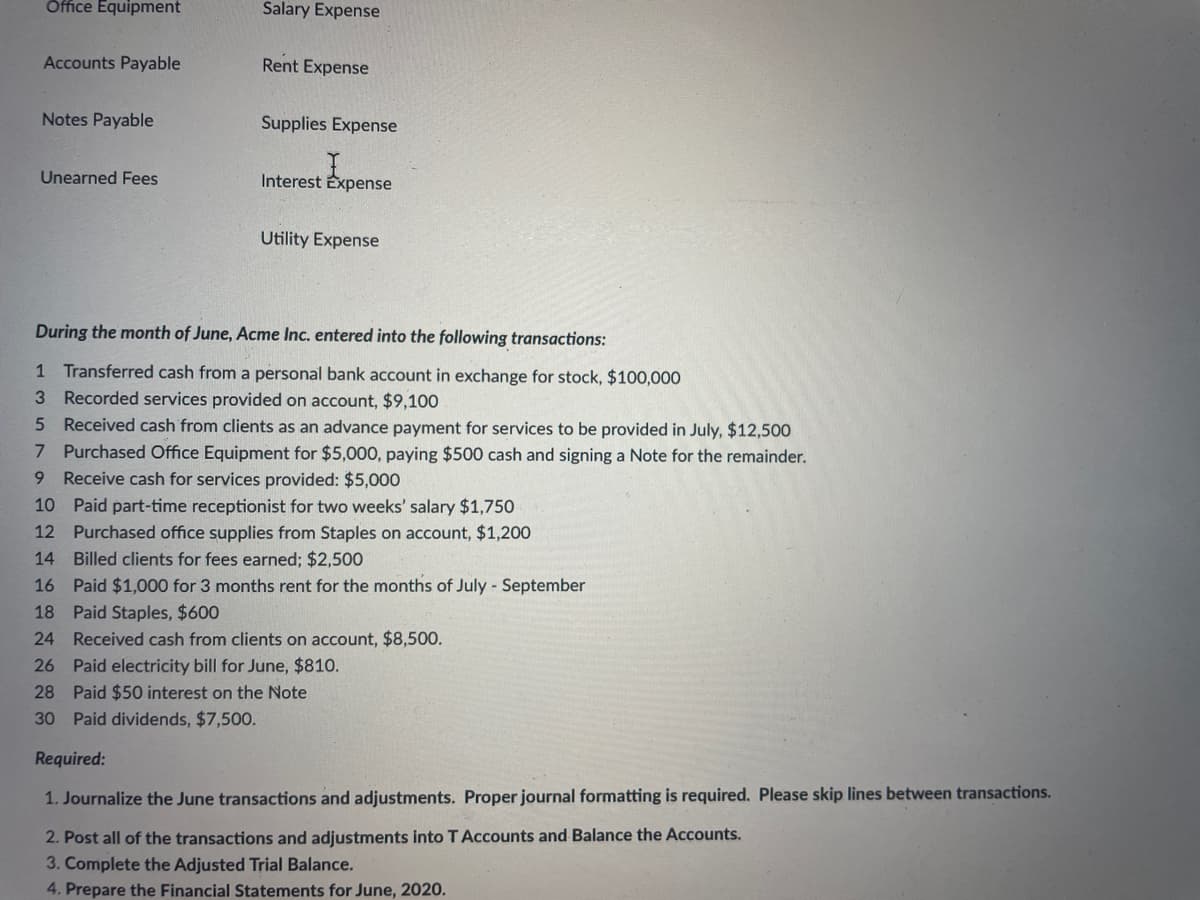

Office Equipment Accounts Payable Notes Payable Unearned Fees Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of July - September 18 Paid Staples, $600 24 Received cash from clients on account, $8,500. 26 28 Paid $50 interest on the Note 30 Paid dividends, $7,500. Required: 1. Journalize the June transactions and adjustments. Proper journal formatting is required. Please skip lines between transactions. Paid electricity bill for June, $810.

Office Equipment Accounts Payable Notes Payable Unearned Fees Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of July - September 18 Paid Staples, $600 24 Received cash from clients on account, $8,500. 26 28 Paid $50 interest on the Note 30 Paid dividends, $7,500. Required: 1. Journalize the June transactions and adjustments. Proper journal formatting is required. Please skip lines between transactions. Paid electricity bill for June, $810.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 8E: Considering the following events, determine which month the revenue or expenses would be recorded...

Related questions

Question

Please help with 1-4

Transcribed Image Text:Office Equipment

Accounts Payable

Notes Payable

Unearned Fees

Salary Expense

Rent Expense

18 Paid Staples, $600

24

Supplies Expense

Interest Expense

Utility Expense

During the month of June, Acme Inc. entered into the following transactions:

1 Transferred cash from a personal bank account in exchange for stock, $100,000

3 Recorded services provided on account, $9,100

5

Received cash from clients as an advance payment for services to be provided in July, $12,500

7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder.

9 Receive cash for services provided: $5,000

10

Paid part-time receptionist for two weeks' salary $1,750

12 Purchased office supplies from Staples on account, $1,200

14

Billed clients for fees earned; $2,500

16 Paid $1,000 for 3 months rent for the months of July - September

Received cash from clients on account, $8,500.

26 Paid electricity bill for June, $810.

28 Paid $50 interest on the Note

30 Paid dividends, $7,500.

Required:

1. Journalize the June transactions and adjustments. Proper journal formatting is required. Please skip lines between transactions.

2. Post all of the transactions and adjustments into T Accounts and Balance the Accounts.

3. Complete the Adjusted Trial Balance.

4. Prepare the Financial Statements for June, 2020.

Transcribed Image Text:gy

B

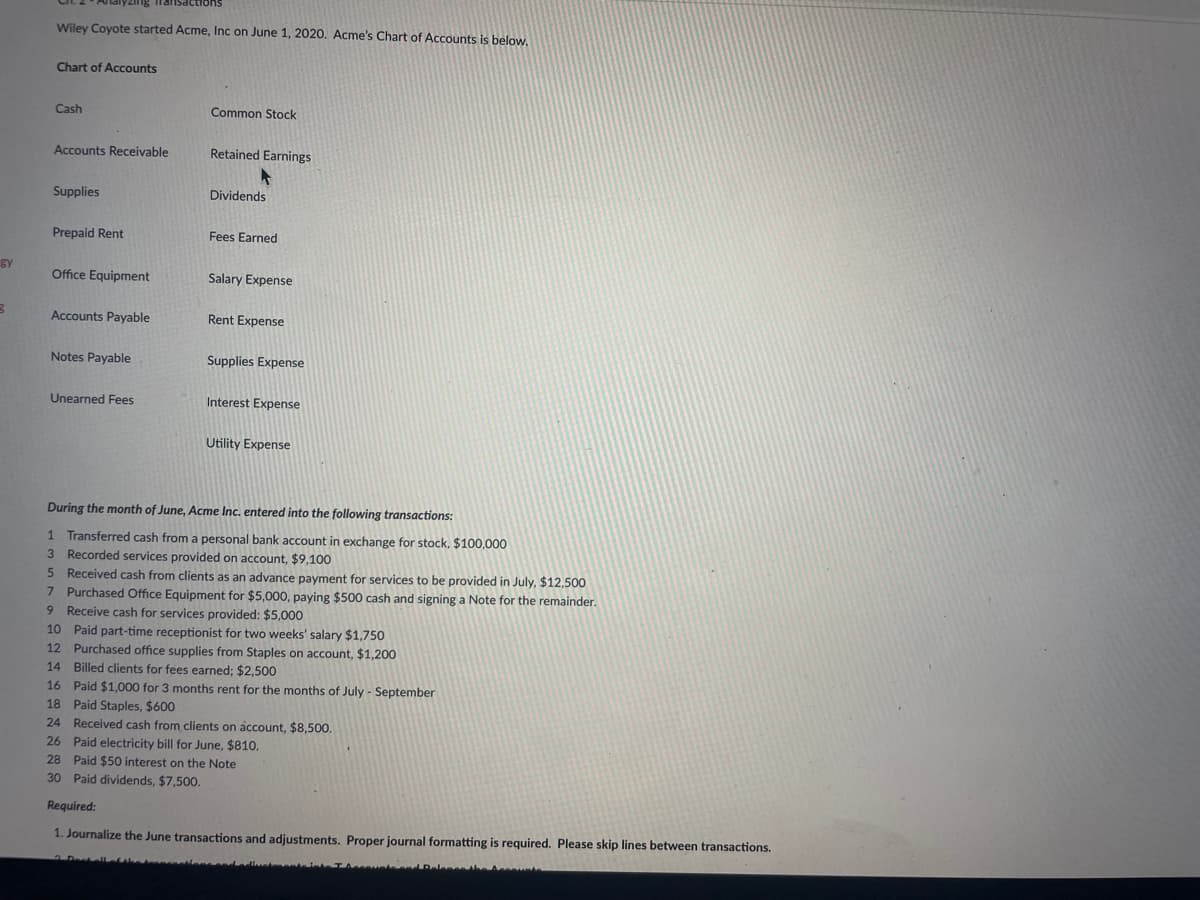

Wiley Coyote started Acme, Inc on June 1, 2020. Acme's Chart of Accounts is below.

Chart of Accounts

Cash

Accounts Receivable

Supplies

Prepaid Rent

Office Equipment

Accounts Payable

Notes Payable

Unearned Fees

Common Stock

Retained Earnings

Dividends

Fees Earned

Salary Expense

Rent Expense

Supplies Expense

Interest Expense

Utility Expense

During the month of June, Acme Inc. entered into the following transactions:

1 Transferred cash from a personal bank account in exchange for stock, $100,000

3 Recorded services provided on account, $9,100

5

Received cash from clients as an advance payment for services to be provided in July, $12,500

7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder.

9 Receive cash for services provided: $5,000

10 Paid part-time receptionist for two weeks' salary $1,750

12 Purchased office supplies from Staples on account, $1,200

14 Billed clients for fees earned; $2,500

16 Paid $1,000 for 3 months rent for the months of July - September

18 Paid Staples, $600

24 Received cash from clients on account, $8,500.

26 Paid electricity bill for June, $810.

28 Paid $50 interest on the Note

30 Paid dividends, $7,500.

Required:

1. Journalize the June transactions and adjustments. Proper journal formatting is required. Please skip lines between transactions.

scounts and Release the A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning