATM card fee NSF fee Reconciled balance

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5PB

Related questions

Question

Transcribed Image Text:Carol Stokke receives her April 6 bank statement showing a balance of $1,154.75; her checkbook balance is $972.75. The bank

statement shows an ATM charge of $29.00, NSF fee of $36.40, earned interest of $2.95, and Carol's $823.05 refund check, which was

processed by the IRS and deposited to her account. Carol has two checks that have not cleared-Number 115 for $610.25 and Number

116 for $315.20. There is also a deposit in transit for $1,504.05.

Prepare Carol's bank reconciliation.

Note: Input all amounts as positive values. Round your answers to 2 decimal places.

Carol's checkbook balance

Add:

Subtotal

Deduct:

Subtotal

Reconciled balance

BANK RECONCILIATION

Bank balance

Add:

Deposit in transit

Interest

Subtotal

Deduct

ATM card fee

NSF fee

Reconciled balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage