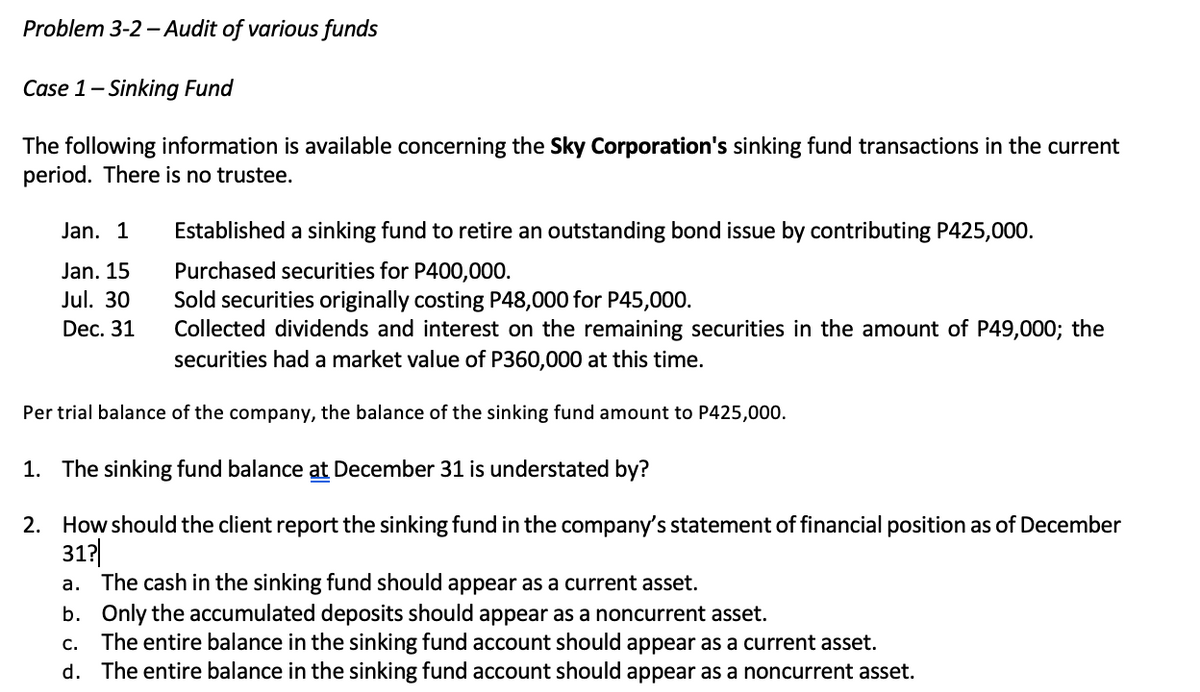

Case 1- Sinking Fund The following information is available concerning the Sky Corporation's sinking fund transactions in the current period. There is no trustee. Jan. 1 Established a sinking fund to retire an outstanding bond issue by contributing P425,000. Purchased securities for P400,000. Sold securities originally costing P48,000 for P45,000. Collected dividends and interest on the remaining securities in the amount of P49,000; the securities had a market value of P360,000 at this time. Jan. 15 Jul. 30 Dec. 31 Per trial balance of the company, the balance of the sinking fund amount to P425,000. 1. The sinking fund balance at December 31 is understated by? 2. How should the client report the sinking fund in the company's statement of financial position as of December 31?| a. The cash in the sinking fund should appear as a current asset. b. Only the accumulated deposits should appear as a noncurrent asset. c. The entire balance in the sinking fund account should appear as a current asset. d. The entire balance in the sinking fund account should appear as a noncurrent asset.

Case 1- Sinking Fund The following information is available concerning the Sky Corporation's sinking fund transactions in the current period. There is no trustee. Jan. 1 Established a sinking fund to retire an outstanding bond issue by contributing P425,000. Purchased securities for P400,000. Sold securities originally costing P48,000 for P45,000. Collected dividends and interest on the remaining securities in the amount of P49,000; the securities had a market value of P360,000 at this time. Jan. 15 Jul. 30 Dec. 31 Per trial balance of the company, the balance of the sinking fund amount to P425,000. 1. The sinking fund balance at December 31 is understated by? 2. How should the client report the sinking fund in the company's statement of financial position as of December 31?| a. The cash in the sinking fund should appear as a current asset. b. Only the accumulated deposits should appear as a noncurrent asset. c. The entire balance in the sinking fund account should appear as a current asset. d. The entire balance in the sinking fund account should appear as a noncurrent asset.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter22: Corporations: Bonds

Section: Chapter Questions

Problem 13SPB

Related questions

Concept explainers

Question

Transcribed Image Text:Problem 3-2 - Audit of various funds

Case 1- Sinking Fund

The following information is available concerning the Sky Corporation's sinking fund transactions in the current

period. There is no trustee.

Jan. 1

Established a sinking fund to retire an outstanding bond issue by contributing P425,000.

Purchased securities for P400,000.

Sold securities originally costing P48,000 for P45,000.

Collected dividends and interest on the remaining securities in the amount of P49,000; the

securities had a market value of P360,000 at this time.

Jan. 15

Jul. 30

Dec. 31

Per trial balance of the company, the balance of the sinking fund amount to P425,000.

1. The sinking fund balance at December 31 is understated by?

2. How should the client report the sinking fund in the company's statement of financial position as of December

317|

a. The cash in the sinking fund should appear as a current asset.

b. Only the accumulated deposits should appear as a noncurrent asset.

The entire balance in the sinking fund account should appear as a current asset.

d. The entire balance in the sinking fund account should appear as a noncurrent asset.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,