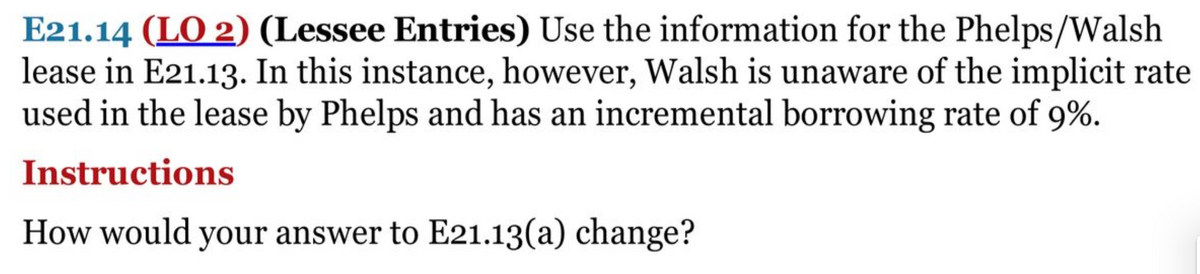

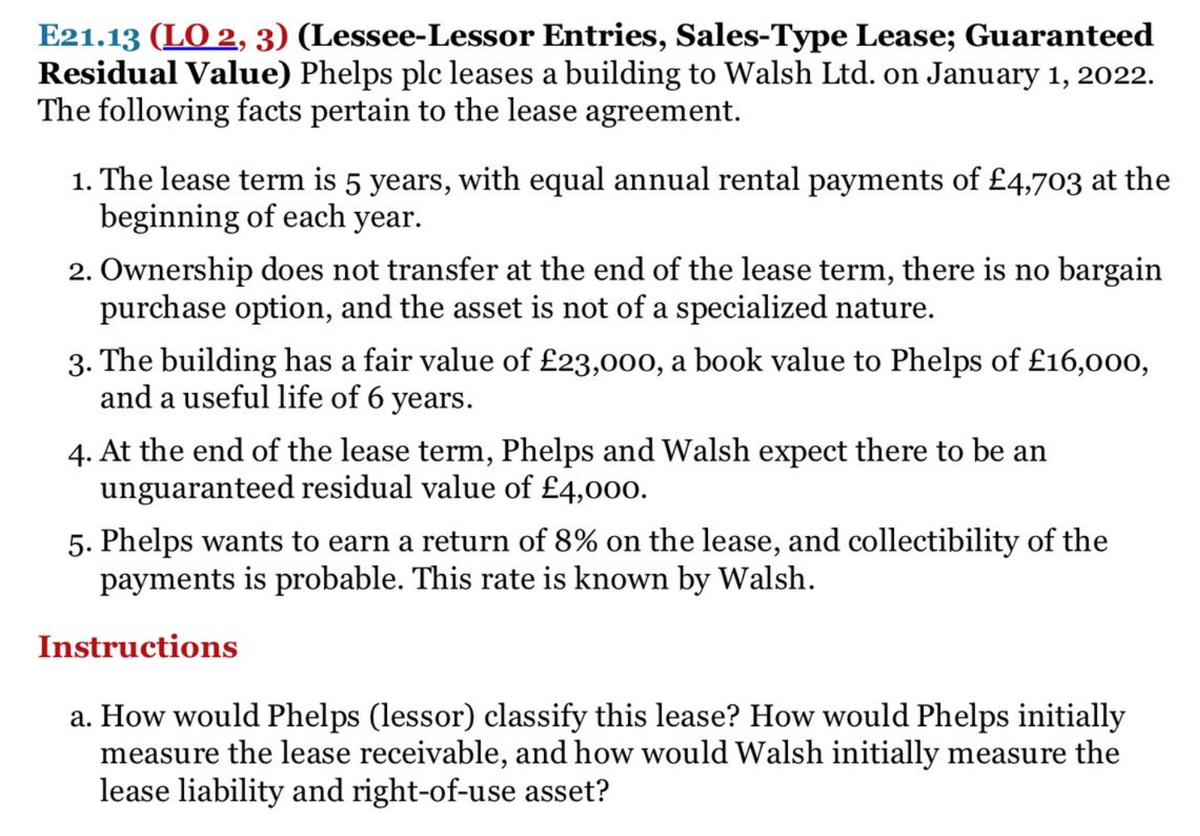

E21.14 (LO 2) (Lessee Entries) Use the information for the Phelps/Walsh lease in E21.13. In this instance, however, Walsh is unaware of the implicit rate used in the lease by Phelps and has an incremental borrowing rate of 9%. Instructions How would your answer to E21.13(a) change?

Q: The inventory account of Leni Company at December 31, 2021 has a balance of P1,800,000 and was found...

A: Under FOB destination, titles of goods are transferred to the buyer only when goods are delivered to...

Q: 38. The Cherry Company’s physical inventory on December 31, 2021 showed that merchandise with a cost...

A:

Q: Based on this information can you create an Income Statment Accounts Receivable $1,200 Accounts Paya...

A: solution concept in the income statement , revenue and expenses are presented so as the find the net...

Q: The inventory records of Cattle Company show the following purchases during the first quarter operat...

A: FIFO means the first in first out which means that goods purchased first will be sold first. Weight...

Q: Ravena Company manufactures office furniture. During the most productive month of the year, 3,500 de...

A: There are two type of costs that are being incurred in business. These are fixed costs and variable ...

Q: Banana Company uses the retail method of inventory valuation. The following information is available...

A: Using FIFO method, the goods Purchased first are to be sold first. FIFO stands for First in First o...

Q: 7.The following data pertain to a particular item sold by Pomegranate Company. 8/1 – Beg. invy: 2,0...

A: Under the weighted average method of inventory valuation, the weighted average cost per unit of the ...

Q: Adjusted Entries: Accrued sales revenue: 29500 Rent Revenue Earned: 14,000 rent was initially prep...

A: Adjustments are increased or decreased the net income of the entity. Revenue adjustments have increa...

Q: BROWN Company keeps limited records. Its assets and liabilities at the beginning and end of the curr...

A: Change in assets = Change in liabilities + Change in equity Change in assets - Change in liabilities...

Q: What is the journal entry to replenish the petty cash fund if expenses were Auto Expense $75, Office...

A: Petty cash is the money that a entity keeps on hand to make small payments, purchases, and reimburse...

Q: 12 000 4 000 1 nd fittings 1 000 2 000 50 000 10 000 2 30.000

A: As per rule, allowed to answer first question and post the remaining in the next submission.

Q: 16.On March 31, 2021, the warehouse of Cucumber Company was destroyed by fire. The company's marku...

A: Opening balance = P600,000 Sales = P2240000 Markup = 40% Cost of sales = 2240000*0.40/(1+0.40) ...

Q: Karen finds that many claim forms were rejected because important information was omitted. How might...

A: Insurance appears to be a contractual covering in which one party promises to repay or insure anothe...

Q: Use this information about Carmelita Inc. to answer the question that follows. Carmelita Inc. has th...

A: "We’ll answer the first question since the exact one wasn’t specified. Please submit a new question ...

Q: Which of the following errors, each considered individually, would cause the trial balance to be out...

A: A trial balance is prepared with a view to ensure the arithmetic accuracy of the the account balance...

Q: How much will be the per unit savings/loss? If the tools are purchased and the facility rented, Can...

A: 1 Particulars Formula Amount (P) Cost of production Variable cost (P28*30000) 840000 ...

Q: Emily, who is single, has been offered a position as a city landscape consultant. The position pays ...

A: Taxable Income is the net amount of income on which tax is imposed or determined using appropriate t...

Q: 1.Refer to the image, The cash received for interest during 2020 was The income statement of Carsen ...

A: Cash paid for expenses during the year: Depreciation, the most major non-cash expenditure reported, ...

Q: Lancelot is a dealer of household appliances. He reported the following in 2019 and 2020: 2019 2020 ...

A: Formula: Gross Income = Installment sales - Cost of Installment sales

Q: Mauro Products distributes a single product, a woven basket whose selling price is $23 per unit and ...

A: A business is said to break even when it is total sales are equal to it is total costs. break even i...

Q: Current Attempt in Progress At December 1, 2022, Tamarisk, Inc. Accounts Receivable balance was $174...

A: Formula: Balance on December 31, 2022 = Balance on December 1, 2022 + Credit sales during December –...

Q: Pear Company recorded the following data pertaining to one of its inventory items during January 202...

A: Cost of goods available of sales / no.of units available for sales.

Q: 1. Assume the company uses variable costing and a FIFO inventory flow assumption (FIFO means first-i...

A: As per our protocol we provide solution to the one question only or to the first three sub-parts onl...

Q: Sugary Company has the policy of valuing inventory at the lower of cost and net realizable value usi...

A:

Q: Assume that if Sunland Water accepts Clifton’s offer, the company can use the freed-up manufacturing...

A: Relevant cost appears to be a management accounting term that alludes to avoidable expenses that exi...

Q: uring the month of August, Amer Corporation produced 12,000 units and sold em for P20 per unit. Tota...

A: The variable cost per unit remains constant but total variable cost changes with change in level of ...

Q: . The Cherry Company's physical inventory on December 31, 2021 showed that merchandise with a cost o...

A: Correct inventory that should appear in Cherry Company's statement of financial position at December...

Q: Exercise 3 An investment of 150,000 is expected to produce annual cash eamings of P50,000 for 5 year...

A: Bail out period incorporates the salvage value in calculation of pay back period. Pay back period is...

Q: The gross profit method of estimating inventory would NOT be useful when a. a periodic system is...

A:

Q: Cabuslay Company showed the following shareholders’ equity on December 31, 2021: Ordinary share c...

A: Book Value is the value of cost of Asset/ Capital accounted for in the financial statements or books...

Q: Identify all false statements about changes in accounting principles and estimates. 1. Investors lik...

A: 1. Investors likely prefer the retrospective approach as it is best for comparability across reporti...

Q: Millers company had retained earnings of $85,000 and stockholders' equity of $105,000 at the beginni...

A: Equity statement: It refers to a financial statement that shows the total equity of the business hel...

Q: Timi, a CPA with a monthly salary of Php. 30,000.00, received a Honda Civic from his employer for su...

A: Answer: Gross compensation income is the amount that is received from employer before any deductions...

Q: to adopt a charity foundation once she receives her money. She promised to donate annually to her ch...

A: The present value is the amount without the interest rate and which is equivalent to the all future ...

Q: A group of thirty 2-year old cattle was held at January 1, 2021. On this same date, additional five...

A: Fair value with no growth: December 31, 2021 Fair value with no growth (Same Age) 2 years old = 35 ...

Q: R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fee...

A: The break even sales are the sales where business earns no profit no loss during the period.

Q: Pomelo Company has the policy of valuing inventory at the lower of cost and net realizable value usi...

A: Balance in Allowance to reduce inventory to NRV account at December 31, 2021 before adjustment = P86...

Q: Based on the data given, Determine the Working Capital in 2018 You discovered the following errors i...

A: Rectification of Errors: It is procedure to revise mistakes/errors made in recording transaction...

Q: try Prepare the journal entries for the following transactions: luly 1-Mr. Bon Hok withdraw P20,000 ...

A: Date particulars Dr amount Cr amount July 1 Mr Bon Hok capital a/c 20,000 Cash a/c 20,000 ...

Q: Jia Inc. sold some of its trademarks. The trademarks had an unlimited useful life and a cost of $10,...

A: Statement of financial position is prepared by every business to see the position of business in fin...

Q: Explain futher what is meant by the statment below Provisions for auditing, tax collection, depositi...

A: The answer is stated below:

Q: Fact pattern: one-fourth represents secured and priority claims. 1. The "net free assets" are P75. 2...

A: 1. Total assets = P200 The assets are expected to be realized at an average of 75% of the carrying a...

Q: Ventana Window and Wall Treatments Company provides draperies, shades and various window treatments....

A: Initial Markup = it is the original amount of markup from cost price to the selling price Additiona...

Q: How much of this refund should be included in his 2021 federal gross income?

A: The tax-ability of refund from state and local government is decided based on whether the tax payer ...

Q: Hayley recently invested $31,000 in a public utility stock paying a 6 percent annual dividend. (Hayl...

A: Qualified Dividend: Generally speaking, qualified dividends are dividends received from shares of st...

Q: From the details given below prepare aTrial Balance as at March 31, 2018. Purchases 80,000 Sala...

A: Trial Balance: Trial balance is a statement in which the closing balance of all ledger accounts are ...

Q: Sales 60000 Variable Costs Fixed Costs 36000 20000 Earnings Before Interest and Taxes 4000 Interest ...

A: Formula: Degree of operating leverage = ( Selling price - Variable cost ) / ( Selling price - Variab...

Q: Diamond trading has the following data: Sales 500,000 Electricity expense 50,000 Water expense 20,00...

A: NET profit after tax is calculation of company's profit after all the expenses and Tax that is paid....

Q: Describe the responsibilities of an accounts payables specialist.

A: Accounts payable specialists ensures vendors get paid for services and products rendered. They play ...

Q: Comprehend and Apply the elements of costing to the process environment.

A: Process Costing is used for industries involving continuous production of goods having same identifi...

Please answer E21-14.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Eubank Company, a lessee, enters into a lease agreement on January 1, 2021, for equipment. The following data are relevant to the lease agreement: - The term of the noncancelable lease is 4 years. Payments of $978,446 are due on January 1 of each year. The first payment is January 2021. - The fair value of the equipment on January 1, 2021 is $3,500,000. The equipment has an economic life of 6 years with nosalvage value. - Eubank uses the straight-line method of depreciation. - Eubank’s implicit rate is 8%. - This will be treated as a finance lease (Lessee Perspective). Instructions: Prepare the journal entries on Eubank’s books (lessee) that relate to the lease agreement for the following dates, you do not need to create an amortization schedule. a. January 1, 2021. b. December 31, 2021.Which of the following lease arrangements would most likely be accounted for as a finance lease by the lessor if it is under US GAAP instead of IFRS? a. The lease agreement runs for 15 years and the economic life of leased property is 20 years. However, the title is not transferred to the lessee at the end of the lease term. b. The present value of future payments is P73,600 when the fair value of the property is P80,000 at the end of the first lease year. c. The lessee shoulders the gain or loss from fluctuation in the fair value of the underlying asset. d. The lessee may renew the two-year lease for two additional years; originally the lease payments were P10,000 monthly. Renewed lease term calls for P11,000 monthly rental payment.On January 1, 2022, Yencay, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Thol Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. The fair value of the building on January 1, 2022 is P4,000,000; however, the book value to Holt is P3,300,000. The building has an estimated economic life of 10 years, with no residual value. Yencay depreciates similar buildings on the straight-line method. At the termination of the lease, the title to the building will be transferred to the lessee. Yencay's incremental borrowing rate is 11% per year. Thol Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yencay, Inc. The yearly rental payment includes P10,000 of executory costs related to taxes on the property. The agreement…

- On January 1, 2022, Yencay, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Thol Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. The fair value of the building on January 1, 2022 is P4,000,000; however, the book value to Holt is P3,300,000. The building has an estimated economic life of 10 years, with no residual value. Yencay depreciates similar buildings on the straight-line method. At the termination of the lease, the title to the building will be transferred to the lessee. Yencay's incremental borrowing rate is 11% per year. Thol Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yencay, Inc. The yearly rental payment includes P10,000 of executory costs related to taxes on the property. The agreement…On January 1, 2021, Pharoah, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $5600000; however, the book value to Holt is $4550000.(c) The building has an estimated economic life of 10 years, with no residual value. Pharoah depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Pharoah’s incremental borrowing rate is 11% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Pharoah, Inc.(f) The yearly rental…On January 1, 2021, Sunland, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $5700000; however, the book value to Holt is $4650000.(c) The building has an estimated economic life of 10 years, with no residual value. Sunland depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Sunland’s incremental borrowing rate is 12% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Sunland, Inc.(f) The yearly rental…

- On January 1, 2021, Sandhill, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2018 is $5800000; however, the book value to Holt is $4750000.(c) The building has an estimated economic life of 10 years, with no residual value. Sandhill depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Sandhill’s incremental borrowing rate is 10% per year. Holt Warehouse Co. set the annual rental to insure a 9% rate of return. The implicit rate of the lessor is known by Sandhill, Inc.(f) The yearly rental…P21-15 (Please use the latest IFRS accounting standards to answer the question, and take note that lessee do recognise depreciation) Cleveland Group leased a new crane to Abriendo Construction under a 5-year, non-cancelable contract starting January 1, 2022. Terms of the lease require payments of R$48,555 each January 1, starting January 1, 2022. The crane has an estimated life of 7 years, a fair value of R$240,000, and a cost to Cleveland of R$240,000. The estimated fair value of the crane is expected to be R$45,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and the crane is not a specialized asset. Both Cleveland and Abriendo adjust and close books annually at December 31. Collectibility of the lease payments is probable. Abriendo's incremental borrowing rate is 8%, and Cleveland's implicit interest rate of 8% is known to Abriendo. Instructions a. Identify the type of lease involved and give reasons for your…On January 1, 2021, Blossom, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2018 is $6500000; however, the book value to Holt is $5450000.(c) The building has an estimated economic life of 10 years, with no residual value. Blossom depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Blossom’s incremental borrowing rate is 12% per year. Holt Warehouse Co. set the annual rental to insure a 11% rate of return. The implicit rate of the lessor is known by Blossom, Inc.(f) The yearly rental…

- Hi, I cannot figure out the amount of 44,564.86 of amortization expense. would you help me out? thanks E20-4 Lessee Accounting for Finance Lease LO 20.4 On January 1, 2019, Concord Corp. signs a contract to lease nonspecialized manufacturing equipment from Stone Inc. Concord agrees to make lease payments of $47,500 per year. Additional information pertaining to the lease is as follows: The term of the noncancelable lease is 3 years, with a renewal option at the end of the lease term. Payments are due every January 1, beginning January 1, 2019. The fair value of the manufacturing equipment on January 1, 2019, is $150,000. The equipment has an economic life of 7 years. Concord guarantees that the equipment will have a residual value of $15,000 at the end of the lease term. Concord considers it probable that it will have to pay $5,000 cash at the end of the lease terms to satisfy this residual value guarantee. Concord Corp. depreciates similar assets using the…The following information pertains to a leased contract entered into by Blue Company, lessee, on January 1, 2018: Lease term, 5 years, useful life of the leased asset, 20 years; Annual rental payable at year-end, P800,000 and the implicit rate is10%. The lease contract contains an option for Blue Company to extend for another 5 years but at the commencement of the lease, the exercise of the option is not reasonably certain, however on January 1, 2021, Blue Company decided to extend the lease term by another 5 years. However, the annual rental starting 2023 (6th year) will be P1,000,000 and the new implicit rate is 8%. How much is the depreciation expense in 2021?The following facts pertain to a non-cancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system. Commencement date October 1, 2020 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at October 1, 2020 $313,043 Book value of asset at October 1, 2020 $280,000 Residual value at end of lease term –0– Lessor's implicit rate 8% Lessee's incremental borrowing rate 8% Annual lease payment due at the beginning of each year, beginning with October 1, 2020 $62,700 The collectibility of the lease payments is probable by the lessor. The asset will revert to the lessor at the end of the lease term. The straight-line depreciation method is used for all equipment. The following amortization schedule has been prepared correctly for use by both the lessor and the lessee in accounting for this lease. The lease is to be accounted for properly as a finance lease…